Hey everyone,

Let me attach some useful info for you guys here:

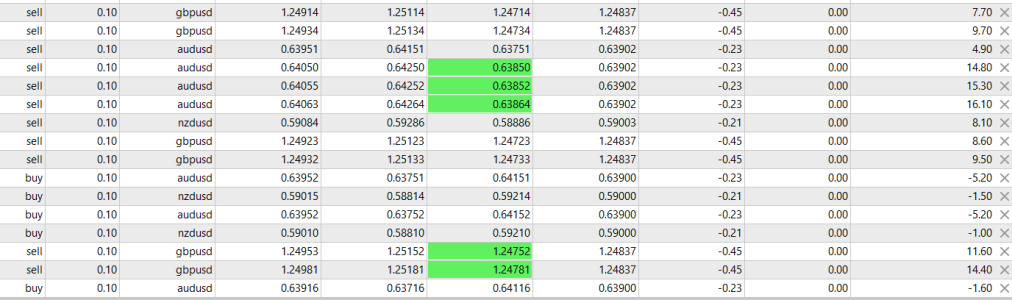

The trading strategy that buys and sells after a certain number of bullish or bearish signals is based on technical analysis. The robot scans the market in real-time, analyzing charts and looking for patterns based on specific parameters. The strategy is designed to detect consecutive bullish or bearish signals, which are generated by technical indicators, and use these signals to determine whether to buy or sell.

For example, if the parameter is set to 5 consecutive bullish signals, the bot will wait until it detects 5 bullish signals in a row before executing a sell order. The same applies to bearish signals.

The strategy is designed to capture inversions of trends in the market and profit from them. The idea behind this strategy is that the more consecutive signals there are, the more likely it is that the trend will reverse.

This type of strategy is commonly used by traders who are looking to automate their technical analysis and make trades based on a set of defined rules. By setting specific parameters for the number of consecutive signals, the robot can make trades that are

based on a clear and concise system, reducing the impact of emotions and human error.

In conclusion, the trading strategy that buys and sells after a certain number of bullish or bearish signals is a

powerful tool for traders who want to automate their technical analysis and

benefit from the scalability and

accuracy of a trading robot.

We suggest starting with the suggested

settings and trying them out in Demo (M1, M5, M30, H1) to find the best configuration that works with your specific setup and broker.

Our first suggestion is to let the bot run in Demo and complete the analysis process. The bot requires real-time data to work effectively, so you need to run it for some time to feed the bot with live data.

We recommend testing and experimenting with all the different presets and different pair combinations in Demo. Additionally, don’t forget to try different timeframes (M1, M5, M30, H1) to find the best configuration that works with your specific setup and broker.

Timeframe Explanation: By decreasing the Time Frame setting (for example M1, M5, M15 or M30), you will instruct GalileoFX to trade more frequently. Likewise, by increasing the Timeframe (for example H1, H2, H4, H6 or D1).

Examples of Timeframes:

M1 = One trade per minute

M5 = One trade every 5 minutes

M15 = One trade every 15 minutes

M30 = One trade every 30 minutes

H1 = One trade every 1 hour

D1 = One trade every 1 day

Consecutive Bullish/Bearish Signals Explanation: This is the most critical setting of GalileoFX. It instructs the software when it should buy or sell. If it’s set low (1–3), the bot will trade with higher risk and higher reward. If it’s set high (7–10), GalileoFX will make fewer trades.

Examples of Consecutive Bullish/Bearish Signals:

High Risk: Consecutive Bullish/Bearish Signals = 1 to 3

Medium Risk: Consecutive Bullish/Bearish Signals = 3 to 6

Low Risk: Consecutive Bullish/Bearish Signals = 7 to 10