Hey everyone, here are the updated settings for this week's backtested on multiple timeframes:

1. Meteor Momentum Maneuver (AUDUSD-M15)

This setting employs a decisive approach with high risk tolerance and a tight control on profits. The strategy balances momentum and trailing logic to capture movements while allowing some flexibility for price shifts. This setup is ideal for those seeking to ride significant market waves with enough buffer to avoid premature exits, while also being ready to adjust positions based on price momentum.

- Lots: 0

- Risk (in %): 4.5%

- Max Orders: 4

- Stop Loss in Points: 300

- Take Profit in Points: 190

- Trailing Start in Points: 140

- Trailing Step in Points: 10

- Consecutive Bullish Signals: 7

- Consecutive Bearish Signals: 9

Trading Style:

Swing Trading

Trading Mode:

Aggressive

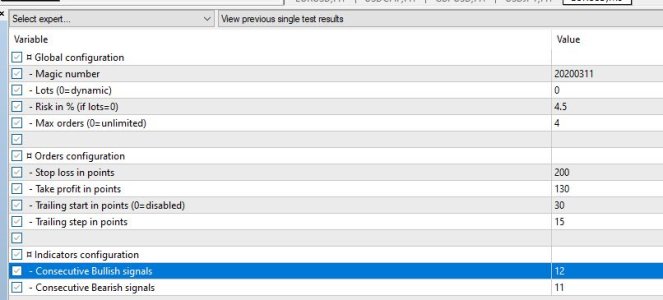

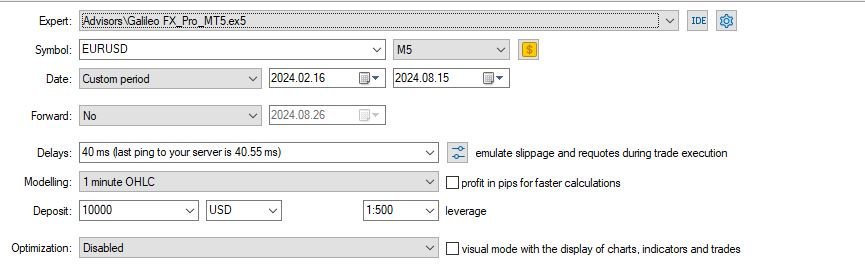

2. Nebula Nexus Surge (NAS100-M15)

This strategy is tailored for high-risk traders aiming to capture large, explosive market movements. With a wide stop loss and extensive trailing configuration, it’s designed to hold positions through significant fluctuations, aligning with powerful market momentum.

- Lots: 0

- Risk (in %): 4.5%

- Max Orders: 4

- Stop Loss in Points: 1160

- Take Profit in Points: 400

- Trailing Start in Points: 380

- Trailing Step in Points: 230

- Consecutive Bullish Signals: 12

- Consecutive Bearish Signals: 10

Trading Style:

Swing Trading

Trading Mode:

Aggressive

This setup is best suited for those looking to capitalize on large, directional moves, with enough patience and resilience to withstand significant market corrections.

3. Galaxy Guard Static (XAUUSD-M30)

This configuration focuses on precise entry points with a strong emphasis on stability. Lacking trailing mechanisms, it is suited for traders looking to lock in gains on specific movements without dynamic adjustments, relying instead on solid stop loss and take profit levels.

- Lots: 0

- Risk (in %): 4.5%

- Max Orders: 4

- Stop Loss in Points: 1000

- Take Profit in Points: 370

- Trailing Start in Points: 0

- Trailing Step in Points: 0

- Consecutive Bullish Signals: 8

- Consecutive Bearish Signals: 8

Trading Style:

Swing Trading

Trading Mode:

Moderate

Ideal for traders who prefer to set clear boundaries for risk and reward, allowing the market to hit defined targets without interference or adjustment.

4. Comet Core Drive (AUDUSD-H6)

This setup combines a balanced approach with a focus on capturing extended market movements. The strategy includes a modest trailing stop mechanism, ensuring profits are secured while giving enough room for substantial market advances.

- Lots: 0

- Risk (in %): 4.5%

- Max Orders: 4

- Stop Loss in Points: 250

- Take Profit in Points: 630

- Trailing Start in Points: 110

- Trailing Step in Points: 70

- Consecutive Bullish Signals: 6

- Consecutive Bearish Signals: 4

Trading Style:

Swing Trading

Trading Mode:

Moderate

This configuration is ideal for traders seeking to leverage strong directional trends, with carefully managed risk and reward parameters that align with sustained market movement potential.

5. Polaris Pulse Sync (USDCHF-H4)

Designed to capture medium-term trends with precision, this setup utilizes a well-balanced trailing mechanism. It provides the flexibility needed to ride out market fluctuations while ensuring that profits are secured at key points of market movement.

- Lots: 0

- Risk (in %): 4.5%

- Max Orders: 4

- Stop Loss in Points: 250

- Take Profit in Points: 550

- Trailing Start in Points: 160

- Trailing Step in Points: 80

- Consecutive Bullish Signals: 8

- Consecutive Bearish Signals: 5

Trading Style:

Swing Trading

Trading Mode:

Moderate

This configuration suits traders focused on medium-term opportunities, balancing between holding positions for larger gains and protecting against potential market reversals.

6. Celestial Orbit Pivot (AUDUSD-H4)

This strategy is designed to secure gains during market fluctuations while maintaining a balanced risk approach. With a moderate trailing setup and equal emphasis on bullish and bearish signals, it aims to capture pivot points within the market’s natural oscillations.

- Lots: 0

- Risk (in %): 4.5%

- Max Orders: 4

- Stop Loss in Points: 510

- Take Profit in Points: 320

- Trailing Start in Points: 130

- Trailing Step in Points: 100

- Consecutive Bullish Signals: 8

- Consecutive Bearish Signals: 8

Trading Style:

Swing Trading

Trading Mode:

Moderate

This configuration is ideal for traders who seek to navigate and capitalize on market turns, with a disciplined approach to risk and reward through consistent trailing adjustments.

7. Aurora Momentum Edge (USDCAD-H6)

This setup is optimized for capturing swift market movements while maintaining a balanced risk approach. The moderate trailing mechanism ensures that gains are secured during strong directional trends, with a particular focus on momentum shifts.

- Lots: 0

- Risk (in %): 4.5%

- Max Orders: 4

- Stop Loss in Points: 670

- Take Profit in Points: 290

- Trailing Start in Points: 170

- Trailing Step in Points: 50

- Consecutive Bullish Signals: 8

- Consecutive Bearish Signals: 7

Trading Style:

Swing Trading

Trading Mode:

Moderate

This configuration is well-suited for traders aiming to exploit medium-term market opportunities, balancing the need for safety with the potential for capitalizing on sustained price movements.

8. Solar Flare Horizon (AUDUSD-1W)

This strategy is built for long-term trend followers who aim to capitalize on large market moves. With a wide take profit and a significant trailing stop, it’s ideal for riding trends while managing risk through careful trailing adjustments.

- Lots: 0

- Risk (in %): 4.5%

- Max Orders: 4

- Stop Loss in Points: 290

- Take Profit in Points: 1190

- Trailing Start in Points: 250

- Trailing Step in Points: 150

- Consecutive Bullish Signals: 3

- Consecutive Bearish Signals: 3

Trading Style:

Long-Term Investing

Trading Mode: Conservative

This setup is perfect for those who prefer to stay in trades for extended periods, allowing the market to reach its full potential while maintaining a controlled risk approach.

9. Titan's Trend Guard (GBPUSD-1W)

This strategy is crafted for cautious long-term traders who prioritize securing profits during major market shifts. With a significant trailing mechanism and a focus on bearish confirmations, it's built to protect gains in prolonged market trends.

- Lots: 0

- Risk (in %): 4.5%

- Max Orders: 4

- Stop Loss in Points: 270

- Take Profit in Points: 1170

- Trailing Start in Points: 300

- Trailing Step in Points: 140

- Consecutive Bullish Signals: 3

- Consecutive Bearish Signals: 14

Trading Style:

Long-Term Investing

Trading Mode:

Conservative

This setup is well-suited for traders who are looking to capitalize on extended trends while employing a robust strategy to mitigate risks during downturns, ensuring steady growth over time.

10. Stellar Swing Beacon (USDCHF-1W)

This strategy is designed for those looking to balance risk and reward over a long-term horizon. With a focus on both bullish and bearish trends, the trailing mechanism aims to lock in gains while allowing room for market movements.

- Lots: 0

- Risk (in %): 4.5%

- Max Orders: 4

- Stop Loss in Points: 330

- Take Profit in Points: 370

- Trailing Start in Points: 170

- Trailing Step in Points: 50

- Consecutive Bullish Signals: 5

- Consecutive Bearish Signals: 3

Trading Style:

Long-Term Investing

Trading Mode: Conservative

Ideal for traders who wish to capture both upward and downward trends, while employing a trailing strategy to ensure profits are maximized as the market unfolds over time.