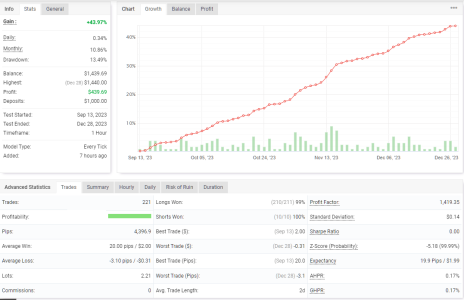

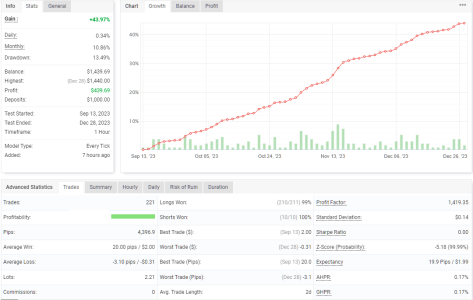

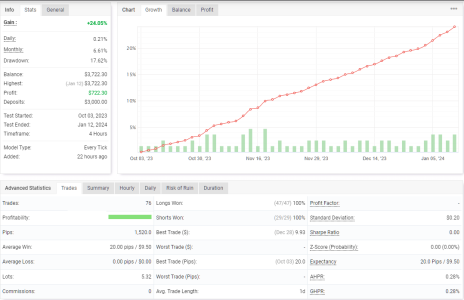

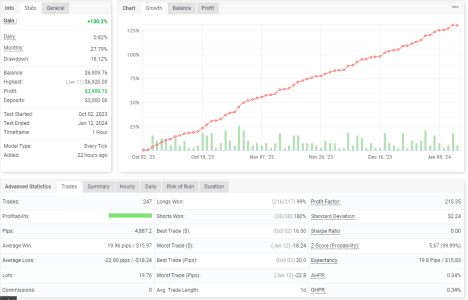

AUDUSD H4= 43.97%

www.myfxbook.com

www.myfxbook.com

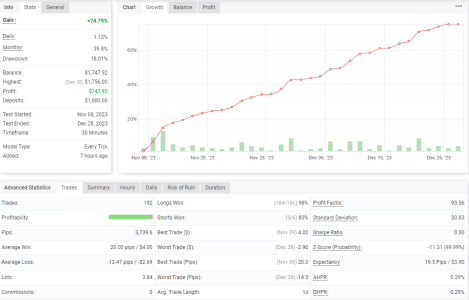

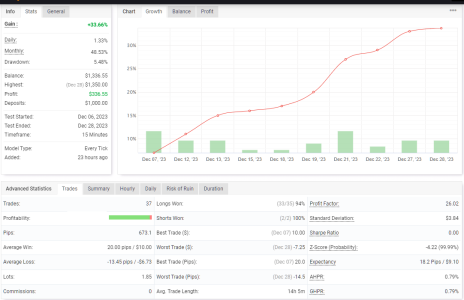

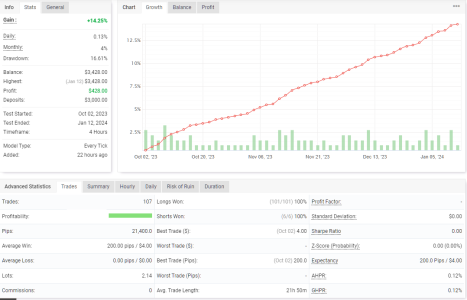

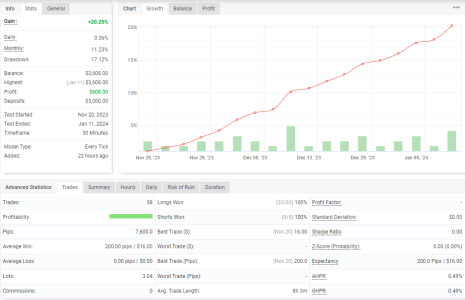

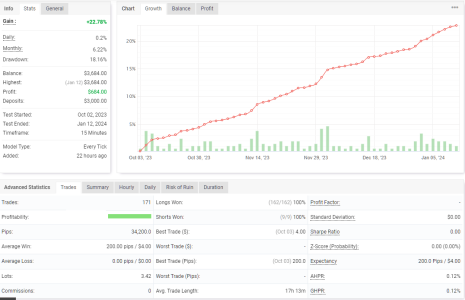

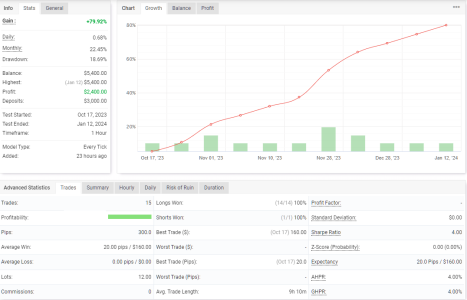

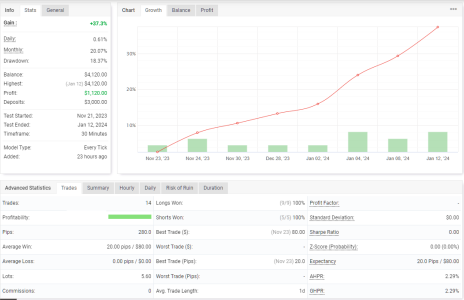

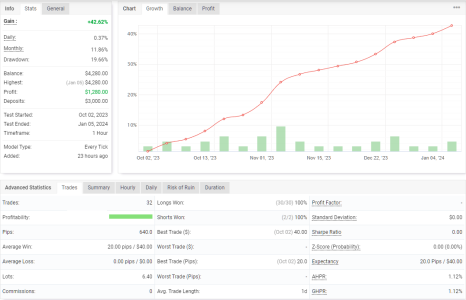

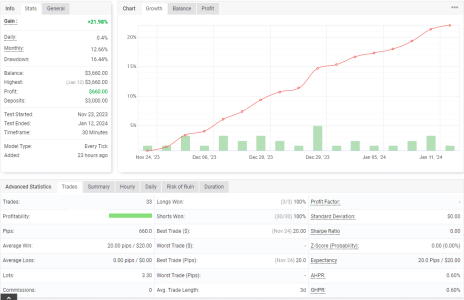

Galileo_FX_June_5-Dec_29_2023_AUDUSD_H4 Strategy | Myfxbook

Results and performance of Galileo_FX_June_5-Dec_29_2023_AUDUSD_H4 strategy. Discuss, review, analyze, export, follow and learn about Galileo_FX_June_5-Dec_29_2023_AUDUSD_H4 strategy on Myfxbook.