Hi everyone,

I hope you're all doing well! I’m new to forex trading and just getting started with the Galileo FX Personal Expert Advisor. I have very little experience in trading, so I'm reaching out for help from the community.

I’m working with a balance of

US $1,000, and I’m trying to figure out the

best profitable settings that would suit my account size while minimizing risk. I’m particularly interested in the following parameters:

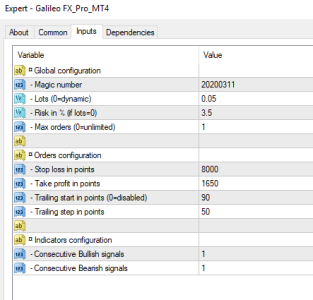

- Lot Size: Should I use dynamic lots or a fixed lot size?

- Risk Percentage: What percentage would you recommend I risk per trade to maintain a good balance between risk and reward?

- Max Orders: How many open trades should I allow at one time?

- Stop Loss & Take Profit: Any advice on the ideal SL and TP points to stay on the safer side?

- Trailing Stop: Should I enable a trailing stop, and if so, what would be a good setting for the Trailing Start (in points) and Trailing Step (in points)??

- Consecutive Bullish/Bearish Signals: How many consecutive signals would be best to ensure reliable entry points?

I’m also using the

H1 timeframe at the moment, but I’m open to suggestions on whether this is the best choice.

If anyone here has experience with the Galileo FX and could offer advice or share their profitable settings for a similar account size, I’d be really grateful! I want to make sure I’m setting myself up for long-term success while keeping my risk low.

Thanks so much for your help in advance!

Best regards,

ljbanii

Hi there. My friends call me CSI (the Common Sense Investor). I saw your post and wanted to encourage you that you are

asking all the right questions. $1000 is the perfect amount to start Forex trading because it is easier to build it to a larger account.

I have taken a small account of $250 and turned that into $500, then $700 and right now we are at $1062. So, I know exactly where you stand.

About "Lot Size"

As for choosing "Lot Size" remember this golden rule: Lot Size tells you how much the trade will cost you to enter into the trade.

For example, you have $1000. And, you want to buy .05 lot size for AUDUSD when Galileo says its a buy (or sell). This means that contract, while you hold it

will cost around $310 dollars. If you have $1000 and you spend $310 to open the position with a lot size of .05, then your free margin will drop by $310 from $1000 to $610.

Now, you should understand that whatever your Free Margin let's you know how much your account can lose before being margin called and your position closed for a loss. For the record, right now, I try and keep about a $300 to $350 in Free Margin at all times. This means all of my positions would have to fall $310 before I could be margin called and the trade sold for a loss.

On Risk %

When you use a "Lot Size" then "Risk %" will be irrelevant. The trade will transact according to what lot size you set. However, you can set Galileo to a lot size of zero (0) and a Risk % of 1% means Galileo will choose a lot size that will risk only 1% of your balance. If you have a Risk % of 2, then Galileo will choose your Lot Size for you that will only risk 2 %....

On Max Orders

Max Orders can be a positive and a negative thing. Let's say you set your Max Orders to 5 and you are on the 5 minute chart. This means that every 5 minutes Galileo will check the chart for a buy or sell opportunity. Now, here is the danger.... I once had my Max Orders on 5 and was trading on the 5 minute time frame. Galileo opened a trade with the AUDUSD. Five minutes later, Galileo checks the chart again for a buy and sell opportunity, if it sees one it will open a second position. You now have 2 positions open in AUDUSD and in 5 minutes, Galileo will check the chart again and if it sees a buy or sell opportunity, then it will open a THIRD trade. And, this can go on for 25 minutes till Galileo has opened 5 orders as per its settings. So, Max Orders on a lower time frame chart needs to be 1.

Now, there is a time to increase your Max Orders. And, that is when you are trading on a higher time frame like the 1 hour chart. In this case, Galileo would open a position when a buy or sell opportunity presented itself. And, in one hour it will check the chart again to see if it is still in that trend and if it sees a buying or selling opportunity. If it does, then when it enters the second trade that would be like averaging down. So, if I used this strategy, I could set my Max Orders to (2).

Stop Loss/Take Profit

Let's be clear. I don't use a stop loss. Well, I set my "Stop/Loss" at 10,000 points (which is 1000 pips) which the currency will never fall that much in one trade (the average is around 30 to 60 pips. The reason I say I don't use a "Stop Loss" is I enter as a "Drawdown" play.

What is Drawdown - When you learn to run your optimization test, it will tell you how much the currency MAY fall before it reverses and goes back up to your take profit point. From the report you will run, you will see that using a lot size of .05 for the AUDUSD will have a "Drawdown" of -$54.42 (how much it will fall if it falls BEFORE GOING BACK UP).

Bullish/Bearish Signals

I am working on a lesson now to teach about how bullish and bearish signals work. In a nut shell, bullish and bearish signals determine how often the bot will buy or sell. If your bot is set on bullish and bearish settings of one (1), then it might make 100 trades. If you have your bot set on five (5), then it may only make 50 to 60 trades. If you have it set on 10 then it may make only 1 trade in the same time period.

Also, if you have the bot set on one (1), what they call Aggressive, then every time the bot sees the first buy or sell signal, it will do a trade. If it is set to 5 then it will wait till the chart shows 5 bullish or 5 bearish signals. So of course, if it is set to only one signal needed to open a trade it will get more trades than if it is set to waiting for 5 consecetive bullish or bearish signal.

Hope this helped. If you need any further help, I have a Youtube Channel with a Playlist of Galileo Video teaching here:

ðHow to Purchase the Galileo FX Trading Bot https://store.galileofx.com/pages/pricing-unlocked Follow Along With Our Results in THIS Google Drive ð https://d...

www.youtube.com