You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Extra Galileo FX Settings: Conservative, Moderate & Aggressive

- Thread starter Sanchay

- Start date

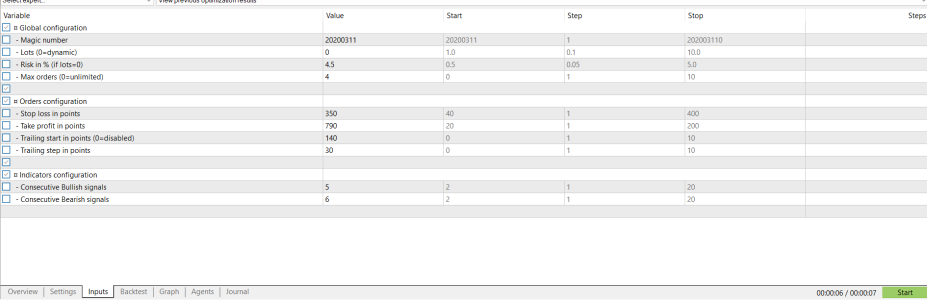

I loaded them all manually. But when I tried to test them, I got this message:Here is the Input tab of MT 5. It does not show a "Load" button to upload the settings.

View attachment 3973

2024.10.22 09:39:51.483 Tester no optimized parameter selected, please check input(s) to be optimized and set start, step and stop values

Any idea what is wrong?

Also, is there a way to see what trades are made, if any? Can't find a way to do that in the chart window of MT5, even set to a Timeframe of 1 minute.

I have asked the broken these two questions and they refer me to you as the EA provider.

Last edited:

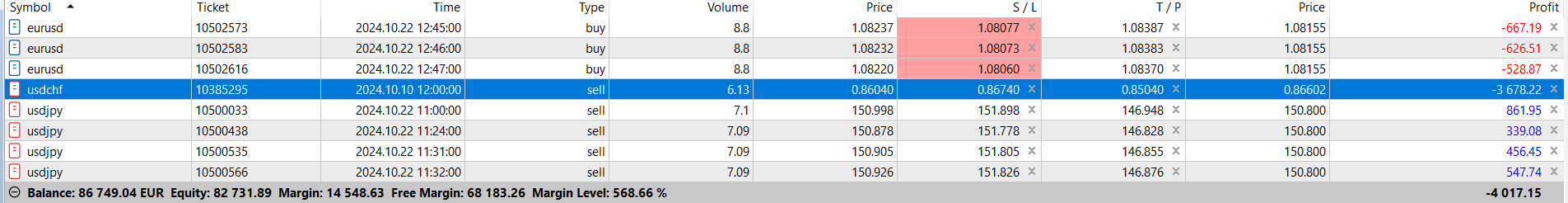

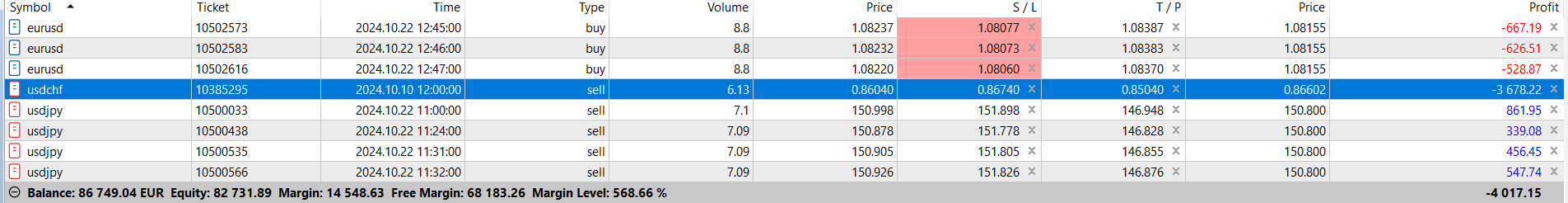

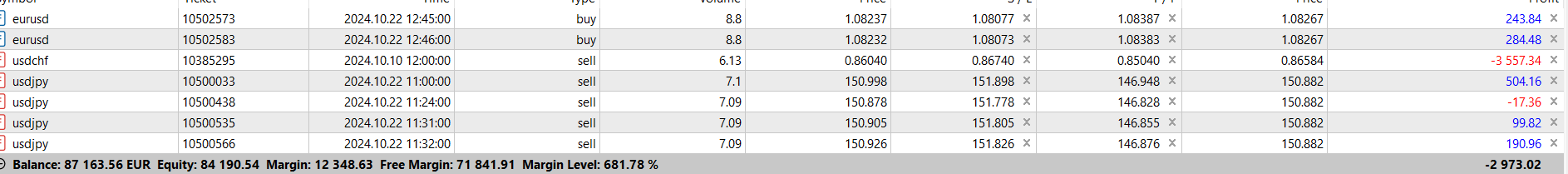

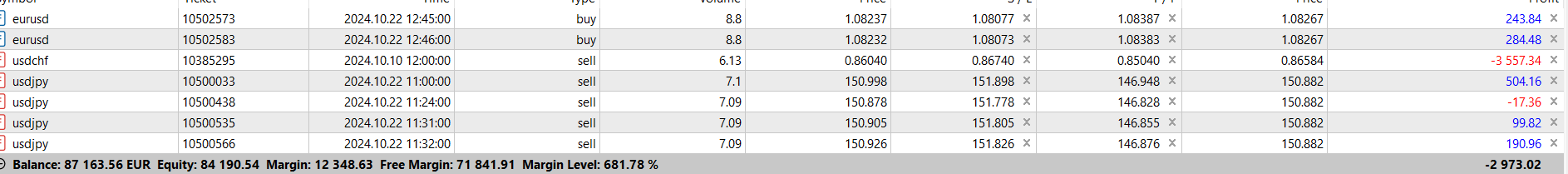

To answer one of my own questions (above), if I go to Toolbox>Trade I can see the live trades (not in the chart window). I had been looking only at History. History seems to be cumulative although the dates of the trades are all mixed up, don't know why. Trade seems to be the current day only. In any case, I'm glad I have 100K in my demo account or I would have been wiped out completely in the first hour of trading. Here is what Trade looks like now:

As I sit here watching the Trade activity swing wildly up and down, I am wondering how one is supposed to "monitor" it. At the moment things look good except for the usdchf M15 trade. What can I do about that? If I close the trading on it I would lose any opportunity to make it up (as in the other cases, so far). Here is the latest:

It is frustrating to see my messages (like the last one) "awaiting moderator approval." This does not encourage communication. What's the problem? I am also wondering about the times given for the trades. Are these local times from different servers located in different places (timezones)?

Last edited:

Hey Noah,

I understand your frustration but some of the queries are already answered.

here is about your load situation: https://forum.galileofx.com/threads/updated-winning-settings.559/post-7117 (you need to right click, read it thoroughly).

To clarify, Galileo FX is a tool it is upto you how you use it. Depending on the strategy you may or may not need to monitor. If you think you will not be able to do so, you should define a fixed timing where you are able to monitor or alternatively try to use conservative settings on higher timeframe. You may use a VPS if you want to do it 24*7 and you can not ensure your PC is switched on with active internet connection. Regarding your ongoing trades they must have been in profit, if you think you can not monitor you can chose to close the positions. However, I can not tell you that if each trade opens gets profitable quickly or even in hours, because even I hold some trades for hours but as per my comfort level only.

Most of the brokers use GMT +2/+3 time zone however, each broker can have different time zones.

Based on your recent responses I humbly request you to learn the usage of MetaTrader Platform. You may use YouTube tutorial or some websites using simple google search.

As always thanks for writing to us, I hope I could help you.

-Sanchay Kasturey

I understand your frustration but some of the queries are already answered.

here is about your load situation: https://forum.galileofx.com/threads/updated-winning-settings.559/post-7117 (you need to right click, read it thoroughly).

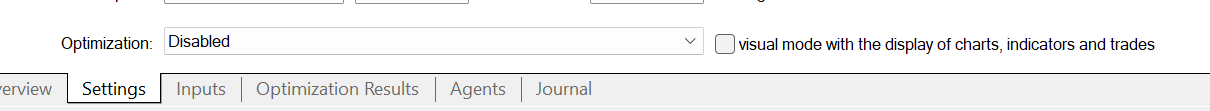

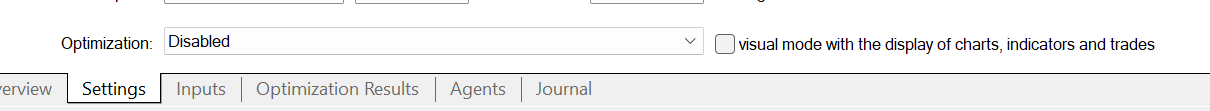

This problem is because you must have selected for optimization, make sure in your Settings tab the Optimization is selected as disabled from the dropdown.2024.10.22 09:39:51.483 Tester no optimized parameter selected, please check input(s) to be optimized and set start, step and stop values

For seeing trades in the chart window during backtesting, you should make sure that your settings tab has this box checked. (You may need to scroll down)To answer one of my own questions (above), if I go to Toolbox>Trade I can see the live trades (not in the chart window). I had been looking only at History. History seems to be cumulative although the dates of the trades are all mixed up, don't know why. Trade seems to be the current day only. In any case, I'm glad I have 100K in my demo account or I would have been wiped out completely in the first hour of trading. Here is what Trade looks like now:

To clarify, Galileo FX is a tool it is upto you how you use it. Depending on the strategy you may or may not need to monitor. If you think you will not be able to do so, you should define a fixed timing where you are able to monitor or alternatively try to use conservative settings on higher timeframe. You may use a VPS if you want to do it 24*7 and you can not ensure your PC is switched on with active internet connection. Regarding your ongoing trades they must have been in profit, if you think you can not monitor you can chose to close the positions. However, I can not tell you that if each trade opens gets profitable quickly or even in hours, because even I hold some trades for hours but as per my comfort level only.

Most of the brokers use GMT +2/+3 time zone however, each broker can have different time zones.

Based on your recent responses I humbly request you to learn the usage of MetaTrader Platform. You may use YouTube tutorial or some websites using simple google search.

As always thanks for writing to us, I hope I could help you.

-Sanchay Kasturey

This is the link of our channel where we post live trading videos: https://www.youtube.com/@GalileoFX

There are live streams as well where galileo is growing account, you should check it out.

There are live streams as well where galileo is growing account, you should check it out.

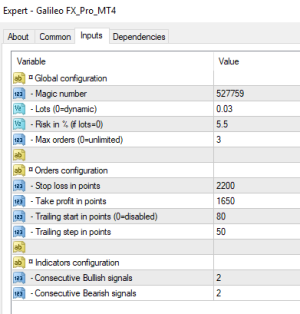

Thanks Sanchay. I have changed the Lots of all the settings to .01 except for the Conservative ones which I have left at 0, namely KO.NYSE, SOLUSD, EURUSD H4, NZDUSD. I have no idea how to "monitor" the Aggresive and Moderate Settings so I'll just let them be and hope the Conservative settings produce more positive results. I much appreciate your help! What I am hoping to find is one or more settings that will lose as little as possible and still make at least a moderate profit that would make the time spent worthwhile.

Does "monitoring" mean watching the trades as they happen? They move so fast I wonder how anyone could do it. Isn't the point of an EA that it does this for you? I feel completely helpless just watching those numbers making huge jumps up and down in split seconds -- although things seem better after adjusting the Lots (see above still unpublished post).

J

Joeboy

Guest

You should use a demo imitating what account balance you can start with, for example 500$ -1000$ so it would be realistic when you jump to live account. Yes monitoring aggressive settings is pivotal and you can close losing trades earlier if the trade goes against you.

Hey Noah, I agree with @Joeboy . For your confusion regarding monitoring and watching, if you feel that the trades are faster then you should consider lowering the risk (if you are using dynamic lot sizing) or you should consider using lower lot size (if you are using fixed lot size). Another suggestion could be to not trade all the time but only when you could watch if you are using aggressive settings or multiple settings under the same account.

martinh210

New member

@Noah2013 I hear your frustration brother. I just had my bot installed on the 18th and I have no clue on what I'm doing. I email customer service on a daily basis and they keep changing the settings for me, and no matter what they do, my bot is still at a 30% win ratio. Why is it that nobody wants to share their settings with anyone else...I know once I get the hang of this, I'll be helping out as many people as I can.

Good to hear from a fellow newbie. Sanchay has been pretty good about responding but I too am disappointed that so few other members seem to want to communicate. Could it be they afraid their setting won't work as well if more people use it? I suspect that is ridiculous but I wish somebody with more insight would confirm it.@Noah2013 I hear your frustration brother. I just had my bot installed on the 18th and I have no clue on what I'm doing. I email customer service on a daily basis and they keep changing the settings for me, and no matter what they do, my bot is still at a 30% win ratio. Why is it that nobody wants to share their settings with anyone else...I know once I get the hang of this, I'll be helping out as many people as I can.

Another thing that is very frustrating is that some of my messages are blocked by the moderator, whoever that is, without any explanation. That is very bad policy.

Lastly, I will share with you all I have learned because I see no reason not to. I have several demo accounts with different brokers and am trying all the settings that Sanchay recommends in this thread, using MetaTrader 5. At the moment I am setting the Lots, though, to .01 instead of 0 for all but the Conservative settings with a demo capital of 1000 or 5000 because I think that affects the amounts won or lost in the trades. Then you use the Trade button in Toolbox to watch the action -- if there is any. I have no idea what "moderating" the setting means, which the Team (Galileo) tells you to do with the Aggressive and Moderate settings. It has taken more literally weeks to find out how to do this much.

If there were more people like you and me communicating here, we could all learn faster, and I respectfully urge the Team Moderator to STOP BLOCKING posts unless you post clear rules for doing so.

Hey @martinh210 , You can check out this thread to learn about settings and also you can check our performance page here to find new settings suited as per your needs: https://store.galileofx.com/pages/performance/@Noah2013 I hear your frustration brother. I just had my bot installed on the 18th and I have no clue on what I'm doing. I email customer service on a daily basis and they keep changing the settings for me, and no matter what they do, my bot is still at a 30% win ratio. Why is it that nobody wants to share their settings with anyone else...I know once I get the hang of this, I'll be helping out as many people as I can.

Can I use less risk reward insteadThis thread is created for sharing the updated settings on a weekly basis for different instruments across different time-frames and different time periods. These settings will also be categorized into conservative, moderate and aggressive for different types of trading styles (Day Trading, Swing Trading and Long Term Investing).

Past 12 months performance for XAU/USD (M30) with $10000 on Conservative mode with Day Trading style:

Lots: 0

Risk (in %): 4.5

Max Orders: 3

Stop Loss in points: 1000

Take Profit in points: 270

Trailing Start in points: 200

Trailing Step in points: 100

Consecutive Bullish Signals: 8

Consecutive Bearish Signals: 10

Attachment Name: XAUUSD-M30.zip

Past 12 months performance for USD/CAD (M5) with $10000 on Moderate mode with Day Trading style:

Lots: 0

Risk (in %): 4.5

Max Orders: 4

Stop Loss in points: 180

Take Profit in points: 190

Trailing Start in points: 120

Trailing Step in points: 30

Consecutive Bullish Signals: 12

Consecutive Bearish Signals: 12

Attachment Name: USDCAD-M5.zip

Past 12 months performance for GBP/USD with $10000 on Aggressive mode with Day Trading style:

Lots: 0

Risk (in %): 3.5

Max Orders: 3

Stop Loss in points: 190

Take Profit in points: 190

Trailing Start in points: 130

Trailing Step in points: 60

Consecutive Bullish Signals: 7

Consecutive Bearish Signals: 10

Attachment Name: GBPUSD-M30.zip

Past 12 months performance for NAS100 with $10000 on Moderate mode with Day Trading style:

Lots: 0

Risk (in %): 4.5

Max Orders: 4

Stop Loss in points: 1260

Take Profit in points: 420

Trailing Start in points: 360

Trailing Step in points: 220

Consecutive Bullish Signals: 9

Consecutive Bearish Signals: 10

Attachment Name: NAS100-M15.zip

Please note that past performance do not guarantee future performance.

-Sanchay Kasturey

We provide backtests as well as videos are uploaded in our youtube channel showing Galileo FX EA trading live. You can verify our performance page results as well.I am also beginning to suspect that these people's settings simply dont work. This whole galileofx thing is just being overhyped.

Yeah sure why not, you can customize your EA inputs strategy as per your preferences, however, the results may differ because of different conditions.Can I use less risk reward instead

Similar threads

- Replies

- 13

- Views

- 562

- Replies

- 11

- Views

- 877

- Replies

- 11

- Views

- 716

- Locked

- Sticky

- Replies

- 0

- Views

- 606