Muscle_Trader

New member

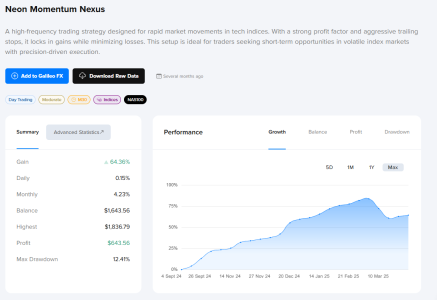

Been sticking with Galileo on demo this week, running mostly US30 just to test consistency. Attached the screenshot of my trades.

Profit: $631.59

Deposit: $10k

Balance now: $10,507.22

Nothing crazy, but for me the win isn’t the $ amount it’s the fact I didn’t go full degen THIS time

A few months ago I would ’ve cranked it to max risk, stacked 10 orders

Then cried myself to sleep when it dumped

Now I’m keeping it tighter: Max Orders low, SL at 2%, lot size reasonable.

But I still wonder if I’m leaving profit on the table by being too conservative. Should I bump risk a little once I get more data or just keep compounding slow & steady?

Would love feedback from anyone who’s been running Galileo on indices longer-term.

Stay safe, and don’t do what I did in my first month

Profit: $631.59

Deposit: $10k

Balance now: $10,507.22

Nothing crazy, but for me the win isn’t the $ amount it’s the fact I didn’t go full degen THIS time

A few months ago I would ’ve cranked it to max risk, stacked 10 orders

Then cried myself to sleep when it dumped

Now I’m keeping it tighter: Max Orders low, SL at 2%, lot size reasonable.

- Some trades close super quick with tiny profit ($0 .35, $7, $28 lol). Feels pointless but I think it’s just the bot managing signals.

- Commission eats a chunk but better that than massive drawdown.

- Drawdown stayed calm compared to how I used to run it. I could actually sleep without checking my phone every 30 minutes.

But I still wonder if I’m leaving profit on the table by being too conservative. Should I bump risk a little once I get more data or just keep compounding slow & steady?

Would love feedback from anyone who’s been running Galileo on indices longer-term.

Stay safe, and don’t do what I did in my first month