You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Weekly Updated Galileo FX Settings: Conservative, Moderate & Aggressive

- Thread starter Sanchay

- Start date

inverzo.tradez

New member

Why I find it that your settings doesn't work all the time? I even tried do optimization and still can't make money out of your strategies.11. Ether Drift Nexus

Engineered for significant ETHUSD trend captures, Ether Drift Nexus combines aggressive risk with a large take-profit margin on the daily chart. With high bullish sensitivity and broad trailing parameters, this setup seeks extended gains in Ethereum’s volatile landscape.

Trading Style: Long-term Investing

Trading Mode: Moderate

Lots: 0

Risk: 5.5%

Max Orders: 4

Stop Loss: 18000

Take Profit: 24000

Trailing Start: 15500

Trailing Step: 2000

Bullish Signals: 10

Bearish Signals: 4

12. Aurora Gold Pulse

Crafted for XAUUSD’s volatility, Aurora Gold Pulse focuses on capturing gold’s dynamic moves on H4 with a moderate risk approach. Using tight stop-loss settings and strategic trailing, this setup seeks frequent, high-probability entries in trending gold markets.

Trading Style: Swing Trading

Trading Mode: Aggressive

Lots: 0

Risk: 2.5%

Max Orders: 3

Stop Loss: 5750

Take Profit: 5200

Trailing Start: 1900

Trailing Step: 220

Bullish Signals: 9

Bearish Signals: 3

13. Solar Index Surge

Focused on capturing swift SPX500 movements, Solar Index Surge operates on M15 with a high-risk, high-reward profile. Utilizing tight stop-losses and frequent trailing adjustments, this setup is built for aggressive traders looking to capitalize on rapid index fluctuations.

Trading Style: Day Trading

Trading Mode: Moderate

Lots: 0

Risk: 2.0%

Max Orders: 2

Stop Loss: 140

Take Profit: 110

Trailing Start: 145

Trailing Step: 70

Bullish Signals: 3

Bearish Signals: 4

14. Euro Comet Trail

Targeting EURCHF trends with a high-risk appetite, Euro Comet Trail uses substantial stop-losses and take-profit levels on the daily timeframe. With a strong bearish signal weighting, this setup is optimized for volatile currency swings and long-term trend capturing.

Trading Style: Long-term Investing

Trading Mode: Aggressive

Lots: 0

Risk: 5.5%

Max Orders: 5

Stop Loss: 850

Take Profit: 1330

Trailing Start: 1335

Trailing Step: 170

Bullish Signals: 4

Bearish Signals: 6

15. Aussie Orbit Strike

Designed for H4 volatility on AUDCAD, Aussie Orbit Strike employs a balanced approach with moderate risk and a high bullish signal sensitivity. Optimized for swing trades, this setup seeks consistent trend captures with dynamic trailing adjustments to lock in gains.

Trading Style: Swing Trading

Trading Mode: Aggressive

Lots: 0

Risk: 2.5%

Max Orders: 3

Stop Loss: 120

Take Profit: 1030

Trailing Start: 120

Trailing Step: 40

Bullish Signals: 12

Bearish Signals: 4

Disclaimer: At Galileo FX, our bot is designed to empower users with tools to help them potentially achieve profitable outcomes. However, it's important to understand that all trading involves risk, and we cannot promise or guarantee easy profits. Please note that we do not provide financial or investment advice. We encourage you to make informed decisions based on your own research.

Plus all your strategies don't have pairs to be match?

Right click when on inputs tab select load, then load the mt5.set file inside zip.Is there a quick ?way to upload settings to the MT 5 tester?

Hey there, the performance report I upload indicates that those settings worked on the respective timeframe, however, if you don't update the settings every week based on your trading strategy and your account configuration the same efficiency in profits gets reduced. I recommend you to read this once: https://forum.galileofx.com/threads/updated-winning-settings.559/post-7183Why I find it that your settings doesn't work all the time? I even tried do optimization and still can't make money out of your strategies.

Plus all your strategies don't have pairs to be match?

I hope i could help you, feel free to write any more doubts if you have any. Thanks!

Have a profitable trading journey with Galileo FX

-Sanchay Kasturey

Thank you for the settings. Did you perform a backtest for the past 12 months?This thread is created for sharing the updated settings on a weekly basis for different instruments across different time-frames and different time periods. These settings will also be categorized into conservative, moderate and aggressive for different types of trading styles (Day Trading, Swing Trading and Long Term Investing).

Past 12 months performance for XAU/USD (M30) with $10000 on Conservative mode with Day Trading style:

Lots: 0

Risk (in %): 4.5

Max Orders: 3

Stop Loss in points: 1000

Take Profit in points: 270

Trailing Start in points: 200

Trailing Step in points: 100

Consecutive Bullish Signals: 8

Consecutive Bearish Signals: 10

Attachment Name: XAUUSD-M30.zip

Past 12 months performance for USD/CAD (M5) with $10000 on Moderate mode with Day Trading style:

Lots: 0

Risk (in %): 4.5

Max Orders: 4

Stop Loss in points: 180

Take Profit in points: 190

Trailing Start in points: 120

Trailing Step in points: 30

Consecutive Bullish Signals: 12

Consecutive Bearish Signals: 12

Attachment Name: USDCAD-M5.zip

Past 12 months performance for GBP/USD with $10000 on Aggressive mode with Day Trading style:

Lots: 0

Risk (in %): 3.5

Max Orders: 3

Stop Loss in points: 190

Take Profit in points: 190

Trailing Start in points: 130

Trailing Step in points: 60

Consecutive Bullish Signals: 7

Consecutive Bearish Signals: 10

Attachment Name: GBPUSD-M30.zip

Past 12 months performance for NAS100 with $10000 on Moderate mode with Day Trading style:

Lots: 0

Risk (in %): 4.5

Max Orders: 4

Stop Loss in points: 1260

Take Profit in points: 420

Trailing Start in points: 360

Trailing Step in points: 220

Consecutive Bullish Signals: 9

Consecutive Bearish Signals: 10

Attachment Name: NAS100-M15.zip

Please note that past performance do not guarantee future performance.

-Sanchay Kasturey

InvictusRO

Member

I tried loading several settings for different pairs from the performance website but I get the "invalid stops" error on all of them except for XAUUSD, anyone knows why?

I had teething issues when I started now I am rocking itI tried loading several settings for different pairs from the performance website but I get the "invalid stops" error on all of them except for XAUUSD, anyone knows why?

InvictusRO

Member

For example '101394811': failed modify #29816078 sell 0.01 NZDCAD sl: 0.83124, tp: 0.82644 -> sl: 0.82938, tp: 0.82644 [Invalid stops]

inverzo.tradez

New member

I don't know which type of account you have, but I think the spread makes it fail cause they are too close for your stop and TP?For example '101394811': failed modify #29816078 sell 0.01 NZDCAD sl: 0.83124, tp: 0.82644 -> sl: 0.82938, tp: 0.82644 [Invalid stops]

Yes I did, there are some with 12 months as well.Thank you for the settings. Did you perform a backtest for the past 12 months?

Can you please provide me the name of those? Let me verify that for you.I tried loading several settings for different pairs from the performance website but I get the "invalid stops" error on all of them except for XAUUSD, anyone knows why?

This seems to be a spread issue. Please verify if the stops or take profit is too close to your ask or bid price.For example '101394811': failed modify #29816078 sell 0.01 NZDCAD sl: 0.83124, tp: 0.82644 -> sl: 0.82938, tp: 0.82644 [Invalid stops]

thanks

InvictusRO

Member

Hi Sanchay, the most recent ones are SP500 and NZDCAD, i downloaded the settings from the Performance link and loaded them into Galileo on MT5.

Do i need to upload the template or just do the settings manually? I've done these manually and i've had no trades at allThis thread is created for sharing the updated settings on a weekly basis for different instruments across different time-frames and different time periods. These settings will also be categorized into conservative, moderate and aggressive for different types of trading styles (Day Trading, Swing Trading and Long Term Investing).

Past 12 months performance for XAU/USD (M30) with $10000 on Conservative mode with Day Trading style:

Lots: 0

Risk (in %): 4.5

Max Orders: 3

Stop Loss in points: 1000

Take Profit in points: 270

Trailing Start in points: 200

Trailing Step in points: 100

Consecutive Bullish Signals: 8

Consecutive Bearish Signals: 10

Attachment Name: XAUUSD-M30.zip

Past 12 months performance for USD/CAD (M5) with $10000 on Moderate mode with Day Trading style:

Lots: 0

Risk (in %): 4.5

Max Orders: 4

Stop Loss in points: 180

Take Profit in points: 190

Trailing Start in points: 120

Trailing Step in points: 30

Consecutive Bullish Signals: 12

Consecutive Bearish Signals: 12

Attachment Name: USDCAD-M5.zip

Past 12 months performance for GBP/USD with $10000 on Aggressive mode with Day Trading style:

Lots: 0

Risk (in %): 3.5

Max Orders: 3

Stop Loss in points: 190

Take Profit in points: 190

Trailing Start in points: 130

Trailing Step in points: 60

Consecutive Bullish Signals: 7

Consecutive Bearish Signals: 10

Attachment Name: GBPUSD-M30.zip

Past 12 months performance for NAS100 with $10000 on Moderate mode with Day Trading style:

Lots: 0

Risk (in %): 4.5

Max Orders: 4

Stop Loss in points: 1260

Take Profit in points: 420

Trailing Start in points: 360

Trailing Step in points: 220

Consecutive Bullish Signals: 9

Consecutive Bearish Signals: 10

Attachment Name: NAS100-M15.zip

Please note that past performance do not guarantee future performance.

-Sanchay Kasturey

InvictusRO

Member

I believe there are a lot of us that don`t have a strategy of our own because our trading knowledge is limited, meaning that our only option is to use the settings you used in a backtesting from the past and it was successful, however, as I`m trying all of the settings you`re posting I don`t get positive results probably because the market trends changed and I do not have the knowledge to tweak Galileo in accordance with the current trends, would you consider posting what settings you are using this week for example for certain pairs / commodities etc. that you think will be profitable?Right click when on inputs tab select load, then load the mt5.set file inside zip.

Hey there, the performance report I upload indicates that those settings worked on the respective timeframe, however, if you don't update the settings every week based on your trading strategy and your account configuration the same efficiency in profits gets reduced. I recommend you to read this once: https://forum.galileofx.com/threads/updated-winning-settings.559/post-7183

I hope i could help you, feel free to write any more doubts if you have any. Thanks!

Have a profitable trading journey with Galileo FX

-Sanchay Kasturey

Last edited:

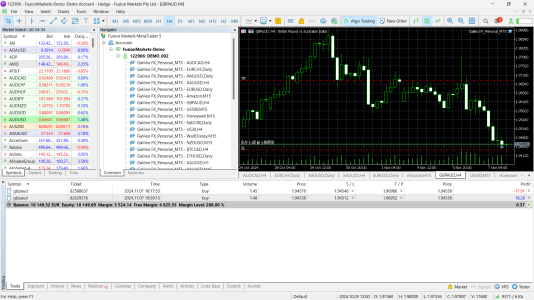

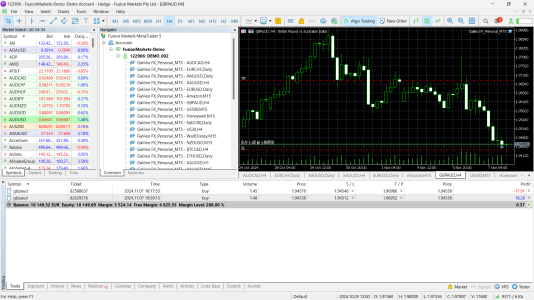

I second the request of InvictusRO above. I'm a slow learner but stubborn and would be extremely grateful if someone feels generous (after all, it's Christmas) and could explain what is happening in this screenshot of my MT 5 demo portfolio in Toolbox > Trade. I see the numbers changing but I don't know what they mean. If I go to the History tab I do not see this gbpaud trade so I guess it is something that is going on at the moment...but I confess utter ignorance.

Hey guys,

Thanks all

Can you please tell me their names so that I can know exactly which ones are you talking about?Hi Sanchay, the most recent ones are SP500 and NZDCAD, i downloaded the settings from the Performance link and loaded them into Galileo on MT5.

You can do either, we provide set files in performance page as well as in this thread as well (in form of zip) for your ease. If there are no trades I recommend you to read this thread: https://forum.galileofx.com/threads/galileo-fx-tutorial-how-to-install-use-the-trading-bot.49/Do i need to upload the template or just do the settings manually? I've done these manually and i've had no trades at all

I understand your view @InvictusRO and yes I will share those settings again on Monday. If you have any preferences for a currency pair, etc. feel free to post here we will try to add them from 18 Nov, 2024. However, I also need to prevent oversaturation on some settings so that these can benefit most of the traders. I will try my best to help you out with the settings. ThanksI believe there are a lot of us that don`t have a strategy of our own because our trading knowledge is limited, meaning that our only option is to use the settings you used in a backtesting from the past and it was successful, however, as I`m trying all of the settings you`re posting I don`t get positive results probably because the market trends changed and I do not have the knowledge to tweak Galileo in accordance with the current trends, would you consider posting what settings you are using this week for example for certain pairs / commodities etc. that you think will be profitable?

Hey Noah, it will not show in history tab until the trade is closed. The numbers going up and down in red and blue is called FLOATING PROFIT as this trade is still open. This is just my humble request that you learn the usage of MetaTrader 5 so that you can understand what's going on. Also, I will definitely try to help you with the settings feel free to add your preferences if they match with my requirements I will try to add them.I second the request of InvictusRO above. I'm a slow learner but stubborn and would be extremely grateful if someone feels generous (after all, it's Christmas) and could explain what is happening in this screenshot of my MT 5 demo portfolio in Toolbox > Trade. I see the numbers changing but I don't know what they mean. If I go to the History tab I do not see this gbpaud trade so I guess it is something that is going on at the moment...but I confess utter ignorance.

View attachment 4023

Thanks all

InvictusRO

Member

Hi Sanchay, Quantum Pivot Raider-NZDCAD-M5 and Solar Index Surge-SPX500-M15. Thank youHey guys,

Can you please tell me their names so that I can know exactly which ones are you talking about?

You can do either, we provide set files in performance page as well as in this thread as well (in form of zip) for your ease. If there are no trades I recommend you to read this thread: https://forum.galileofx.com/threads/galileo-fx-tutorial-how-to-install-use-the-trading-bot.49/

I understand your view @InvictusRO and yes I will share those settings again on Monday. If you have any preferences for a currency pair, etc. feel free to post here we will try to add them from 18 Nov, 2024. However, I also need to prevent oversaturation on some settings so that these can benefit most of the traders. I will try my best to help you out with the settings. Thanks

Hey Noah, it will not show in history tab until the trade is closed. The numbers going up and down in red and blue is called FLOATING PROFIT as this trade is still open. This is just my humble request that you learn the usage of MetaTrader 5 so that you can understand what's going on. Also, I will definitely try to help you with the settings feel free to add your preferences if they match with my requirements I will try to add them.

Thanks all

Past 6 months performance for EUR/USD with $10000 on Conservative mode with Day Trading style:

Lots: 0

Risk (in %): 4.5

Max Orders: 4

Stop Loss in points: 200

Take Profit in points: 130

Trailing Start in points: 30

Trailing Step in points: 15

Consecutive Bullish Signals: 12

Consecutive Bearish Signals: 11

Attachment Name: EURUSD-conservative.zip

Past 12 months performance for NZD/USD with $10000 on Conservative mode with Long Term Investing style:

Lots: 0

Risk (in %): 4.5

Max Orders: 5

Stop Loss in points: 1320

Take Profit in points: 550

Trailing Start in points: 150

Trailing Step in points: 80

Consecutive Bullish Signals: 7

Consecutive Bearish Signals: 3

Attachment Name: NZDUSD-conservative.zip

Past 6 months performance for USD/CAD with $10000 on Aggressive mode with Swing Trading style:

Lots: 0

Risk (in %): 4.5

Max Orders: 5

Stop Loss in points: 400

Take Profit in points: 490

Trailing Start in points: 100

Trailing Step in points: 20

Consecutive Bullish Signals: 4

Consecutive Bearish Signals: 4

Attachment Name: USDCAD-swing.zip

Past week performance for USD/JPY with $5000 on Conservative mode with Day Trading style:

Lots: 0

Risk (in %): 4.5

Max Orders: 5

Stop Loss in points: 200

Take Profit in points: 100

Trailing Start in points: 0

Trailing Step in points: 0

Consecutive Bullish Signals: 12

Consecutive Bearish Signals: 12

Attachment Name: USDJPY-week.zip

Past month performance for XAU/USD with $10000 on Moderate mode with Day Trading style:

Lots: 0

Risk (in %): 4.5

Max Orders: 5

Stop Loss in points: 400

Take Profit in points: 290

Trailing Start in points: 140

Trailing Step in points: 20

Consecutive Bullish Signals: 12

Consecutive Bearish Signals: 11

Attachment Name: XAUUSD-month.zip

Past 3 months performance for USD/JPY with $1000 on Conservative mode with Day Trading style:

Lots: 0

Risk (in %): 4.5

Max Orders: 4

Stop Loss in points: 1980

Take Profit in points: 640

Trailing Start in points: 220

Trailing Step in points: 30

Consecutive Bullish Signals: 5

Consecutive Bearish Signals: 7

Attachment Name: USDJPY-3-months.zip

Thanks, Sanchay. My preference is a setting with the smallest drawdown and greatest consistency over time. I have not found one on the Peformance page (under "Smallest Drawdown") or here ("Conservative") that I would risk real money on, at least nothing more than Lots = 0.01Hey guys,

Can you please tell me their names so that I can know exactly which ones are you talking about?

You can do either, we provide set files in performance page as well as in this thread as well (in form of zip) for your ease. If there are no trades I recommend you to read this thread: https://forum.galileofx.com/threads/galileo-fx-tutorial-how-to-install-use-the-trading-bot.49/

I understand your view @InvictusRO and yes I will share those settings again on Monday. If you have any preferences for a currency pair, etc. feel free to post here we will try to add them from 18 Nov, 2024. However, I also need to prevent oversaturation on some settings so that these can benefit most of the traders. I will try my best to help you out with the settings. Thanks

Hey Noah, it will not show in history tab until the trade is closed. The numbers going up and down in red and blue is called FLOATING PROFIT as this trade is still open. This is just my humble request that you learn the usage of MetaTrader 5 so that you can understand what's going on. Also, I will definitely try to help you with the settings feel free to add your preferences if they match with my requirements I will try to add them.

Thanks all

Hey Everyone,

I'm looking at some of these settings and don't understand how folks are getting results.

When I use high consecutive bullish/bearish signals, I don't ever see them trigger. This EUR/USD setting with Consecutive Bullish Signals: 12 and Consecutive Bearish Signals: 11, won't activate a trade for me. I've had settings as low as 7 for both, and they don't trigger on a daily or even a 1H basis. I'm not sure if there is something that I'm not doing right, but the market conditions don't ever seem to get to a point where these conservative settings activate a trade. Granted, that's what we want when we're going for a 'conservative' strategy because the likelihood of a reversal is higher. I'm just finding it hard to believe 11 and 12 signal settings would ever yield results because I've not seen many 11 or 12 consecutive signals.

What am I missing?

I'm looking at some of these settings and don't understand how folks are getting results.

Hey There,Past 6 months performance for EUR/USD with $10000 on Conservative mode with Day Trading style:

Lots: 0

Risk (in %): 4.5

Max Orders: 4

Stop Loss in points: 200

Take Profit in points: 130

Trailing Start in points: 30

Trailing Step in points: 15

Consecutive Bullish Signals: 12

Consecutive Bearish Signals: 11

Attachment Name: EURUSD-conservative.zip

Past 12 months performance for NZD/USD with $10000 on Conservative mode with Long Term Investing style:

Lots: 0

Risk (in %): 4.5

Max Orders: 5

Stop Loss in points: 1320

Take Profit in points: 550

Trailing Start in points: 150

Trailing Step in points: 80

Consecutive Bullish Signals: 7

Consecutive Bearish Signals: 3

Attachment Name: NZDUSD-conservative.zip

Past 6 months performance for USD/CAD with $10000 on Aggressive mode with Swing Trading style:

Lots: 0

Risk (in %): 4.5

Max Orders: 5

Stop Loss in points: 400

Take Profit in points: 490

Trailing Start in points: 100

Trailing Step in points: 20

Consecutive Bullish Signals: 4

Consecutive Bearish Signals: 4

Attachment Name: USDCAD-swing.zip

Past week performance for USD/JPY with $5000 on Conservative mode with Day Trading style:

Lots: 0

Risk (in %): 4.5

Max Orders: 5

Stop Loss in points: 200

Take Profit in points: 100

Trailing Start in points: 0

Trailing Step in points: 0

Consecutive Bullish Signals: 12

Consecutive Bearish Signals: 12

Attachment Name: USDJPY-week.zip

Past month performance for XAU/USD with $10000 on Moderate mode with Day Trading style:

Lots: 0

Risk (in %): 4.5

Max Orders: 5

Stop Loss in points: 400

Take Profit in points: 290

Trailing Start in points: 140

Trailing Step in points: 20

Consecutive Bullish Signals: 12

Consecutive Bearish Signals: 11

Attachment Name: XAUUSD-month.zip

Past 3 months performance for USD/JPY with $1000 on Conservative mode with Day Trading style:

Lots: 0

Risk (in %): 4.5

Max Orders: 4

Stop Loss in points: 1980

Take Profit in points: 640

Trailing Start in points: 220

Trailing Step in points: 30

Consecutive Bullish Signals: 5

Consecutive Bearish Signals: 7

Attachment Name: USDJPY-3-months.zip

When I use high consecutive bullish/bearish signals, I don't ever see them trigger. This EUR/USD setting with Consecutive Bullish Signals: 12 and Consecutive Bearish Signals: 11, won't activate a trade for me. I've had settings as low as 7 for both, and they don't trigger on a daily or even a 1H basis. I'm not sure if there is something that I'm not doing right, but the market conditions don't ever seem to get to a point where these conservative settings activate a trade. Granted, that's what we want when we're going for a 'conservative' strategy because the likelihood of a reversal is higher. I'm just finding it hard to believe 11 and 12 signal settings would ever yield results because I've not seen many 11 or 12 consecutive signals.

What am I missing?

Here is my backtesting report, just done on the last Conservative and Moderate settings from Nov. 4-today, with Lots = 0.01:

Galactic Pulse Drift -.25

Nebula Surge Vector 0 trades

Nova Trade Navigator +1.97

Orbital Breakout Surge -2.86

Total for Conservative settings: -1.14

Celestial Momentum Drive 0 trades

Cosmic Trend Beacon 0 trades

Ether Drift Nexus 0 trades

Solar Index Surge -.18

Honeywell 0 trades

Supernova Profit Vector 0 trades

Total for Moderate settings: -.18

Galactic Pulse Drift -.25

Nebula Surge Vector 0 trades

Nova Trade Navigator +1.97

Orbital Breakout Surge -2.86

Total for Conservative settings: -1.14

Celestial Momentum Drive 0 trades

Cosmic Trend Beacon 0 trades

Ether Drift Nexus 0 trades

Solar Index Surge -.18

Honeywell 0 trades

Supernova Profit Vector 0 trades

Total for Moderate settings: -.18

Can you explain the reports in the attached zipfiles? The data only goes to July 2024, not to current date?This thread is created for sharing the updated settings on a weekly basis for different instruments across different time-frames and different time periods. These settings will also be categorized into conservative, moderate and aggressive for different types of trading styles (Day Trading, Swing Trading and Long Term Investing).

Past 12 months performance for XAU/USD (M30) with $10000 on Conservative mode with Day Trading style:

Lots: 0

Risk (in %): 4.5

Max Orders: 3

Stop Loss in points: 1000

Take Profit in points: 270

Trailing Start in points: 200

Trailing Step in points: 100

Consecutive Bullish Signals: 8

Consecutive Bearish Signals: 10

Attachment Name: XAUUSD-M30.zip

Past 12 months performance for USD/CAD (M5) with $10000 on Moderate mode with Day Trading style:

Lots: 0

Risk (in %): 4.5

Max Orders: 4

Stop Loss in points: 180

Take Profit in points: 190

Trailing Start in points: 120

Trailing Step in points: 30

Consecutive Bullish Signals: 12

Consecutive Bearish Signals: 12

Attachment Name: USDCAD-M5.zip

Past 12 months performance for GBP/USD with $10000 on Aggressive mode with Day Trading style:

Lots: 0

Risk (in %): 3.5

Max Orders: 3

Stop Loss in points: 190

Take Profit in points: 190

Trailing Start in points: 130

Trailing Step in points: 60

Consecutive Bullish Signals: 7

Consecutive Bearish Signals: 10

Attachment Name: GBPUSD-M30.zip

Past 12 months performance for NAS100 with $10000 on Moderate mode with Day Trading style:

Lots: 0

Risk (in %): 4.5

Max Orders: 4

Stop Loss in points: 1260

Take Profit in points: 420

Trailing Start in points: 360

Trailing Step in points: 220

Consecutive Bullish Signals: 9

Consecutive Bearish Signals: 10

Attachment Name: NAS100-M15.zip

Please note that past performance do not guarantee future performance.

-Sanchay Kasturey

Similar threads

- Replies

- 13

- Views

- 249

- Replies

- 11

- Views

- 279

- Replies

- 11

- Views

- 360

- Locked

- Sticky

- Replies

- 0

- Views

- 197