Hey everyone,

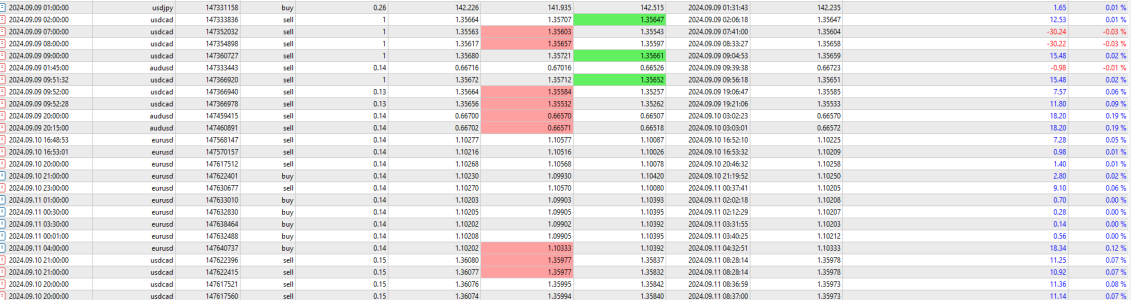

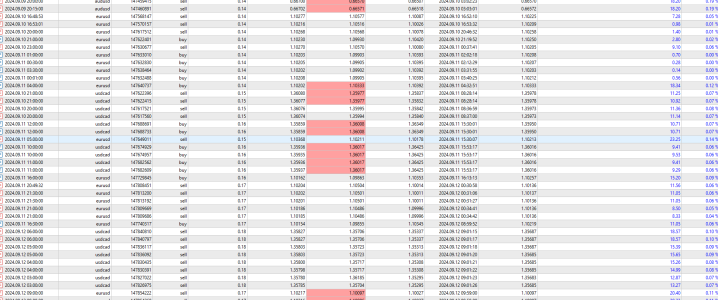

I’ve been experimenting with Galileo FX for about a month now, starting with a demo account and recently moving to my first live trade last week. So far, I’ve seen good results, especially with USDCAD, AUDUSD, and EURUSD pairs. For most of my trades, I’ve been using the presets available on the official GFX presets page, except for EURUSD, where I customized my settings based on recommendations for handling consecutive bearish and bullish signals across conservative, moderate, and aggressive setups.

As a first-time trader, I’ve been relying heavily on this community and experimenting (mainly in the demo account) to figure out which settings work best for me. Here are the settings I’m currently using:

I’m still experimenting with different settings, but I’d love to hear from you! What pairs and settings have been working well for you?

I’ve been experimenting with Galileo FX for about a month now, starting with a demo account and recently moving to my first live trade last week. So far, I’ve seen good results, especially with USDCAD, AUDUSD, and EURUSD pairs. For most of my trades, I’ve been using the presets available on the official GFX presets page, except for EURUSD, where I customized my settings based on recommendations for handling consecutive bearish and bullish signals across conservative, moderate, and aggressive setups.

As a first-time trader, I’ve been relying heavily on this community and experimenting (mainly in the demo account) to figure out which settings work best for me. Here are the settings I’m currently using:

- AUDUSD: Meteor Momentum Maneuver (found on the performance page)

- USDCAD: USDCAD Swing m15 (got this from @Sanchay’s thread, “Updated Winning Settings”)

I’m still experimenting with different settings, but I’d love to hear from you! What pairs and settings have been working well for you?