You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

My Personal Back Testing Results for GBPUSD M30

- Thread starter mjkidd27

- Start date

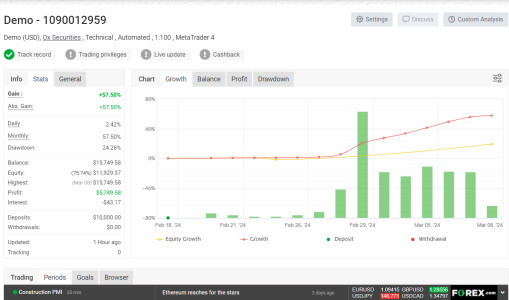

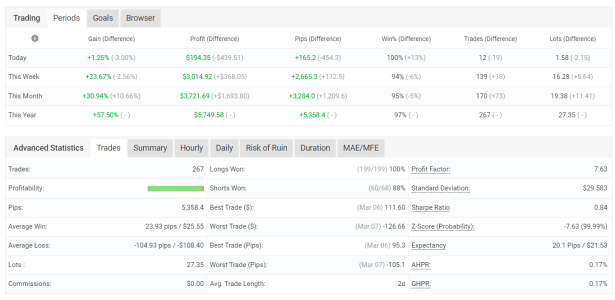

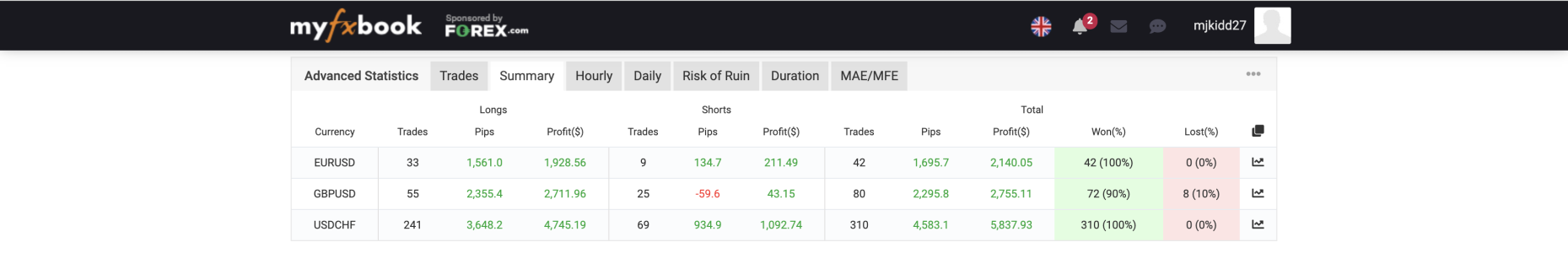

Can you share an example of your back testing setup on MT5Update for March 5th, 2024. Been running since Feb 18th and have accounted for 180 trades with 154 of those on the USDCHF M5. See the results below. 154 winning trades (100%) accounting for 2,867.5 pips of profit. My objective is to continue to optimize the bot over the weekends and apply any tweaks to the settings as required. I'm anticipating (and hoping) to see minimal required changes to the settings, but I do expect there will be changes as the market & pair change personality. I originally started with TP at 200 and Bull/Bear of 4/4. This week optimization suggested a tweak of TP at 100 and Bull/Bear of 5/4. Here are the results since beginning 2/18. You'll notice I also have some strategies running on the EUR and GBP.

mjkidd27

Member

Update for March 10th, 2024. Been running since Feb 18th and have accounted for 264 trades with 195 of those on the USDCHF M5. The USDCHF has yet to take a loss but has a handful of trades underwater with the worst being -107 pips. This week will be telling to see if price rallies back up or continues to fall. Last week I was running the USDCHF with Bull/Bear of 5/4 and TP at 100 (10 pips). This week optimization suggests 7/6 and 150.

As you will see below, I took 8 losses on the GBPUSD which had a SL of 1050 (105 pips) last week.

The EURUSD is still plugging away but well underwater too.

This week will be telling! I'm hinging on manually closing the worst EUR and GBP trades and thereby freeing up margin to allow the CHF to continue to outperform.

As you will see below, I took 8 losses on the GBPUSD which had a SL of 1050 (105 pips) last week.

The EURUSD is still plugging away but well underwater too.

This week will be telling! I'm hinging on manually closing the worst EUR and GBP trades and thereby freeing up margin to allow the CHF to continue to outperform.

Attachments

mjkidd27

Member

These are live results. This is not back tested data I’m showing here.Thanks for the update and goodluck. I wonder if live results will be similar.

mjkidd27

Member

Yes, same here. Theoretically, it should not differ…we shall see!I meant real account with real money

InvictusRO

Member

69% up trading just USDCHF bullish/bearish 5/4, 0 S/L and 100 T/P? I`ve been testing these settings of yours for 2 weeks now and did not touch it, so far 47 winners and 0 loosers (no stop loss).Update...I let the open worst EUR and GBP trades run and did not manually close them. I'm most interested in seeing how the bot performs under stress. Looking to go LIVE starting April 1st! Currently sitting at 69.38% up in less than 1 month of trading!

norman Says

New member

Hi! Are you manually closing all your trades or are you setting a TP and just wait to hit it. Do you also set an SL?Update...I let the open worst EUR and GBP trades run and did not manually close them. I'm most interested in seeing how the bot performs under stress. Looking to go LIVE starting April 1st! Currently sitting at 69.38% up in less than 1 month of trading!

mjkidd27

Member

Higher in the thread you will see my settings for Bull/Bear and TP. with SL set to 0, all based on optimizations. A very important setting that is often overlooked is the % Risk. I have it set at 1% based on optimizations with Maximum Orders at 0 (unlimited). I mention this bc with an overly aggressive % Risk setting, the account is too easily and too quickly put under stress and more likely at the risk of ruin.Hi! Are you manually closing all your trades or are you setting a TP and just wait to hit it. Do you also set an SL?

InvictusRO

Member

Hey man, how`s it going? Still using the same settings for the USDCHF?Higher in the thread you will see my settings for Bull/Bear and TP. with SL set to 0, all based on optimizations. A very important setting that is often overlooked is the % Risk. I have it set at 1% based on optimizations with Maximum Orders at 0 (unlimited). I mention this bc with an overly aggressive % Risk setting, the account is too easily and too quickly put under stress and more likely at the risk of ruin.

mjkidd27

Member

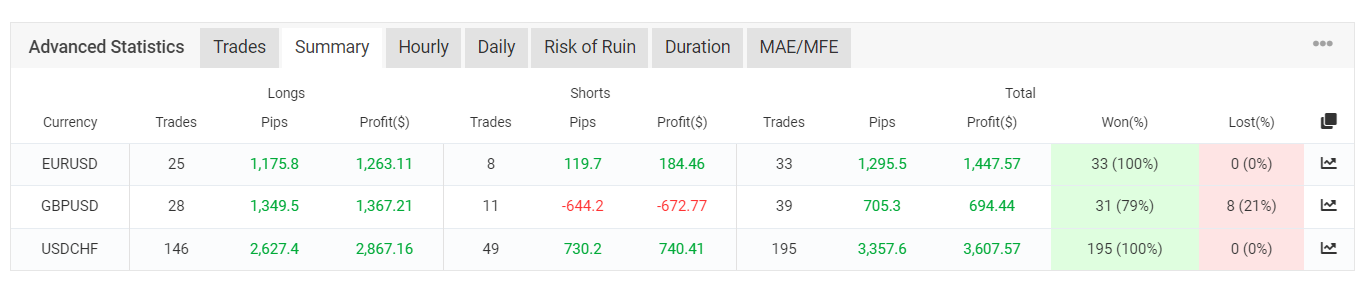

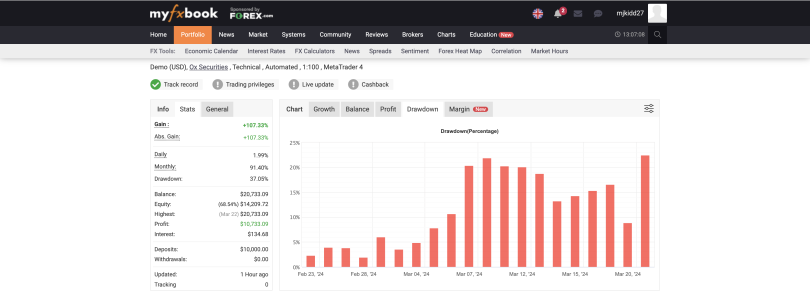

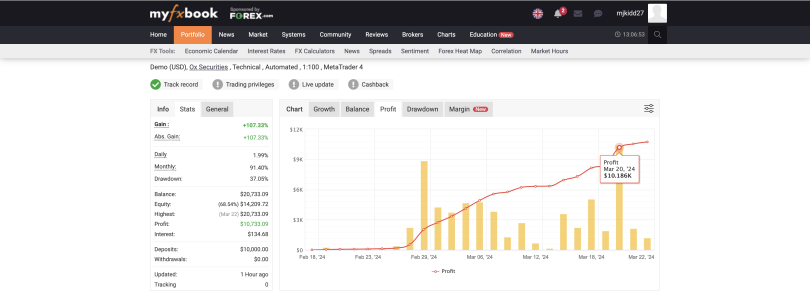

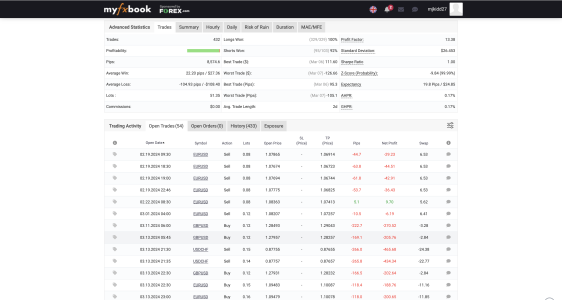

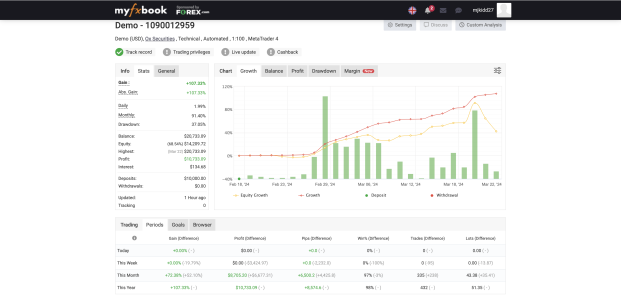

Ok, here's the latest update on the $10,000 DEMO account that started trading on 2/18/24. It took 23 trading days to double the account while risking 1% per trade! Recall, I've been trading the EURUSD-M30, GBPUSD-M30 and USDCHF-M5 simultaneously with great results. See data attached below.

A few things to take note of here that may be missed in light of the exciting "doubled the account" news:

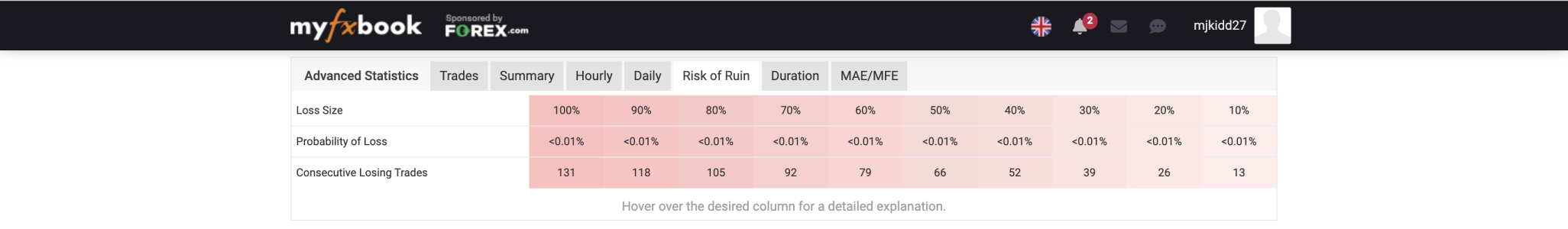

1. The Risk of Ruin is quite comfortable for my liking. In order to lose 10% of the account value, we would require 13 consecutive losing trades and 118 consecutive losing trades to lose 90% of the account. In 432 total trades between the 3 pairs, I realized 8 losing trades due to stop outs when using a Stop Loss. (More on this in my next post)

2. Not surprising but Wednesday and Thursday are the big moving days and account for the greatest amount of overall account growth.

3. Maximum Drawdown was at 22.48% on March 21st. This is quite comfortable for me as I don't like to see that reach beyond 30%.

4. Doubling the account was achieved with a modest 1% risk per trade and not restricting the number of trades the bot could enter or have open. This is an interesting point to consider and I'll elaborate on my thoughts in the next post...

I hope this data is helpful. Please share your thoughts and questions.

A few things to take note of here that may be missed in light of the exciting "doubled the account" news:

1. The Risk of Ruin is quite comfortable for my liking. In order to lose 10% of the account value, we would require 13 consecutive losing trades and 118 consecutive losing trades to lose 90% of the account. In 432 total trades between the 3 pairs, I realized 8 losing trades due to stop outs when using a Stop Loss. (More on this in my next post)

2. Not surprising but Wednesday and Thursday are the big moving days and account for the greatest amount of overall account growth.

3. Maximum Drawdown was at 22.48% on March 21st. This is quite comfortable for me as I don't like to see that reach beyond 30%.

4. Doubling the account was achieved with a modest 1% risk per trade and not restricting the number of trades the bot could enter or have open. This is an interesting point to consider and I'll elaborate on my thoughts in the next post...

I hope this data is helpful. Please share your thoughts and questions.

Attachments

-

Screenshot 2024-03-26 at 1.07.24 PM.png410.3 KB · Views: 0

Screenshot 2024-03-26 at 1.07.24 PM.png410.3 KB · Views: 0 -

Screenshot 2024-03-26 at 1.07.11 PM.png382.9 KB · Views: 0

Screenshot 2024-03-26 at 1.07.11 PM.png382.9 KB · Views: 0 -

Screenshot 2024-03-26 at 1.06.55 PM.png402.7 KB · Views: 0

Screenshot 2024-03-26 at 1.06.55 PM.png402.7 KB · Views: 0 -

Screenshot 2024-03-26 at 12.57.31 PM.png185.5 KB · Views: 0

Screenshot 2024-03-26 at 12.57.31 PM.png185.5 KB · Views: 0 -

Screenshot 2024-03-26 at 12.57.17 PM.png200.9 KB · Views: 0

Screenshot 2024-03-26 at 12.57.17 PM.png200.9 KB · Views: 0 -

Screenshot 2024-03-26 at 12.56.50 PM.png590.4 KB · Views: 0

Screenshot 2024-03-26 at 12.56.50 PM.png590.4 KB · Views: 0 -

Screenshot 2024-03-26 at 12.56.18 PM.png520.3 KB · Views: 0

Screenshot 2024-03-26 at 12.56.18 PM.png520.3 KB · Views: 0

mjkidd27

Member

Ok, now let's talk about the Risk of Ruin! As I mentioned in the post above, the current RoR has held steady at 13 trades to lose 10% of the account. What I'd like to expand upon is what I'm most interested in with regards to the DEMO account and giving the bot every chance to ruin the account without any interference by me in the way of manually trading.

Some ground rules first:

(1) I optimize each pair weekly, looking back 30 days to the current end of week. I then update the trade settings for each of the 3 pairs on Sunday, in time for the markets to open.

(2) I do not interfere in the bots trading such as manually opening or closing trades.

(3) The optimizer has never recommended I use a Stop Loss while looking back 30 days. If however, the timeframe is significantly extended, the bot becomes far less profitable.

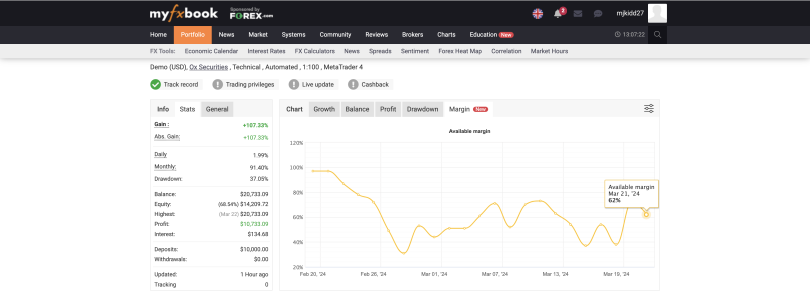

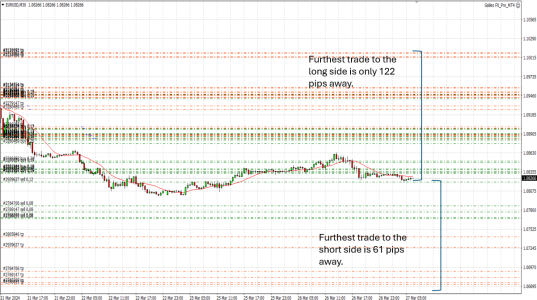

Ok, now let's look at the images attached below...My theory has always been that IF the bot never uses a SL, then at some point as the market moves away from open positions left behind, eventually the account's Margin Level % and it's ability to hold those stranded positions open, will be stressed. As the stranded positions wait for the market to one day return, the account's available margin will be put under significant stress and eventually be subjected to Margin Calls. This theory was proven correct in another DEMO account when trading the same settings but with 5% risk per trade vice the modest 1% risk per trade shown in the results in my previous post. What occurred was exactly what I had suspected...the account was running below 100% Margin Level (think less than 10% margin available) and the brokerage starting closing out positions automatically. This resulted in a quick 88% of the account's balance/value being washed away! The original $10,000 account went from over $17,000 in value to $1,500 in value in a single day.

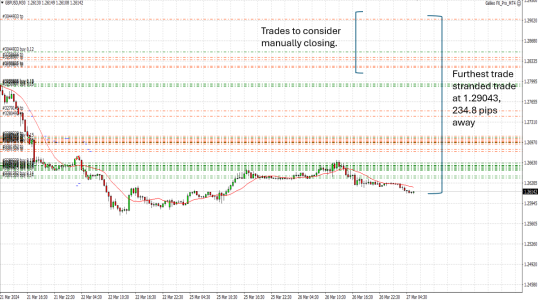

So what do I propose? I propose that an account not using Stop Losses in their bot settings will need to manually intervene periodically if we experience a significant and prolonged move away from stranded trades. In the 1st image below, a trader would need to monitor the account's Margin Level and if the account begins to become over-stressed, i.e. <100% Margin Level for example, the worst trades will need to be manually closed to preserve the account and prevent the brokerage from taking over.

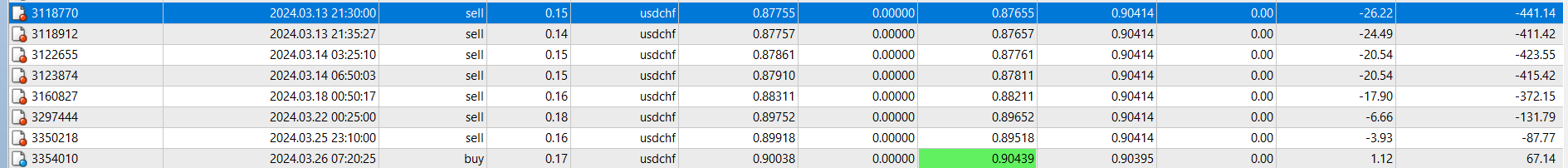

The second image shows the current worst trade for the USDCHF pair at -276.7 pips. (The $ does not matter but if you're curious and asking, this is a .15 lot sized trade or -$442 that has been open since 3/13/24 at 21:30) The 3rd image shows the open trades for the USDCHF. The 5 worse trades are worth -$1,660. With current price that far away, it is costing the account 23% in Margin Level with a total of all open CHF trades accounting for 34% of available margin. If I manually close these trades out and take a $1,660 loss on 5 trades, it would provide substantial cushion to the account's available margin.

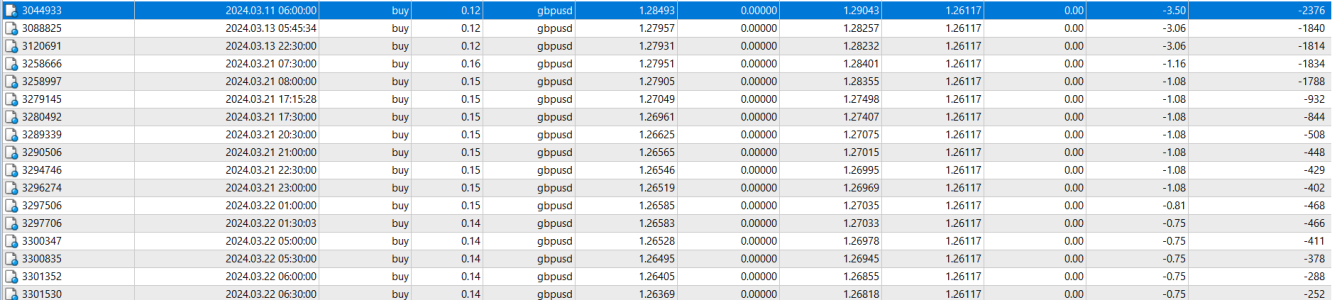

Now let's look at the GBPUSD pair. The 4th Image shows the open trades in points with the worst being -237.6 pips (lot size of .12). Total of the 5 worst trades is -$1,277 or 18% of available margin with an overall claim of 31% on available margin as seen in 5th image.

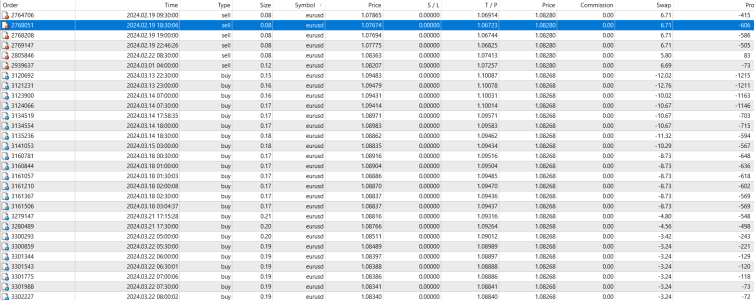

Lastly, let's look at the EURUSD pair. This pair has trades spread out on both sides of current price and is relatively still healthy. See images 6 & 7. I would not plan on manually closing any of these trades out yet. Total claim on available margin is 35%

Conclusions: !. I believe it truly matters on the pair and what the total trade value means in regards to the Available Margin Level. If a pair truly has open trades that are stranded and need to be manually closed to preserve Available Margin for ongoing open and future trades, then I believe it would be best to close those and effectively reset and recover the trading pair's health.

I hope this has analysis been beneficial and I welcome your thoughts and questions. Does anyone see this differently and have an argument for a different approach?

Some ground rules first:

(1) I optimize each pair weekly, looking back 30 days to the current end of week. I then update the trade settings for each of the 3 pairs on Sunday, in time for the markets to open.

(2) I do not interfere in the bots trading such as manually opening or closing trades.

(3) The optimizer has never recommended I use a Stop Loss while looking back 30 days. If however, the timeframe is significantly extended, the bot becomes far less profitable.

Ok, now let's look at the images attached below...My theory has always been that IF the bot never uses a SL, then at some point as the market moves away from open positions left behind, eventually the account's Margin Level % and it's ability to hold those stranded positions open, will be stressed. As the stranded positions wait for the market to one day return, the account's available margin will be put under significant stress and eventually be subjected to Margin Calls. This theory was proven correct in another DEMO account when trading the same settings but with 5% risk per trade vice the modest 1% risk per trade shown in the results in my previous post. What occurred was exactly what I had suspected...the account was running below 100% Margin Level (think less than 10% margin available) and the brokerage starting closing out positions automatically. This resulted in a quick 88% of the account's balance/value being washed away! The original $10,000 account went from over $17,000 in value to $1,500 in value in a single day.

So what do I propose? I propose that an account not using Stop Losses in their bot settings will need to manually intervene periodically if we experience a significant and prolonged move away from stranded trades. In the 1st image below, a trader would need to monitor the account's Margin Level and if the account begins to become over-stressed, i.e. <100% Margin Level for example, the worst trades will need to be manually closed to preserve the account and prevent the brokerage from taking over.

The second image shows the current worst trade for the USDCHF pair at -276.7 pips. (The $ does not matter but if you're curious and asking, this is a .15 lot sized trade or -$442 that has been open since 3/13/24 at 21:30) The 3rd image shows the open trades for the USDCHF. The 5 worse trades are worth -$1,660. With current price that far away, it is costing the account 23% in Margin Level with a total of all open CHF trades accounting for 34% of available margin. If I manually close these trades out and take a $1,660 loss on 5 trades, it would provide substantial cushion to the account's available margin.

Now let's look at the GBPUSD pair. The 4th Image shows the open trades in points with the worst being -237.6 pips (lot size of .12). Total of the 5 worst trades is -$1,277 or 18% of available margin with an overall claim of 31% on available margin as seen in 5th image.

Lastly, let's look at the EURUSD pair. This pair has trades spread out on both sides of current price and is relatively still healthy. See images 6 & 7. I would not plan on manually closing any of these trades out yet. Total claim on available margin is 35%

Conclusions: !. I believe it truly matters on the pair and what the total trade value means in regards to the Available Margin Level. If a pair truly has open trades that are stranded and need to be manually closed to preserve Available Margin for ongoing open and future trades, then I believe it would be best to close those and effectively reset and recover the trading pair's health.

I hope this has analysis been beneficial and I welcome your thoughts and questions. Does anyone see this differently and have an argument for a different approach?

Attachments

-

Screenshot 2024-03-26 203441.png371.9 KB · Views: 0

Screenshot 2024-03-26 203441.png371.9 KB · Views: 0 -

Screenshot 2024-03-26 200804.png74.4 KB · Views: 0

Screenshot 2024-03-26 200804.png74.4 KB · Views: 0 -

Screenshot 2024-03-26 202306.png311.9 KB · Views: 0

Screenshot 2024-03-26 202306.png311.9 KB · Views: 0 -

Screenshot 2024-03-26 195407.png36.7 KB · Views: 0

Screenshot 2024-03-26 195407.png36.7 KB · Views: 0 -

Screenshot 2024-03-26 201545.png244 KB · Views: 0

Screenshot 2024-03-26 201545.png244 KB · Views: 0 -

Screenshot 2024-03-26 at 1.39.05 PM.png656.1 KB · Views: 0

Screenshot 2024-03-26 at 1.39.05 PM.png656.1 KB · Views: 0 -

Screenshot 2024-03-26 203514.png127.3 KB · Views: 0

Screenshot 2024-03-26 203514.png127.3 KB · Views: 0

mjkidd27

Member

@VinzOk, here's the latest update on the $10,000 DEMO account that started trading on 2/18/24. It took 23 trading days to double the account while risking 1% per trade! Recall, I've been trading the EURUSD-M30, GBPUSD-M30 and USDCHF-M5 simultaneously with great results. See data attached below.

A few things to take note of here that may be missed in light of the exciting "doubled the account" news:

1. The Risk of Ruin is quite comfortable for my liking. In order to lose 10% of the account value, we would require 13 consecutive losing trades and 118 consecutive losing trades to lose 90% of the account. In 432 total trades between the 3 pairs, I realized 8 losing trades due to stop outs when using a Stop Loss. (More on this in my next post)

2. Not surprising but Wednesday and Thursday are the big moving days and account for the greatest amount of overall account growth.

3. Maximum Drawdown was at 22.48% on March 21st. This is quite comfortable for me as I don't like to see that reach beyond 30%.

4. Doubling the account was achieved with a modest 1% risk per trade and not restricting the number of trades the bot could enter or have open. This is an interesting point to consider and I'll elaborate on my thoughts in the next post...

I hope this data is helpful. Please share your thoughts and questions.

Similar threads

- Replies

- 2

- Views

- 310

- Replies

- 7

- Views

- 699

- Replies

- 8

- Views

- 3K

- Replies

- 26

- Views

- 4K

J