- Start in demo. Don’t be a hero. Nobody wins by risking real money on day one. Demo is free practice, so use it.

- Hit the Performance Page https://performance.galileofx.com. Scroll around, grab 10 strategies you vibe with. Pick based on your style and the assets you actually like.

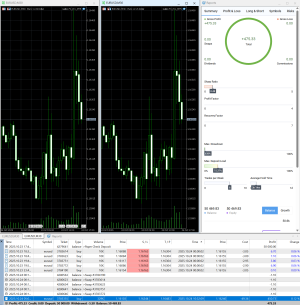

- Load ’em up in Galileo FX. Run all 10 in your demo account. Yes, all at once. Let the bot do the heavy lifting.

- Sit on your hands. Seriously. Do not touch a thing until each strategy has at least 30 trades, ideally 50. That’s when the numbers mean something.

- Cut the duds. Out of 10, a few will flop. No problem. Kill them off. You’ll still have 3, 4, maybe 5 solid winners. Replace the losers with 5 new ones.

- Double down on the winners. Keep them running in demo without messing with them. Once you’re comfortable, take those winners live with a small sum. Then grow slowly.

- Rinse and repeat. After a couple weeks, you’ll know exactly which strategies are making you money. This is the system the winners use. Nothing fancy. Just discipline.

- Optimization. If a strategy stops pulling its weight, don’t force it. Shut it down and toss it back into demo. Reload it on three charts, tweak the consecutive signals setting just a bit and let it prove itself again. You can adjust other settings too, but the more you change, the less consistent your results will be.

The opposite approach is what many beginners fall into:

- Jumping straight into live trading with money on the line

- Picking one or two random strategies without testing them properly

- Quitting after just a handful of losing trades

- Constantly tweaking settings mid-test instead of letting the data build

- Chasing “the perfect setup” instead of building consistency

Why it fails:

- No statistical base

With only a few trades, results are random. A couple of bad trades can make a good strategy look broken, or a few lucky wins can fool you into thinking you found gold. Either way, you are making decisions on noise, not data. - Emotional rollercoaster

When money is live and results swing up and down with no system in place, emotions take over. Frustration, anger, and self-doubt kick in. Instead of learning, you burn out. - Constant tinkering

Changing settings mid-test destroys any chance of knowing what works. You never give a strategy enough time to show its true performance, so you’re always stuck starting over. - Demoralization

The cycle of hype, quick losses, and abandonment drains energy. It feels like the bot is failing, when really it’s the process that’s broken. - Anger and blame

Without a clear method, losses feel personal. Traders get angry at the bot, the market, or themselves. That mindset kills confidence and makes quitting feel easier than fixing the approach.

The opposite of disciplined testing is chaos. It’s a recipe for wasted money, wasted time, and the kind of frustration that makes people walk away right before they could have built something real.

Last edited: