Hi

@SerenityNetworks, To calculate your financial risk in both scenarios, you’ll want to understand the core equation behind position sizing and loss calculation. Let’s break down both examples and point out key elements and missing variables.

Scenario 1: Dynamic Lot Sizing (Risk-Based)

- Pair: EURUSD

- Lot Size: 0.0 (Dynamic, based on risk %)

- Risk in %: 0.2%

- Stop Loss: 645 points

- Leverage: 1:100

- Max Orders: 2

In this case, the risk is set as a percentage of your total account balance. The formula to calculate dynamic lot size is:

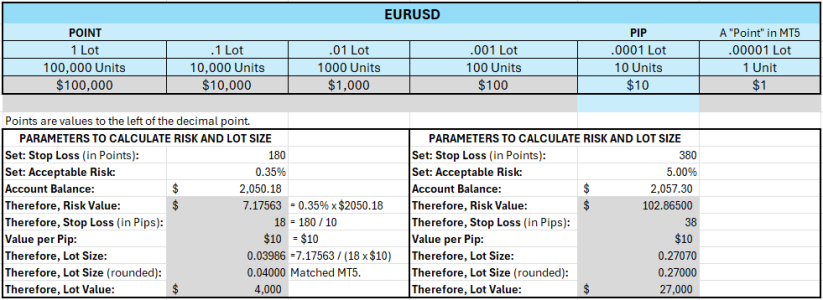

Lot Size = (Account Balance × Risk%) / (Stop Loss in Points × Point Value)

Where:

- Point Value for EURUSD with a micro lot (0.01) is usually $0.10 per point

- Stop Loss in points needs to be converted properly (e.g., 645 points = 64.5 pips)

- Leverage doesn’t directly affect the lot size here, but impacts your margin requirement

To calculate accurately, we need your

account balance. Without it, we can’t compute the lot size or dollar risk per trade. However, with 0.2% risk and a stop of 645 points, the robot will automatically determine a lot size that matches that risk.

Other Key Factors to Consider:

- Spread: High spread could impact execution price

- Slippage: Especially in high-volatility markets

- Execution speed & broker latency

- Market conditions: Trending vs ranging behavior

- Trading timeframes

Scenario 2: Fixed Lot Size (1.0 Lot)

- Pair: EURUSD

- Lot Size: 1.0 (Fixed)

- Risk %: n/a

- Stop Loss: 645 points

- Leverage: 1:100

- Max Orders: 2

This is a straightforward calculation.

With a standard lot (1.0), the

point value is $10 per point for EURUSD. Therefore:

Risk per Trade = Lot Size × Point Value × Stop Loss in Points

= 1 × $10 × 645 = $6,450 per trade

With a

Max Orders = 2, your worst-case risk = $6,450 × 2 =

$12,900.

Again, if your account size is $100,000, this would be a

12.9% risk, which is significantly high for most traders.

Suggestion: Unless you're trading with very high capital and accept high drawdown, you'd probably want to reassess the fixed lot size. Most Galileo FX clients who prioritize long-term gains tend to use much smaller fixed lots or rely on dynamic lot sizing with tight risk controls.

Closing Advice

In both cases, the following should be considered when calculating and controlling risk:

- Account equity (not just balance)

- Spread and slippage during execution

- Broker’s margin requirements (influenced by leverage)

- Drawdown risk across multiple trades

- Use of trailing stops, if applicable

For users of Galileo FX, these calculations are automated when using the risk % method, but understanding the math behind it helps align your strategy with your personal risk tolerance.