You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Weekly Updated Galileo FX Settings: Conservative, Moderate & Aggressive

- Thread starter Sanchay

- Start date

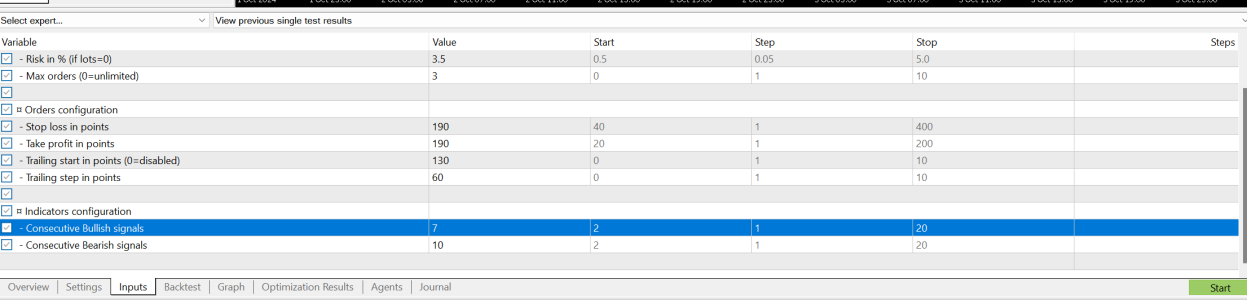

Hey, during backtesting if you need to achieve similar results I recommend you to use the same environment settings as shown in the backtests under inputs tab and settings tab as well.

Now, those of you who are unable to achieve this check each setting once again and make sure you get it.

Disclaimer: At Galileo FX, our bot is designed to empower users with tools to help them potentially achieve profitable outcomes. However, it's important to understand that all trading involves risk, and we cannot promise or guarantee easy profits. Please note that we do not provide financial or investment advice. We encourage you to make informed decisions based on your own research.

Now, those of you who are unable to achieve this check each setting once again and make sure you get it.

Disclaimer: At Galileo FX, our bot is designed to empower users with tools to help them potentially achieve profitable outcomes. However, it's important to understand that all trading involves risk, and we cannot promise or guarantee easy profits. Please note that we do not provide financial or investment advice. We encourage you to make informed decisions based on your own research.

This week's updated winning settings:

1. Cosmic Trajectory Breakout

This aggressive setting leverages high-risk, high-reward breakouts in volatile market conditions. By using tighter trailing stops and bullish/bearish signal confirmations, this setup is ideal for rapid intraday price movements in trending markets, capturing significant upward or downward surges.

Trading Style: Long-Term Investing

Trading Mode: Moderate

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 700

Take Profit: 1000

Trailing Start: 560

Trailing Step: 130

Bullish Signals: 4

Bearish Signals: 7

2. Nebula Swing Pivot

This strategy takes advantage of medium-term market swings with a balanced approach. By focusing on measured stop loss and take profit levels, combined with precise trailing settings, it captures momentum in trending conditions while maintaining control over downside risks.

Trading Style: Day Trading

Trading Mode: Conservative

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 130

Take Profit: 250

Trailing Start: 90

Trailing Step: 80

Bullish Signals: 6

Bearish Signals: 5

3. Gravity Wave Convergence

Designed for long-term investors with a moderate risk appetite, this setting capitalizes on sustained market trends. The combination of a wide trailing start and step ensures that the strategy locks in profits during significant moves while minimizing exposure during drawdowns.

Trading Style: Swing Trading

Trading Mode: Moderate

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 580

Take Profit: 650

Trailing Start: 450

Trailing Step: 190

Bullish Signals: 5

Bearish Signals: 3

4. Pulsar Trend Divergence

This strategy targets major market movements with a higher level of volatility tolerance. Combining a tight trailing stop and balanced risk-reward ratio, it captures momentum while preventing extended losses in rapid price shifts.

Trading Style: Swing Trading

Trading Mode: Aggressive

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 125

Take Profit: 305

Trailing Start: 65

Trailing Step: 10

Bullish Signals: 5

Bearish Signals: 5

5. Solar Flare Momentum

Designed for aggressive traders seeking to capitalize on rapid momentum shifts, this setup employs a high number of consecutive signals for bullish trends while managing risk with dynamic trailing stop mechanisms. Ideal for fast-paced markets with significant volatility.

Trading Style: Day Trading

Trading Mode: Aggressive

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 195

Take Profit: 225

Trailing Start: 50

Trailing Step: 10

Bullish Signals: 13

Bearish Signals: 6

6. Photon Surge Scalper

This aggressive scalping strategy is designed for rapid trades in volatile markets. It uses a high number of bullish and bearish signals to capture short bursts of price movement, allowing for quick entries and exits with a tight stop loss to minimize risk exposure.

Trading Style: Day Trading

Trading Mode: Moderate

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 350

Take Profit: 270

Trailing Start: 0

Trailing Step: 0

Bullish Signals: 9

Bearish Signals: 9

7. Meteor Burst Reversal

This moderately aggressive strategy is built to exploit short-term market reversals. With a tight stop-loss and trailing system, it focuses on quick trades in highly dynamic environments, capturing profits from both bullish and bearish movements in rapidly changing conditions.

Trading Style: Day Trading

Trading Mode: Conservative

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 155

Take Profit: 170

Trailing Start: 45

Trailing Step: 10

Bullish Signals: 8

Bearish Signals: 10

8. Galactic Swing Horizon

This long-term investing strategy is designed for low-frequency trades with wide profit targets and stop-losses. With a strong emphasis on trend continuation, it leverages both bullish and bearish signals to capitalize on major price swings in stable market conditions.

Trading Style: Long-Term Investing

Trading Mode: Conservative

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 1000

Take Profit: 2000

Trailing Start: 1000

Trailing Step: 500

Bullish Signals: 3

Bearish Signals: 3

9. Orbital Risk Pulse

This aggressive strategy aims to capture sharp market reversals with a focus on high volatility. With tight risk management and larger stop-loss buffers, it seeks to optimize profit opportunities while maintaining a clear structure for downside protection in trending markets.

Trading Style: Swing Trading

Trading Mode: Moderate

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 700

Take Profit: 1000

Trailing Start: 690

Trailing Step: 150

Bullish Signals: 3

Bearish Signals: 7

10. Aurora Pulse Trend

This strategy focuses on capturing sustained trends with a high number of bullish signals. Using dynamic trailing stops and a balanced risk-to-reward ratio, it ensures steady profit capture while limiting downside risk in trending markets.

Trading Style: Swing Trading

Trading Mode: Aggressive

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 300

Take Profit: 150

Trailing Start: 130

Trailing Step: 60

Bullish Signals: 10

Bearish Signals: 3

Disclaimer: At Galileo FX, our bot is designed to empower users with tools to help them potentially achieve profitable outcomes. However, it's important to understand that all trading involves risk, and we cannot promise or guarantee easy profits. Please note that we do not provide financial or investment advice. We encourage you to make informed decisions based on your own research.

1. Cosmic Trajectory Breakout

This aggressive setting leverages high-risk, high-reward breakouts in volatile market conditions. By using tighter trailing stops and bullish/bearish signal confirmations, this setup is ideal for rapid intraday price movements in trending markets, capturing significant upward or downward surges.

Trading Style: Long-Term Investing

Trading Mode: Moderate

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 700

Take Profit: 1000

Trailing Start: 560

Trailing Step: 130

Bullish Signals: 4

Bearish Signals: 7

2. Nebula Swing Pivot

This strategy takes advantage of medium-term market swings with a balanced approach. By focusing on measured stop loss and take profit levels, combined with precise trailing settings, it captures momentum in trending conditions while maintaining control over downside risks.

Trading Style: Day Trading

Trading Mode: Conservative

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 130

Take Profit: 250

Trailing Start: 90

Trailing Step: 80

Bullish Signals: 6

Bearish Signals: 5

3. Gravity Wave Convergence

Designed for long-term investors with a moderate risk appetite, this setting capitalizes on sustained market trends. The combination of a wide trailing start and step ensures that the strategy locks in profits during significant moves while minimizing exposure during drawdowns.

Trading Style: Swing Trading

Trading Mode: Moderate

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 580

Take Profit: 650

Trailing Start: 450

Trailing Step: 190

Bullish Signals: 5

Bearish Signals: 3

4. Pulsar Trend Divergence

This strategy targets major market movements with a higher level of volatility tolerance. Combining a tight trailing stop and balanced risk-reward ratio, it captures momentum while preventing extended losses in rapid price shifts.

Trading Style: Swing Trading

Trading Mode: Aggressive

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 125

Take Profit: 305

Trailing Start: 65

Trailing Step: 10

Bullish Signals: 5

Bearish Signals: 5

5. Solar Flare Momentum

Designed for aggressive traders seeking to capitalize on rapid momentum shifts, this setup employs a high number of consecutive signals for bullish trends while managing risk with dynamic trailing stop mechanisms. Ideal for fast-paced markets with significant volatility.

Trading Style: Day Trading

Trading Mode: Aggressive

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 195

Take Profit: 225

Trailing Start: 50

Trailing Step: 10

Bullish Signals: 13

Bearish Signals: 6

6. Photon Surge Scalper

This aggressive scalping strategy is designed for rapid trades in volatile markets. It uses a high number of bullish and bearish signals to capture short bursts of price movement, allowing for quick entries and exits with a tight stop loss to minimize risk exposure.

Trading Style: Day Trading

Trading Mode: Moderate

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 350

Take Profit: 270

Trailing Start: 0

Trailing Step: 0

Bullish Signals: 9

Bearish Signals: 9

7. Meteor Burst Reversal

This moderately aggressive strategy is built to exploit short-term market reversals. With a tight stop-loss and trailing system, it focuses on quick trades in highly dynamic environments, capturing profits from both bullish and bearish movements in rapidly changing conditions.

Trading Style: Day Trading

Trading Mode: Conservative

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 155

Take Profit: 170

Trailing Start: 45

Trailing Step: 10

Bullish Signals: 8

Bearish Signals: 10

8. Galactic Swing Horizon

This long-term investing strategy is designed for low-frequency trades with wide profit targets and stop-losses. With a strong emphasis on trend continuation, it leverages both bullish and bearish signals to capitalize on major price swings in stable market conditions.

Trading Style: Long-Term Investing

Trading Mode: Conservative

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 1000

Take Profit: 2000

Trailing Start: 1000

Trailing Step: 500

Bullish Signals: 3

Bearish Signals: 3

9. Orbital Risk Pulse

This aggressive strategy aims to capture sharp market reversals with a focus on high volatility. With tight risk management and larger stop-loss buffers, it seeks to optimize profit opportunities while maintaining a clear structure for downside protection in trending markets.

Trading Style: Swing Trading

Trading Mode: Moderate

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 700

Take Profit: 1000

Trailing Start: 690

Trailing Step: 150

Bullish Signals: 3

Bearish Signals: 7

10. Aurora Pulse Trend

This strategy focuses on capturing sustained trends with a high number of bullish signals. Using dynamic trailing stops and a balanced risk-to-reward ratio, it ensures steady profit capture while limiting downside risk in trending markets.

Trading Style: Swing Trading

Trading Mode: Aggressive

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 300

Take Profit: 150

Trailing Start: 130

Trailing Step: 60

Bullish Signals: 10

Bearish Signals: 3

Disclaimer: At Galileo FX, our bot is designed to empower users with tools to help them potentially achieve profitable outcomes. However, it's important to understand that all trading involves risk, and we cannot promise or guarantee easy profits. Please note that we do not provide financial or investment advice. We encourage you to make informed decisions based on your own research.

Attachments

-

Orbital Risk Pulse.zip80.8 KB · Views: 13

-

Galactic Swing Horizon.zip74.2 KB · Views: 9

-

Meteor Burst Reversal.zip68.6 KB · Views: 12

-

Photon Surge Scalper.zip85.1 KB · Views: 9

-

Solar Flare Momentum.zip85 KB · Views: 10

-

Pulsar Trend Divergence.zip74.2 KB · Views: 9

-

Gravity Wave Convergence.zip94.9 KB · Views: 8

-

Nebula Swing Pivot.zip77.1 KB · Views: 8

-

Cosmic Trajectory Breakout.zip71.4 KB · Views: 10

-

Aurora Pulse Trend.zip98.9 KB · Views: 10

Coltus Black

New member

How can I watch Galileo execute these settings in real time? In other words, on MT4, is there a window to watch the bot buy/sell my trades in real time?This thread is created for sharing the updated settings on a weekly basis for different instruments across different time-frames and different time periods. These settings will also be categorized into conservative, moderate and aggressive for different types of trading styles (Day Trading, Swing Trading and Long Term Investing).

Past 12 months performance for XAU/USD (M30) with $10000 on Conservative mode with Day Trading style:

Lots: 0

Risk (in %): 4.5

Max Orders: 3

Stop Loss in points: 1000

Take Profit in points: 270

Trailing Start in points: 200

Trailing Step in points: 100

Consecutive Bullish Signals: 8

Consecutive Bearish Signals: 10

Attachment Name: XAUUSD-M30.zip

Past 12 months performance for USD/CAD (M5) with $10000 on Moderate mode with Day Trading style:

Lots: 0

Risk (in %): 4.5

Max Orders: 4

Stop Loss in points: 180

Take Profit in points: 190

Trailing Start in points: 120

Trailing Step in points: 30

Consecutive Bullish Signals: 12

Consecutive Bearish Signals: 12

Attachment Name: USDCAD-M5.zip

Past 12 months performance for GBP/USD with $10000 on Aggressive mode with Day Trading style:

Lots: 0

Risk (in %): 3.5

Max Orders: 3

Stop Loss in points: 190

Take Profit in points: 190

Trailing Start in points: 130

Trailing Step in points: 60

Consecutive Bullish Signals: 7

Consecutive Bearish Signals: 10

Attachment Name: GBPUSD-M30.zip

Past 12 months performance for NAS100 with $10000 on Moderate mode with Day Trading style:

Lots: 0

Risk (in %): 4.5

Max Orders: 4

Stop Loss in points: 1260

Take Profit in points: 420

Trailing Start in points: 360

Trailing Step in points: 220

Consecutive Bullish Signals: 9

Consecutive Bearish Signals: 10

Attachment Name: NAS100-M15.zip

Please note that past performance do not guarantee future performance.

-Sanchay Kasturey

scott27787

New member

Any pairs you are focusing on for this weeks updated settings?

This thread is created for sharing the updated settings on a weekly basis for different instruments across different time-frames and different time periods. These settings will also be categorized into conservative, moderate and aggressive for different types of trading styles (Day Trading, Swing Trading and Long Term Investing).

Past 12 months performance for XAU/USD (M30) with $10000 on Conservative mode with Day Trading style:

Lots: 0

Risk (in %): 4.5

Max Orders: 3

Stop Loss in points: 1000

Take Profit in points: 270

Trailing Start in points: 200

Trailing Step in points: 100

Consecutive Bullish Signals: 8

Consecutive Bearish Signals: 10

Attachment Name: XAUUSD-M30.zip

Past 12 months performance for USD/CAD (M5) with $10000 on Moderate mode with Day Trading style:

Lots: 0

Risk (in %): 4.5

Max Orders: 4

Stop Loss in points: 180

Take Profit in points: 190

Trailing Start in points: 120

Trailing Step in points: 30

Consecutive Bullish Signals: 12

Consecutive Bearish Signals: 12

Attachment Name: USDCAD-M5.zip

Past 12 months performance for GBP/USD with $10000 on Aggressive mode with Day Trading style:

Lots: 0

Risk (in %): 3.5

Max Orders: 3

Stop Loss in points: 190

Take Profit in points: 190

Trailing Start in points: 130

Trailing Step in points: 60

Consecutive Bullish Signals: 7

Consecutive Bearish Signals: 10

Attachment Name: GBPUSD-M30.zip

Past 12 months performance for NAS100 with $10000 on Moderate mode with Day Trading style:

Lots: 0

Risk (in %): 4.5

Max Orders: 4

Stop Loss in points: 1260

Take Profit in points: 420

Trailing Start in points: 360

Trailing Step in points: 220

Consecutive Bullish Signals: 9

Consecutive Bearish Signals: 10

Attachment Name: NAS100-M15.zip

Please note that past performance do not guarantee future performance.

-Sanchay Kasturey

Thank you Sanchay - however I do not see any performance figures mentioned for the various pairs? What is the past 12 months performance for say USDCAD?

Currently we only have the following setting for USDCAD:

store.galileofx.com

store.galileofx.com

However, We are continuously working on creating more settings with different style and different modes. Meanwhile please be patient or you may chose to find settings based on your understanding. We will do our best to include most of the pairs with different mode and style suited for all kinds of traders.

Performance

Notice: The displayed results, verified by Myfxbook, demonstrate potential but not guaranteed outcomes of the Galileo FX software. Backtests Videos Explore the potential of Galileo FX with over 300 Myfxbook verified backtests, covering a range of settings, capital amounts, and currency pairs...

store.galileofx.com

store.galileofx.com

However, We are continuously working on creating more settings with different style and different modes. Meanwhile please be patient or you may chose to find settings based on your understanding. We will do our best to include most of the pairs with different mode and style suited for all kinds of traders.

Here is the result of the backtest I just did of Quantum Impulse Vector from 20 June 24 to 24 July 24 for which you show a profit of 699.84 % (using Zero latency and Every tick based on real ticks):

Lots 0 produced 0 trades

Lots 0.01 produced 0 trades

Lots 0.10 produced a net loss of - 0.95

Lots 0.50 produced a net loss of -4.47

Lots 0 produced 0 trades

Lots 0.01 produced 0 trades

Lots 0.10 produced a net loss of - 0.95

Lots 0.50 produced a net loss of -4.47

Hey Noah,

I understand our performance report is fully correct. Its just that since lots are fixed in your inputs it is not producing the same results.

When you change even one parameter the results can be very different. Depending on the instrument and the type of setting we change the lots, risk, and max orders.

Thanks

I understand our performance report is fully correct. Its just that since lots are fixed in your inputs it is not producing the same results.

When you change even one parameter the results can be very different. Depending on the instrument and the type of setting we change the lots, risk, and max orders.

Thanks

Hey guys, here are the updated settings for this week:

1. Solar Profit Orbit

This setting leverages tight control with 4 max orders and a risk ratio of 4.5%. Designed to capture swift momentum in day trading, it combines moderate trailing and strong bullish/bearish divergence filters to optimize position exits. A calculated, methodical strategy for swing-based trading that aims to minimize equity drawdown and maximize win streaks.

Trading Style: Day Trading

Trading Mode: Moderate

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 550

Take Profit: 760

Trailing Start: 350

Trailing Step: 140

Bullish Signals: 7

Bearish Signals: 12

2. Nebula Scalper Pulse

Focused on short-term trades with precise stop-loss and trailing adjustments, this setting is ideal for scalping fast market movements. With a higher bearish signal ratio and strong balance control, it captures quick profits while managing risks through tight drawdown limits.

Trading Style: Swing Trading

Trading Mode: Aggressive

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 210

Take Profit: 630

Trailing Start: 70

Trailing Step: 80

Bullish Signals: 3

Bearish Signals: 13

3. Galactic Pivot Surge

This strategy thrives on larger market swings, with high take-profit targets and expansive trailing steps. Balanced between bullish and bearish signals, it aims for sustained gains over longer timeframes, focusing on high-reward opportunities while managing substantial drawdowns.

Trading Style: Swing Trading

Trading Mode: Aggressive

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 750

Take Profit: 3550

Trailing Start: 1350

Trailing Step: 950

Bullish Signals: 4

Bearish Signals: 4

4. Stellar Breakout Vector

This setting targets key breakout points with higher risk tolerance, combining wide stop-loss and take-profit levels to capture significant price movements. Its balanced signal ratio enhances flexibility across different market conditions, perfect for long-term trend traders seeking steady, substantial gains.

Trading Style: Long-Term Investing

Trading Mode: Moderate

Lots: 0

Risk: 7.0%

Max Orders: 4

Stop Loss: 300

Take Profit: 1000

Trailing Start: 420

Trailing Step: 200

Bullish Signals: 6

Bearish Signals: 3

5. Cosmic Trend Voyager

Designed for high-volatility markets, this setting utilizes deep stop-loss levels and extended trailing steps to navigate unpredictable price swings. With balanced bullish and bearish signals, it's crafted for traders who aim to capture significant moves while withstanding substantial drawdowns.

Trading Style: Day Trading

Trading Mode: Aggressive

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 27,000

Take Profit: 27,700

Trailing Start: 15,000

Trailing Step: 12,000

Bullish Signals: 5

Bearish Signals: 4

6. Lunar Retrace Beacon

This setting is engineered for short-term market retracements, using tight stop-loss levels and swift trailing adjustments to lock in profits. With a strong bearish signal bias, it’s designed for traders focused on short positions and rapid trend reversals in volatile markets.

Trading Style: Day Trading

Trading Mode: Moderate

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 210

Take Profit: 135

Trailing Start: 80

Trailing Step: 20

Bullish Signals: 4

Bearish Signals: 11

7. Orbital Swing Matrix

This setting excels at capturing short-term price swings with tight risk management, boasting a low drawdown profile and impressive profit factor. With strong bearish filters, it's built for traders seeking precision in short trades while maintaining controlled volatility.

Trading Style: Long-Term Trading

Trading Mode: Conservative

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 710

Take Profit: 570

Trailing Start: 310

Trailing Step: 70

Bullish Signals: 5

Bearish Signals: 12

8. Quantum Scalper Drive

This setting is built for rapid, high-frequency trading on shorter timeframes, utilizing tight stop-losses and swift trailing to capture quick market movements. With an equal balance of bullish and bearish signals, it excels in volatile environments, ideal for traders looking to capitalize on both up and down price swings.

Trading Style: Day Trading

Trading Mode: Moderate

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 590

Take Profit: 470

Trailing Start: 180

Trailing Step: 40

Bullish Signals: 3

Bearish Signals: 3

9. Supernova Trend Pulse

Optimized for long-term trading, this setting focuses on large price movements with a high take-profit target. Strong bullish signals and minimal drawdown make it a powerful choice for steady upward trends, with balanced risk management through trailing adjustments.

Trading Style: Swing Trading

Trading Mode: Conservative

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 2,380

Take Profit: 3,700

Trailing Start: 200

Trailing Step: 200

Bullish Signals: 8

Bearish Signals: 3

10. Celestial Surge Engine

Built for long-term trades on a weekly timeframe, this setting focuses on capturing massive market moves with wide stop-loss and take-profit levels. Its high bullish signal count and robust trailing system make it ideal for riding strong trends with minimal drawdown.

Trading Style: Long-Term Investing

Trading Mode: Conservative

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 3,200

Take Profit: 3,800

Trailing Start: 500

Trailing Step: 310

Bullish Signals: 7

Bearish Signals: 3

1. Solar Profit Orbit

This setting leverages tight control with 4 max orders and a risk ratio of 4.5%. Designed to capture swift momentum in day trading, it combines moderate trailing and strong bullish/bearish divergence filters to optimize position exits. A calculated, methodical strategy for swing-based trading that aims to minimize equity drawdown and maximize win streaks.

Trading Style: Day Trading

Trading Mode: Moderate

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 550

Take Profit: 760

Trailing Start: 350

Trailing Step: 140

Bullish Signals: 7

Bearish Signals: 12

2. Nebula Scalper Pulse

Focused on short-term trades with precise stop-loss and trailing adjustments, this setting is ideal for scalping fast market movements. With a higher bearish signal ratio and strong balance control, it captures quick profits while managing risks through tight drawdown limits.

Trading Style: Swing Trading

Trading Mode: Aggressive

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 210

Take Profit: 630

Trailing Start: 70

Trailing Step: 80

Bullish Signals: 3

Bearish Signals: 13

3. Galactic Pivot Surge

This strategy thrives on larger market swings, with high take-profit targets and expansive trailing steps. Balanced between bullish and bearish signals, it aims for sustained gains over longer timeframes, focusing on high-reward opportunities while managing substantial drawdowns.

Trading Style: Swing Trading

Trading Mode: Aggressive

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 750

Take Profit: 3550

Trailing Start: 1350

Trailing Step: 950

Bullish Signals: 4

Bearish Signals: 4

4. Stellar Breakout Vector

This setting targets key breakout points with higher risk tolerance, combining wide stop-loss and take-profit levels to capture significant price movements. Its balanced signal ratio enhances flexibility across different market conditions, perfect for long-term trend traders seeking steady, substantial gains.

Trading Style: Long-Term Investing

Trading Mode: Moderate

Lots: 0

Risk: 7.0%

Max Orders: 4

Stop Loss: 300

Take Profit: 1000

Trailing Start: 420

Trailing Step: 200

Bullish Signals: 6

Bearish Signals: 3

5. Cosmic Trend Voyager

Designed for high-volatility markets, this setting utilizes deep stop-loss levels and extended trailing steps to navigate unpredictable price swings. With balanced bullish and bearish signals, it's crafted for traders who aim to capture significant moves while withstanding substantial drawdowns.

Trading Style: Day Trading

Trading Mode: Aggressive

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 27,000

Take Profit: 27,700

Trailing Start: 15,000

Trailing Step: 12,000

Bullish Signals: 5

Bearish Signals: 4

6. Lunar Retrace Beacon

This setting is engineered for short-term market retracements, using tight stop-loss levels and swift trailing adjustments to lock in profits. With a strong bearish signal bias, it’s designed for traders focused on short positions and rapid trend reversals in volatile markets.

Trading Style: Day Trading

Trading Mode: Moderate

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 210

Take Profit: 135

Trailing Start: 80

Trailing Step: 20

Bullish Signals: 4

Bearish Signals: 11

7. Orbital Swing Matrix

This setting excels at capturing short-term price swings with tight risk management, boasting a low drawdown profile and impressive profit factor. With strong bearish filters, it's built for traders seeking precision in short trades while maintaining controlled volatility.

Trading Style: Long-Term Trading

Trading Mode: Conservative

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 710

Take Profit: 570

Trailing Start: 310

Trailing Step: 70

Bullish Signals: 5

Bearish Signals: 12

8. Quantum Scalper Drive

This setting is built for rapid, high-frequency trading on shorter timeframes, utilizing tight stop-losses and swift trailing to capture quick market movements. With an equal balance of bullish and bearish signals, it excels in volatile environments, ideal for traders looking to capitalize on both up and down price swings.

Trading Style: Day Trading

Trading Mode: Moderate

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 590

Take Profit: 470

Trailing Start: 180

Trailing Step: 40

Bullish Signals: 3

Bearish Signals: 3

9. Supernova Trend Pulse

Optimized for long-term trading, this setting focuses on large price movements with a high take-profit target. Strong bullish signals and minimal drawdown make it a powerful choice for steady upward trends, with balanced risk management through trailing adjustments.

Trading Style: Swing Trading

Trading Mode: Conservative

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 2,380

Take Profit: 3,700

Trailing Start: 200

Trailing Step: 200

Bullish Signals: 8

Bearish Signals: 3

10. Celestial Surge Engine

Built for long-term trades on a weekly timeframe, this setting focuses on capturing massive market moves with wide stop-loss and take-profit levels. Its high bullish signal count and robust trailing system make it ideal for riding strong trends with minimal drawdown.

Trading Style: Long-Term Investing

Trading Mode: Conservative

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 3,200

Take Profit: 3,800

Trailing Start: 500

Trailing Step: 310

Bullish Signals: 7

Bearish Signals: 3

Attachments

-

Orbital Swing Matrix.zip74.6 KB · Views: 18

-

Quantum Scalper Drive.zip130.3 KB · Views: 18

-

Supernova Trend Pulse.zip77.3 KB · Views: 17

-

Celestial Surge Engine.zip68.8 KB · Views: 16

-

Lunar Retrace Beacon.zip86.6 KB · Views: 15

-

Cosmic Trend Voyager.zip150.4 KB · Views: 17

-

Stellar Breakout Vector.zip80.1 KB · Views: 16

-

Galactic Pivot Surge.zip90.5 KB · Views: 15

-

Nebula Scalper Pulse.zip85.4 KB · Views: 21

-

Solar Profit Orbit.zip78.1 KB · Views: 21

11. Nova Trend Navigator

This strategy is designed for mid-term trend trading, with high bullish signal strength and moderate drawdown management. Using wide stop-loss and take-profit levels, it aims to capture large market movements with a trailing system that locks in gains during extended trends.

Trading Style: Day Trading

Trading Mode: Moderate

Lots: 0

Risk: 4.5%

Max Orders: 6

Stop Loss: 1,190

Take Profit: 1,030

Trailing Start: 330

Trailing Step: 50

Bullish Signals: 12

Bearish Signals: 7

12. Nebula Pulse Tracker

Designed for high-frequency, short-term trades, this setting uses tight stop-losses and rapid trailing to capture quick market fluctuations. With a strong bullish bias and moderate risk, it excels at identifying swift entry and exit points in volatile conditions.

Trading Style: Day Trading

Trading Mode: Aggressive

Lots: 0

Risk: 3.5%

Max Orders: 3

Stop Loss: 60

Take Profit: 390

Trailing Start: 50

Trailing Step: 30

Bullish Signals: 9

Bearish Signals: 8

13. Zenith Oscillator Sweep

This setting is optimized for medium-term trend reversals, using a blend of high-risk tolerance and trailing strategies to capture large swings. With strong bearish filters, it’s designed to thrive in volatile markets, while balancing risk with calculated stop-loss and take-profit levels.

Trading Style: Swing Trading

Trading Mode: Aggressive

Lots: 0

Risk: 6.5%

Max Orders: 4

Stop Loss: 410

Take Profit: 950

Trailing Start: 240

Trailing Step: 100

Bullish Signals: 5

Bearish Signals: 12

14. Cosmic Pivot Tracker

This setting focuses on short-term price reversals with precise stop-loss management and no trailing steps, ideal for fast-paced trades. With a strong bullish signal bias and limited max orders, it’s built for traders looking to capitalize on quick movements while minimizing risk.

Trading Style: Day Trading

Trading Mode: Conservative

Lots: 0

Risk: 4.5%

Max Orders: 2

Stop Loss: 235

Take Profit: 170

Trailing Start: 0

Trailing Step: 0

Bullish Signals: 11

Bearish Signals: 4

15. Nebula Breakout Rider

This setting targets daily breakout opportunities, blending moderate risk with trailing stop adjustments to capture sustained price movements. With balanced bullish and bearish signals, it's designed for steady, consistent gains while maintaining tight control over drawdowns.

Trading Style: Long-Term Investing

Trading Mode: Moderate

Lots: 0

Risk: 4.0%

Max Orders: 4

Stop Loss: 620

Take Profit: 1,140

Trailing Start: 610

Trailing Step: 210

Bullish Signals: 3

Bearish Signals: 3

This strategy is designed for mid-term trend trading, with high bullish signal strength and moderate drawdown management. Using wide stop-loss and take-profit levels, it aims to capture large market movements with a trailing system that locks in gains during extended trends.

Trading Style: Day Trading

Trading Mode: Moderate

Lots: 0

Risk: 4.5%

Max Orders: 6

Stop Loss: 1,190

Take Profit: 1,030

Trailing Start: 330

Trailing Step: 50

Bullish Signals: 12

Bearish Signals: 7

12. Nebula Pulse Tracker

Designed for high-frequency, short-term trades, this setting uses tight stop-losses and rapid trailing to capture quick market fluctuations. With a strong bullish bias and moderate risk, it excels at identifying swift entry and exit points in volatile conditions.

Trading Style: Day Trading

Trading Mode: Aggressive

Lots: 0

Risk: 3.5%

Max Orders: 3

Stop Loss: 60

Take Profit: 390

Trailing Start: 50

Trailing Step: 30

Bullish Signals: 9

Bearish Signals: 8

13. Zenith Oscillator Sweep

This setting is optimized for medium-term trend reversals, using a blend of high-risk tolerance and trailing strategies to capture large swings. With strong bearish filters, it’s designed to thrive in volatile markets, while balancing risk with calculated stop-loss and take-profit levels.

Trading Style: Swing Trading

Trading Mode: Aggressive

Lots: 0

Risk: 6.5%

Max Orders: 4

Stop Loss: 410

Take Profit: 950

Trailing Start: 240

Trailing Step: 100

Bullish Signals: 5

Bearish Signals: 12

14. Cosmic Pivot Tracker

This setting focuses on short-term price reversals with precise stop-loss management and no trailing steps, ideal for fast-paced trades. With a strong bullish signal bias and limited max orders, it’s built for traders looking to capitalize on quick movements while minimizing risk.

Trading Style: Day Trading

Trading Mode: Conservative

Lots: 0

Risk: 4.5%

Max Orders: 2

Stop Loss: 235

Take Profit: 170

Trailing Start: 0

Trailing Step: 0

Bullish Signals: 11

Bearish Signals: 4

15. Nebula Breakout Rider

This setting targets daily breakout opportunities, blending moderate risk with trailing stop adjustments to capture sustained price movements. With balanced bullish and bearish signals, it's designed for steady, consistent gains while maintaining tight control over drawdowns.

Trading Style: Long-Term Investing

Trading Mode: Moderate

Lots: 0

Risk: 4.0%

Max Orders: 4

Stop Loss: 620

Take Profit: 1,140

Trailing Start: 610

Trailing Step: 210

Bullish Signals: 3

Bearish Signals: 3

Attachments

But as I said I ran the backtest with 3 different Lot settings, one of which was 0 which is the "relative" one that is given in your settings. What Lot setting do I need to use to replicate your results? (Also, though you kindly answered my question, it still says here that it is "awaiting moderation.")Hey Noah,

I understand our performance report is fully correct. Its just that since lots are fixed in your inputs it is not producing the same results.

When you change even one parameter the results can be very different. Depending on the instrument and the type of setting we change the lots, risk, and max orders.

Thanks

Hey Noah, I know you have run with 3 different lot settings but in order to achieve results like mine in a backtest you need to use the exact same settings. Please review the settings and other factors. You can find all these in the same thread as well as the performance page.

Hey everyone, here are the weekly updated performance reports for the past week:

1. Cosmic Scalper Flux

This setting is optimized for fast-paced, short-term trades on the M5 timeframe. It balances low risk with tight trailing and take-profit levels to capture quick market movements, utilizing strong bullish signals and moderate bearish filters for consistent trade entries.

Trading Style: Day Trading

Trading Mode: Moderate

Lots: 0

Risk: 1.5%

Max Orders: 3

Stop Loss: 160

Take Profit: 150

Trailing Start: 60

Trailing Step: 10

Bullish Signals: 13

Bearish Signals: 8

2. Nebula Momentum Grid

Built for M30 swing trading, this setting focuses on medium-term price movements with a balanced risk-to-reward ratio. Strong bearish signals and wide trailing parameters make it ideal for capturing significant trend shifts while managing volatility.

Trading Style: Day Trading

Trading Mode: Aggressive

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 450

Take Profit: 3,260

Trailing Start: 1,480

Trailing Step: 200

Bullish Signals: 6

Bearish Signals: 12

3. Galactic Range Voyager

This setting focuses on medium-term trend trading with moderate risk and wide trailing stops, aiming to capture large market moves on the H4 timeframe. Balanced between bullish and bearish signals, it's designed for consistent performance in both trending and ranging markets.

Trading Style: Swing Trading

Trading Mode: Moderate

Lots: 0

Risk: 3.0%

Max Orders: 3

Stop Loss: 350

Take Profit: 2,310

Trailing Start: 980

Trailing Step: 600

Bullish Signals: 4

Bearish Signals: 3

4. Orion Wave Navigator

This setting is tailored for daily trend following, leveraging wide trailing stops and a balanced risk profile to capture significant price movements. Strong bullish signals and a moderate bearish filter make it ideal for traders looking to ride longer-term trends while maintaining manageable drawdowns.

Trading Style: Long-Term Investing

Trading Mode: Moderate

Lots: 0

Risk: 4.0%

Max Orders: 4

Stop Loss: 490

Take Profit: 2,170

Trailing Start: 850

Trailing Step: 700

Bullish Signals: 8

Bearish Signals: 4

5. Stellar Momentum Tracker

Optimized for H1 trading, this setting is designed to capture quick momentum shifts with moderate risk. It employs a balanced signal ratio, with a tight stop-loss and trailing system, making it ideal for traders who aim to minimize drawdowns while capitalizing on swift market movements.

Trading Style: Day Trading

Trading Mode: Conservative

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 120

Take Profit: 250

Trailing Start: 280

Trailing Step: 100

Bullish Signals: 10

Bearish Signals: 9

6. Pulsar Swing Orbit

This setting is designed for H2 swing trading, targeting significant market swings with moderate risk management. With balanced signal filters and precise trailing stops, it aims to capture larger price movements while maintaining consistent performance in trending markets.

Trading Style: Swing Trading

Trading Mode: Aggressive

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 1,400

Take Profit: 1,300

Trailing Start: 460

Trailing Step: 70

Bullish Signals: 3

Bearish Signals: 4

7. Comet Swing Vector

Designed for H4 trading, this setting captures medium-term market movements with precise stop-loss and trailing strategies. A strong bullish signal bias, coupled with low drawdown, makes it ideal for swing traders seeking steady performance with minimal volatility.

Trading Style: Swing Trading

Trading Mode: Conservative

Lots: 0

Risk: 4.0%

Max Orders: 3

Stop Loss: 1,200

Take Profit: 640

Trailing Start: 510

Trailing Step: 140

Bullish Signals: 6

Bearish Signals: 4

8. Zenith Trend Voyager

This H12 setting is optimized for long-term trend trading with wide stop-loss and take-profit levels to capture significant market moves. Strong bearish filters and robust trailing stops make it suitable for navigating volatile markets, while balancing risk with high-reward opportunities.

Trading Style: Long-Term Investing

Trading Mode: Aggressive

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 900

Take Profit: 4,050

Trailing Start: 500

Trailing Step: 800

Bullish Signals: 4

Bearish Signals: 8

9. Solar Pulse Seeker

This M30 strategy is built for high-frequency trading with tight stop-losses and trailing settings, ideal for capturing short-term market swings. With strong bearish signals and a focus on precision entries, it's designed to take advantage of frequent market fluctuations while minimizing risk.

Trading Style: Day Trading

Trading Mode: Conservative

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 120

Take Profit: 90

Trailing Start: 50

Trailing Step: 45

Bullish Signals: 7

Bearish Signals: 9

10. Nova Scalper Matrix

Designed for M15 trading, this setting capitalizes on quick market fluctuations with precise stop-loss and trailing systems. Its strong bullish signal bias and moderate bearish filter allow for efficient short-term trading, ideal for scalping fast-moving trends with controlled risk.

Trading Style: Day Trading

Trading Mode: Conservative

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 300

Take Profit: 300

Trailing Start: 230

Trailing Step: 30

Bullish Signals: 10

Bearish Signals: 5

Disclaimer: At Galileo FX, our bot is designed to empower users with tools to help them potentially achieve profitable outcomes. However, it's important to understand that all trading involves risk, and we cannot promise or guarantee easy profits. Please note that we do not provide financial or investment advice. We encourage you to make informed decisions based on your own research.

1. Cosmic Scalper Flux

This setting is optimized for fast-paced, short-term trades on the M5 timeframe. It balances low risk with tight trailing and take-profit levels to capture quick market movements, utilizing strong bullish signals and moderate bearish filters for consistent trade entries.

Trading Style: Day Trading

Trading Mode: Moderate

Lots: 0

Risk: 1.5%

Max Orders: 3

Stop Loss: 160

Take Profit: 150

Trailing Start: 60

Trailing Step: 10

Bullish Signals: 13

Bearish Signals: 8

2. Nebula Momentum Grid

Built for M30 swing trading, this setting focuses on medium-term price movements with a balanced risk-to-reward ratio. Strong bearish signals and wide trailing parameters make it ideal for capturing significant trend shifts while managing volatility.

Trading Style: Day Trading

Trading Mode: Aggressive

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 450

Take Profit: 3,260

Trailing Start: 1,480

Trailing Step: 200

Bullish Signals: 6

Bearish Signals: 12

3. Galactic Range Voyager

This setting focuses on medium-term trend trading with moderate risk and wide trailing stops, aiming to capture large market moves on the H4 timeframe. Balanced between bullish and bearish signals, it's designed for consistent performance in both trending and ranging markets.

Trading Style: Swing Trading

Trading Mode: Moderate

Lots: 0

Risk: 3.0%

Max Orders: 3

Stop Loss: 350

Take Profit: 2,310

Trailing Start: 980

Trailing Step: 600

Bullish Signals: 4

Bearish Signals: 3

4. Orion Wave Navigator

This setting is tailored for daily trend following, leveraging wide trailing stops and a balanced risk profile to capture significant price movements. Strong bullish signals and a moderate bearish filter make it ideal for traders looking to ride longer-term trends while maintaining manageable drawdowns.

Trading Style: Long-Term Investing

Trading Mode: Moderate

Lots: 0

Risk: 4.0%

Max Orders: 4

Stop Loss: 490

Take Profit: 2,170

Trailing Start: 850

Trailing Step: 700

Bullish Signals: 8

Bearish Signals: 4

5. Stellar Momentum Tracker

Optimized for H1 trading, this setting is designed to capture quick momentum shifts with moderate risk. It employs a balanced signal ratio, with a tight stop-loss and trailing system, making it ideal for traders who aim to minimize drawdowns while capitalizing on swift market movements.

Trading Style: Day Trading

Trading Mode: Conservative

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 120

Take Profit: 250

Trailing Start: 280

Trailing Step: 100

Bullish Signals: 10

Bearish Signals: 9

6. Pulsar Swing Orbit

This setting is designed for H2 swing trading, targeting significant market swings with moderate risk management. With balanced signal filters and precise trailing stops, it aims to capture larger price movements while maintaining consistent performance in trending markets.

Trading Style: Swing Trading

Trading Mode: Aggressive

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 1,400

Take Profit: 1,300

Trailing Start: 460

Trailing Step: 70

Bullish Signals: 3

Bearish Signals: 4

7. Comet Swing Vector

Designed for H4 trading, this setting captures medium-term market movements with precise stop-loss and trailing strategies. A strong bullish signal bias, coupled with low drawdown, makes it ideal for swing traders seeking steady performance with minimal volatility.

Trading Style: Swing Trading

Trading Mode: Conservative

Lots: 0

Risk: 4.0%

Max Orders: 3

Stop Loss: 1,200

Take Profit: 640

Trailing Start: 510

Trailing Step: 140

Bullish Signals: 6

Bearish Signals: 4

8. Zenith Trend Voyager

This H12 setting is optimized for long-term trend trading with wide stop-loss and take-profit levels to capture significant market moves. Strong bearish filters and robust trailing stops make it suitable for navigating volatile markets, while balancing risk with high-reward opportunities.

Trading Style: Long-Term Investing

Trading Mode: Aggressive

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 900

Take Profit: 4,050

Trailing Start: 500

Trailing Step: 800

Bullish Signals: 4

Bearish Signals: 8

9. Solar Pulse Seeker

This M30 strategy is built for high-frequency trading with tight stop-losses and trailing settings, ideal for capturing short-term market swings. With strong bearish signals and a focus on precision entries, it's designed to take advantage of frequent market fluctuations while minimizing risk.

Trading Style: Day Trading

Trading Mode: Conservative

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 120

Take Profit: 90

Trailing Start: 50

Trailing Step: 45

Bullish Signals: 7

Bearish Signals: 9

10. Nova Scalper Matrix

Designed for M15 trading, this setting capitalizes on quick market fluctuations with precise stop-loss and trailing systems. Its strong bullish signal bias and moderate bearish filter allow for efficient short-term trading, ideal for scalping fast-moving trends with controlled risk.

Trading Style: Day Trading

Trading Mode: Conservative

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 300

Take Profit: 300

Trailing Start: 230

Trailing Step: 30

Bullish Signals: 10

Bearish Signals: 5

Disclaimer: At Galileo FX, our bot is designed to empower users with tools to help them potentially achieve profitable outcomes. However, it's important to understand that all trading involves risk, and we cannot promise or guarantee easy profits. Please note that we do not provide financial or investment advice. We encourage you to make informed decisions based on your own research.

Attachments

-

Nova Scalper Matrix.zip98.2 KB · Views: 13

-

Solar Pulse Seeker.zip114.7 KB · Views: 12

-

Zenith Trend Voyager.zip128.8 KB · Views: 9

-

Comet Swing Vector.zip116.3 KB · Views: 10

-

Pulsar Swing Orbit.zip177 KB · Views: 10

-

Stellar Momentum Tracker.zip85.4 KB · Views: 9

-

Orion Wave Navigator.zip98.1 KB · Views: 9

-

Galactic Range Voyager-GBPAUD.zip246.3 KB · Views: 11

-

Nebula Momentum Grid-ETHUSD.zip139.6 KB · Views: 9

-

Cosmic Scalper Flux-USDCAD.zip194.6 KB · Views: 11

11. Nebula Scalper Drive

Optimized for M5 trading, this setting focuses on rapid market movements with tight stop-losses and quick take-profit levels. With strong bullish signal filters and minimal trailing, it's designed for aggressive scalping in fast-moving markets, capturing short-term opportunities while managing drawdowns effectively.

Trading Style: Day Trading

Trading Mode: Aggressive

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 70

Take Profit: 290

Trailing Start: 0

Trailing Step: 0

Bullish Signals: 12

Bearish Signals: 8

12. Lunar Gold Surge

This M15 strategy is designed for quick but strategic trades, utilizing moderate risk with tight stop-loss and trailing systems. Balanced between bullish and bearish signals, it captures short-term price movements in volatile markets, with a focus on minimizing drawdown while securing profits.

Trading Style: Day Trading

Trading Mode: Conservative

Lots: 0

Risk: 4.5%

Max Orders: 2

Stop Loss: 400

Take Profit: 1,400

Trailing Start: 500

Trailing Step: 70

Bullish Signals: 8

Bearish Signals: 8

Disclaimer: At Galileo FX, our bot is designed to empower users with tools to help them potentially achieve profitable outcomes. However, it's important to understand that all trading involves risk, and we cannot promise or guarantee easy profits. Please note that we do not provide financial or investment advice. We encourage you to make informed decisions based on your own research.

Optimized for M5 trading, this setting focuses on rapid market movements with tight stop-losses and quick take-profit levels. With strong bullish signal filters and minimal trailing, it's designed for aggressive scalping in fast-moving markets, capturing short-term opportunities while managing drawdowns effectively.

Trading Style: Day Trading

Trading Mode: Aggressive

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 70

Take Profit: 290

Trailing Start: 0

Trailing Step: 0

Bullish Signals: 12

Bearish Signals: 8

12. Lunar Gold Surge

This M15 strategy is designed for quick but strategic trades, utilizing moderate risk with tight stop-loss and trailing systems. Balanced between bullish and bearish signals, it captures short-term price movements in volatile markets, with a focus on minimizing drawdown while securing profits.

Trading Style: Day Trading

Trading Mode: Conservative

Lots: 0

Risk: 4.5%

Max Orders: 2

Stop Loss: 400

Take Profit: 1,400

Trailing Start: 500

Trailing Step: 70

Bullish Signals: 8

Bearish Signals: 8

Disclaimer: At Galileo FX, our bot is designed to empower users with tools to help them potentially achieve profitable outcomes. However, it's important to understand that all trading involves risk, and we cannot promise or guarantee easy profits. Please note that we do not provide financial or investment advice. We encourage you to make informed decisions based on your own research.

Attachments

Similar threads

- Replies

- 13

- Views

- 251

- Replies

- 11

- Views

- 281

- Replies

- 11

- Views

- 360

- Locked

- Sticky

- Replies

- 0

- Views

- 200