I've noticed a fair share of questions swirling around on how to dial in the best settings for our beloved Galileo FX bot. Trust me, I get it. We all want to make this trading workhorse gallop at its best. So, I thought, why not pool our collective wisdom, learn from each other, and discover how to make the most of Galileo FX.

Getting the settings right for Galileo FX, like any trading bot, isn't a one-size-fits-all scenario. It's more of an art, complemented by a bit of science and a lot of patience.

Here's how I go about it:

First, I take a deep breath and remember what I'm after. Is it the total net profit, the Sharpe ratio, or is it about managing the drawdown? Having clear objectives is half the battle won.

Next, I put on my lab coat and do some backtesting on MetaTrader 5. It's a nifty platform that lets me test how Galileo FX would have performed using historical market data. Though remember, as any wise trader will tell you, past performance is not indicative of future results. But as Warren Buffett says, in business, looking at the past is a good way to predict the future.

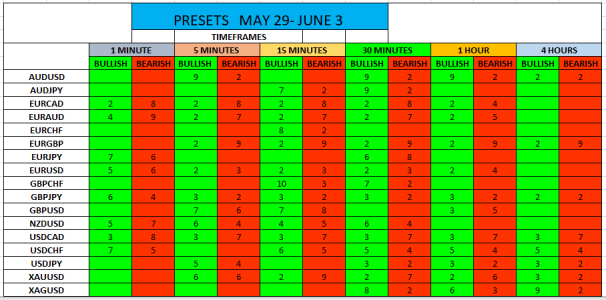

Once I've got a hang of the baseline performance, I start experimenting. I begin toying with Galileo FX's parameters - the Lots, percRisk, Max Orders, stopLoss, takeProfit, TrailingStart, TrailingStep, Bullish Signals, and Bearish Signals. Be wary, though; there's a sweet spot to this. Over-optimization can turn a knight in shining armor into a damsel in distress real quick!

I also check the results posted here, along with the settings: MyFxBook Links with Settings | Page 3 | Official Galileo FX Community

After I've found settings that I'm satisfied with, I take them out for a spin in the real world. Forward testing, they call it. I put them to test in a demo account, watch, learn, and fine-tune.

Then comes the tricky bit. You see, markets are living, breathing beasts. They change their spots faster than a leopard. So, I always keep an eye on my bot's performance, ready to adjust its settings to the new norm.

Finally, the golden rule. No matter how much I trust my bot or how well it has been performing, I never forget about risk management. I make sure I'm comfortable with the maximum risk per trade. After all, we're here to make money, not lose sleep, right?

There you have it, folks, my two cents. Keep in mind, though, even the most advanced bot isn't a surefire ticket to Profitville. Be patient, manage your risks, and never bet more than what you can afford to lose.

I hope this helps you find your way to a more profitable Galileo FX experience. Keep those questions coming and remember, we're all here to learn from each other.

Getting the settings right for Galileo FX, like any trading bot, isn't a one-size-fits-all scenario. It's more of an art, complemented by a bit of science and a lot of patience.

Here's how I go about it:

First, I take a deep breath and remember what I'm after. Is it the total net profit, the Sharpe ratio, or is it about managing the drawdown? Having clear objectives is half the battle won.

Next, I put on my lab coat and do some backtesting on MetaTrader 5. It's a nifty platform that lets me test how Galileo FX would have performed using historical market data. Though remember, as any wise trader will tell you, past performance is not indicative of future results. But as Warren Buffett says, in business, looking at the past is a good way to predict the future.

Once I've got a hang of the baseline performance, I start experimenting. I begin toying with Galileo FX's parameters - the Lots, percRisk, Max Orders, stopLoss, takeProfit, TrailingStart, TrailingStep, Bullish Signals, and Bearish Signals. Be wary, though; there's a sweet spot to this. Over-optimization can turn a knight in shining armor into a damsel in distress real quick!

I also check the results posted here, along with the settings: MyFxBook Links with Settings | Page 3 | Official Galileo FX Community

After I've found settings that I'm satisfied with, I take them out for a spin in the real world. Forward testing, they call it. I put them to test in a demo account, watch, learn, and fine-tune.

Then comes the tricky bit. You see, markets are living, breathing beasts. They change their spots faster than a leopard. So, I always keep an eye on my bot's performance, ready to adjust its settings to the new norm.

Finally, the golden rule. No matter how much I trust my bot or how well it has been performing, I never forget about risk management. I make sure I'm comfortable with the maximum risk per trade. After all, we're here to make money, not lose sleep, right?

There you have it, folks, my two cents. Keep in mind, though, even the most advanced bot isn't a surefire ticket to Profitville. Be patient, manage your risks, and never bet more than what you can afford to lose.

I hope this helps you find your way to a more profitable Galileo FX experience. Keep those questions coming and remember, we're all here to learn from each other.