I've been looking at the recently posted Galileo performance tests here: https://store.galileofx.com/pages/performance

I'm trying to replicate some of these in MT5's Strategy Tester, but unable to get the same (or even similar) results.

Just one example: GBP/CHF M30 Sep 11-15 (posted perf test here: https://www.myfxbook.com/strategies/galileo-fx-sept-11-sept/348830)

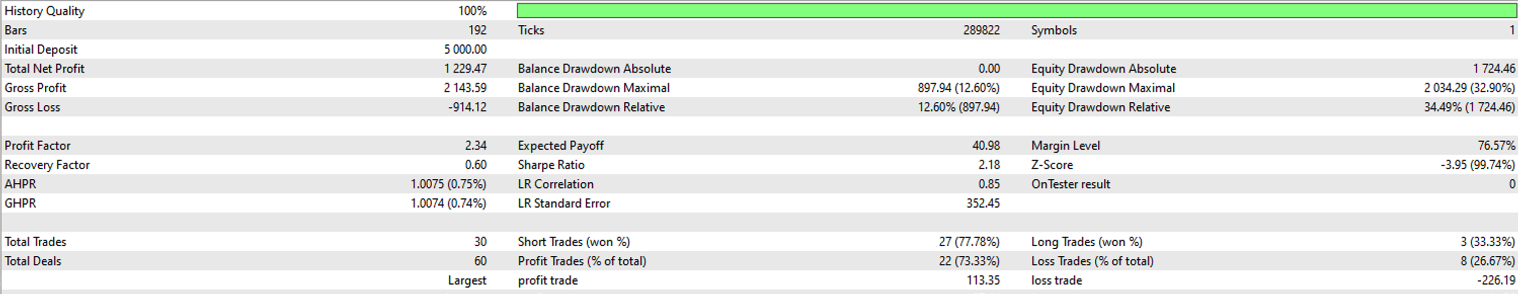

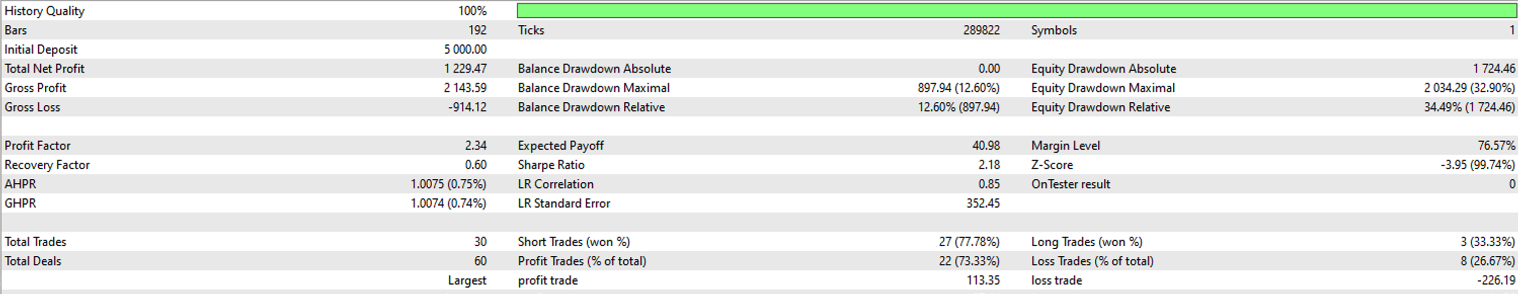

What I get out of MT5 with the exact same settings (using Galileo Pro) is totally different:

What am I doing wrong?

Thank you in advance, as I've only started with Galileo a couple of weeks ago.

I'm trying to replicate some of these in MT5's Strategy Tester, but unable to get the same (or even similar) results.

Just one example: GBP/CHF M30 Sep 11-15 (posted perf test here: https://www.myfxbook.com/strategies/galileo-fx-sept-11-sept/348830)

What I get out of MT5 with the exact same settings (using Galileo Pro) is totally different:

What am I doing wrong?

Thank you in advance, as I've only started with Galileo a couple of weeks ago.