Hi everyone,

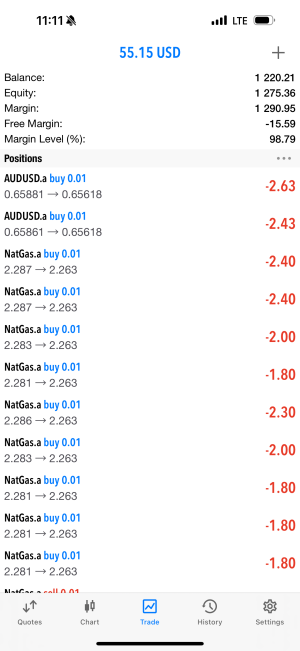

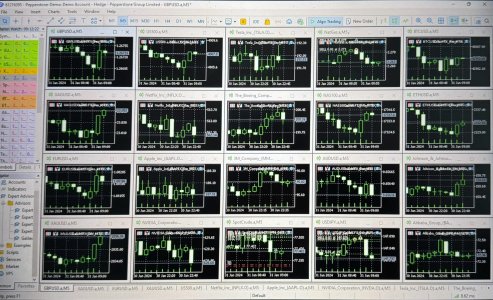

Just started yesterday, opened a pepper stone demo account and put $1200 in, I have a VPS running 24/7. Purchased Pro with premium settings package. I set everything up myself very quickly/easily with no issues. I’ve opened up a chart for each of the available trades in the demo account , various forex, commodities, indexes & stocks. Each has loaded either the respective premium settings or the appropriate aggressive setting from GFX guide. All on timeframe M5. Here we are 24 hours later and from a $1200 demo account I’ve made $55.

Is this normal? Any suggestions?

Also, one thing I can’t find anywhere is what the difference is between the Gold 5/10/20/50% and Silver 6/11/23%/seperate silver preset please?

Thank you all!

Just started yesterday, opened a pepper stone demo account and put $1200 in, I have a VPS running 24/7. Purchased Pro with premium settings package. I set everything up myself very quickly/easily with no issues. I’ve opened up a chart for each of the available trades in the demo account , various forex, commodities, indexes & stocks. Each has loaded either the respective premium settings or the appropriate aggressive setting from GFX guide. All on timeframe M5. Here we are 24 hours later and from a $1200 demo account I’ve made $55.

Is this normal? Any suggestions?

Also, one thing I can’t find anywhere is what the difference is between the Gold 5/10/20/50% and Silver 6/11/23%/seperate silver preset please?

Thank you all!