Daneil

New member

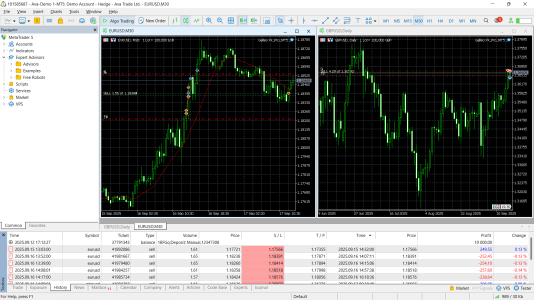

For this week's testiing , i picked the " Rogue Impulse Nexus " strategy from GalileoFx performance page (link - https://store.galileofx.com/pages/performance/settings?name=rogue-impulse-nexus ) to see how it reacts in real conditions . on the performance page , the description clearly indicated that it was tested on the USDCAD pair using the 30 - minute timeframe .

in comparison , i ran the test on EURUSD and GBPUSD pairs using 1-minute Timefreame.

Setup

Account : 10k

Pairs : EURUSD / GBPUSD

Timefreame : 1 Minute

Risk to reward ratio (RRR) : 1:1

The risk to reward ration was the interesting part . i noticed a pattern, which is why i changed it. previously, i belive it was around 1:3 or 1:3.5 by changing it to 1:1 ; i think we're making some progress.

The System already closed two trades with profit . don't get me wrong - from a risk management perspective , a 1:1 RRR isn't ideal . but remeber , risk to reward goes hand in hand with the win rate . if we stay above 50% winning trades , we good to go .

Let's see how it perform on a weekly and monthly basis . if results are solid , i'll share the settings.

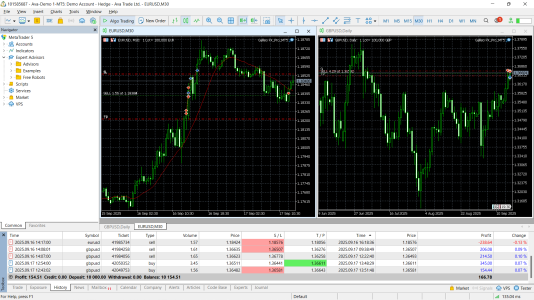

Results ( 3-day Test )

Total trades : 9

Wins : 5

Losses : 4

Net profit: +$166

Max Drawdown : -$632

Compared to my first day , the setting i chnaged more trade entries . i also tested the strategy on two pairs this time , and the trades felt much more meaningful . what stood out to me was that both trades on GBPUSD were 100 % winners , which i really liked because the system locked in gains automatically without any manual intervention . that's actually my favorite feature on GalileoFX.

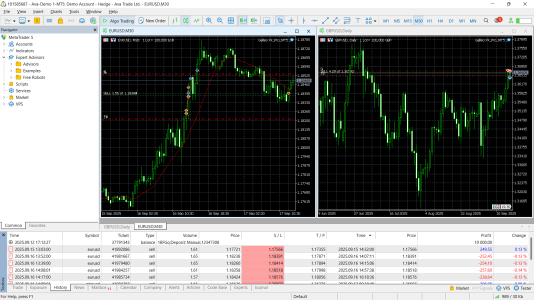

I'll continue running this startegy for the rest of the week - especially during major news events - and share a weekly wrap-up by friday , comparing GBPUSD vs EURUSD perfromance .

Has anyone else tested Rogue Impulse Nexus On pairs with bigger swings (Gold Or GBPJPY) ?

in comparison , i ran the test on EURUSD and GBPUSD pairs using 1-minute Timefreame.

Setup

Account : 10k

Pairs : EURUSD / GBPUSD

Timefreame : 1 Minute

Risk to reward ratio (RRR) : 1:1

The risk to reward ration was the interesting part . i noticed a pattern, which is why i changed it. previously, i belive it was around 1:3 or 1:3.5 by changing it to 1:1 ; i think we're making some progress.

The System already closed two trades with profit . don't get me wrong - from a risk management perspective , a 1:1 RRR isn't ideal . but remeber , risk to reward goes hand in hand with the win rate . if we stay above 50% winning trades , we good to go .

Let's see how it perform on a weekly and monthly basis . if results are solid , i'll share the settings.

Results ( 3-day Test )

Total trades : 9

Wins : 5

Losses : 4

Net profit: +$166

Max Drawdown : -$632

Compared to my first day , the setting i chnaged more trade entries . i also tested the strategy on two pairs this time , and the trades felt much more meaningful . what stood out to me was that both trades on GBPUSD were 100 % winners , which i really liked because the system locked in gains automatically without any manual intervention . that's actually my favorite feature on GalileoFX.

I'll continue running this startegy for the rest of the week - especially during major news events - and share a weekly wrap-up by friday , comparing GBPUSD vs EURUSD perfromance .

Has anyone else tested Rogue Impulse Nexus On pairs with bigger swings (Gold Or GBPJPY) ?