You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Optimizing the Galileo FX bot for better profitability - A systematic approach

- Thread starter David

- Start date

I have an overall strategy question. I've been testing NZDUSD against MetaQuotes for 12 days with settings Lot Size = 0.02, Max Orders = 15, Take Profit = 100, Max Bullish = 3, Max Bearish = 4. The backtest results are right on for me: great profit, reasonably low Max Drawdown. On Sept 6, 14 short trades were executed and then the price went up so they've been in the red since then. Other than configuring a stop loss, is there another strategy/configuration I should be using to avoid this? Or do I just have to be patient and wait for the price to drop?

amirwanms

Member

spot on... 100%I've noticed a fair share of questions swirling around on how to dial in the best settings for our beloved Galileo FX bot. Trust me, I get it. We all want to make this trading workhorse gallop at its best. So, I thought, why not pool our collective wisdom, learn from each other, and discover how to make the most of Galileo FX.

Getting the settings right for Galileo FX, like any trading bot, isn't a one-size-fits-all scenario. It's more of an art, complemented by a bit of science and a lot of patience.

Here's how I go about it:

First, I take a deep breath and remember what I'm after. Is it the total net profit, the Sharpe ratio, or is it about managing the drawdown? Having clear objectives is half the battle won.

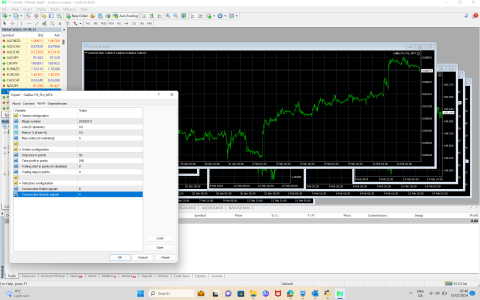

Next, I put on my lab coat and do some backtesting on MetaTrader 5. It's a nifty platform that lets me test how Galileo FX would have performed using historical market data. Though remember, as any wise trader will tell you, past performance is not indicative of future results. But as Warren Buffett says, in business, looking at the past is a good way to predict the future.

Once I've got a hang of the baseline performance, I start experimenting. I begin toying with Galileo FX's parameters - the Lots, percRisk, Max Orders, stopLoss, takeProfit, TrailingStart, TrailingStep, Bullish Signals, and Bearish Signals. Be wary, though; there's a sweet spot to this. Over-optimization can turn a knight in shining armor into a damsel in distress real quick!

I also check the results posted here, along with the settings: MyFxBook Links with Settings | Page 3 | Official Galileo FX Community

After I've found settings that I'm satisfied with, I take them out for a spin in the real world. Forward testing, they call it. I put them to test in a demo account, watch, learn, and fine-tune.

Then comes the tricky bit. You see, markets are living, breathing beasts. They change their spots faster than a leopard. So, I always keep an eye on my bot's performance, ready to adjust its settings to the new norm.

Finally, the golden rule. No matter how much I trust my bot or how well it has been performing, I never forget about risk management. I make sure I'm comfortable with the maximum risk per trade. After all, we're here to make money, not lose sleep, right?

There you have it, folks, my two cents. Keep in mind, though, even the most advanced bot isn't a surefire ticket to Profitville. Be patient, manage your risks, and never bet more than what you can afford to lose.

I hope this helps you find your way to a more profitable Galileo FX experience. Keep those questions coming and remember, we're all here to learn from each other.

Reena@3004

New member

Time Frame has not been given for Premium settingsWith Galileo FX Pro and premium settings, you're off to a great start. Its pre-set configurations are designed for diverse market conditions and serve as a solid foundation for your trades.

While regular monitoring and minor adjustments are part of the process, they're straightforward and require just a few minutes each day or even once a week However, it's worth noting that we have many instances where members have used the same settings for 6 months to a year, achieving effective performance without frequent adjustments.

This underlines the bot's robustness and the potential longevity of well-optimized settings. So, while being vigilant is necessary, it's entirely possible to find a set of parameters that can work effectively over the long term.

With Galileo FX Pro, the right settings, and a few minutes of your day, you're well-positioned for a rewarding trading journey.

Can you please specify

amirwanms

Member

for those settings in premium is for H@ but then if you vtoss check back its safer and higher rate of succes. its just that if we quire ROI then can always speed up the settings.Time Frame has not been given for Premium settings

Can you please specify

If it’s set low (1–3), the bot will trade with higher risk and higher reward, if it’s set high (7–10), Galileo FX will make fewer trades.

amirwanms

Member

H1for those settings in premium is for H@ but then if you vtoss check back its safer and higher rate of succes. its just that if we quire ROI then can always speed up the settings.

If it’s set low (1–3), the bot will trade with higher risk and higher reward, if it’s set high (7–10), Galileo FX will make fewer trades.

Hi guys,

I am trying to do some backtesting on MT5. I have selected optimization: fast genetic based algorithm and want to backtest on M1, M5, M15 and M30. Can you please advise how much back in time should I go for the different timeframes? I'd also appreciate if you could share your thoughts on the different ranges that you enter in the input tab?

Thanks in advance for your assistance!

I am trying to do some backtesting on MT5. I have selected optimization: fast genetic based algorithm and want to backtest on M1, M5, M15 and M30. Can you please advise how much back in time should I go for the different timeframes? I'd also appreciate if you could share your thoughts on the different ranges that you enter in the input tab?

Thanks in advance for your assistance!

Hi guys,

hello sir how may i help you?

I am trying to do some backtesting on MT5. I have selected optimization: fast genetic based algorithm and want to backtest on M1, M5, M15 and M30. Can you please advise how much back in time should I go for the different timeframes? I'd also appreciate if you could share your thoughts on the different ranges that you enter in the input tab?

Thanks in advance for your assistance!

Usually it takes some time until it start trading.Hello, I purchased Pro today and have on safe settings but its almost 3 hours and not one trade and i am wondering is it even working? all my installation and settings are accurate according to the support team? please help

thank you, is there any guide as to how to use it correctly? there was about 50 trades and buying and selling same currency?it seems out of controlUsually it takes some time until it start trading.

M1 mean your app will do one trade/minute. This can cause some hectic results. GalileoFx suggests to use H1/H4 for a safer approach. It would be less resilient for crazyness on the market. I am using those settings and what can I say that I see no trades for the past few days.

great thanks, but when i purchased i thought there would be settings to make steady daily profits? but seems diffcult to find the right onesM1 mean your app will do one trade/minute. This can cause some hectic results. GalileoFx suggests to use H1/H4 for a safer approach. It would be less resilient for crazyness on the market. I am using those settings and what can I say that I see no trades for the past few days.

m1 is 1 min candle timeframe..this is agressive..and gives less time and data to algo to analyze..if you have max order settings set to 0..it means its unlimited..set it to your desirabel max number of trades to cap it..M1, i fiddled around with it to see if it was working and then the trades took off!!!! but all conflicted, is there a profitable set of settings on certain pairs? or has anyone figured it out?

Similar threads

- Replies

- 0

- Views

- 150

- Replies

- 3

- Views

- 405

- Replies

- 0

- Views

- 177

- Replies

- 2

- Views

- 672