You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Extra Galileo FX Settings: Conservative, Moderate & Aggressive

- Thread starter Sanchay

- Start date

I just added SPY.US M15 and US500 M15 (Quantum Impulse Vector) because I like the graph and could not find SPX500 in MT5, only "SPX.GB Spirax Sarco" and "US500-F, SU SPX 500 Forward (19 Sep-18 Dec)" -- whatever the heck that means. I guess SPY.US is the SPDR ETF on the S&P500 and US500 is the index itself. Did I do this right? Is there a "SPX500" that somehow I can't find?

Just added today's top pick CADCHF H8. Suggestion: Any way the Galileo team could send an email alert whenever the Performance page changes -- at least the "top picks" and "today's top choice" so I don't have to keep checking the page?

Hey Noah,

I don't know your account size, I would use $1000 per currency pair and I would use only 0.01 lot. For every $1000 more i can add one more currency pair with 0.01 lot. Now, coming to the adjustment part I see you are trading M1 and M5 timeframes a lot, these timeframes change way too much and way too fast so my suggestion is to test a mix of timeframes on an account prefer higher timeframes like M30 and H1 for ensuring small gains but steady.

I don't know your account size, I would use $1000 per currency pair and I would use only 0.01 lot. For every $1000 more i can add one more currency pair with 0.01 lot. Now, coming to the adjustment part I see you are trading M1 and M5 timeframes a lot, these timeframes change way too much and way too fast so my suggestion is to test a mix of timeframes on an account prefer higher timeframes like M30 and H1 for ensuring small gains but steady.

Hey guys hope you are doing great. Here are the performance reports of the past week:

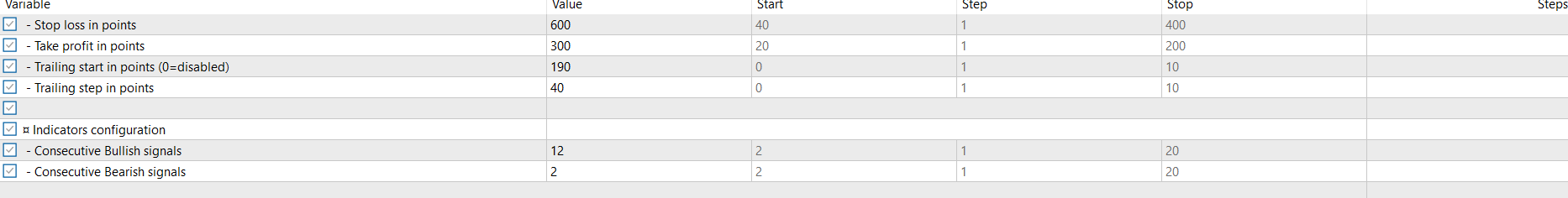

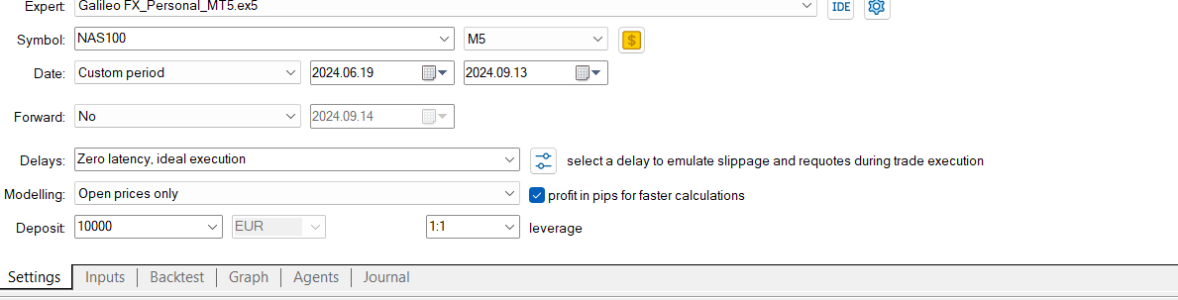

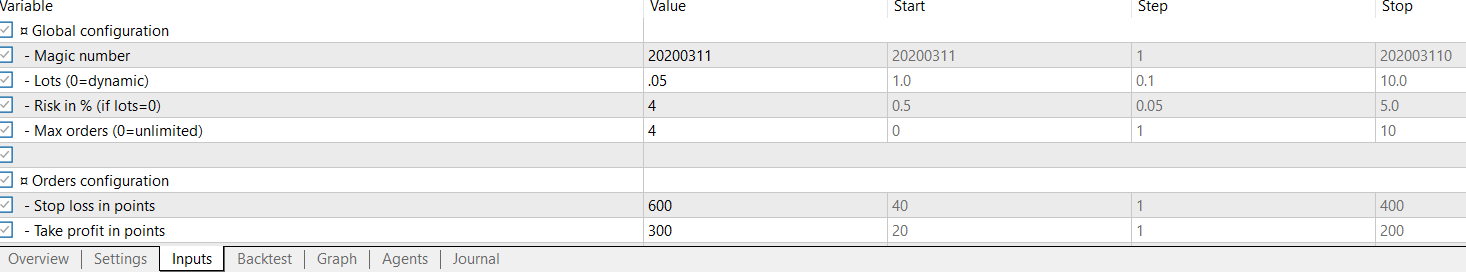

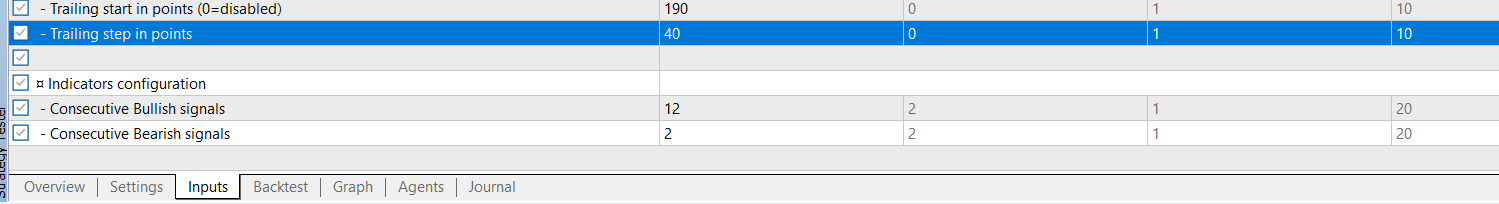

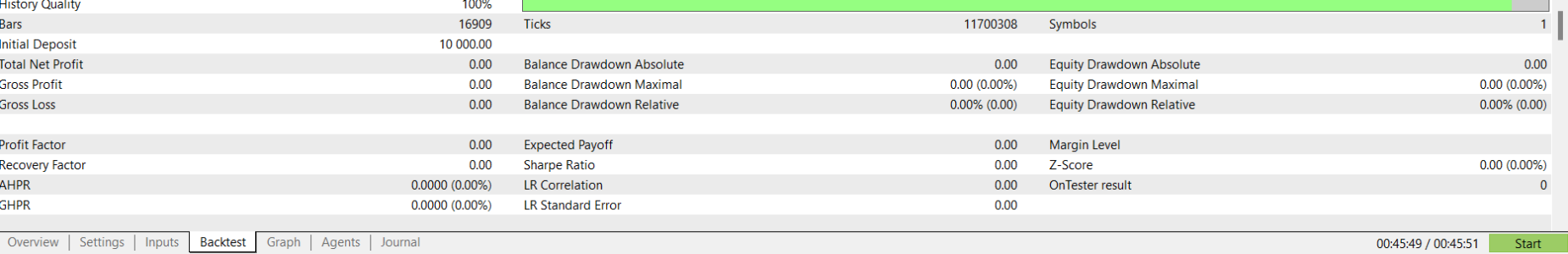

1. Celestial Momentum Surge

Designed for those seeking to capitalize on swift NAS100 market movements, this setting balances risk with precision, leveraging trailing stops and profit trades to secure gains while limiting exposure to losses.

Trading Style: Day Trading

Trading Mode: Aggressive

Lots: 0.5

Risk: 4%

Max Orders: 4

Stop Loss: 600

Take Profit: 300

Trailing Start: 190

Trailing Step: 40

Bullish Signals: 12

Bearish Signals: 7

2. Stellar Wave Pulsar

Focused on long-term opportunities with XAGUSD, this setting targets consistent profit accumulation with disciplined risk management. Trailing stops and balanced signal settings ensure traders capture momentum while limiting exposure to adverse market movements.

Trading Style: Swing Trading

Trading Mode: Moderate

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 2150

Take Profit: 1650

Trailing Start: 210

Trailing Step: 50

Bullish Signals: 4

Bearish Signals: 4

3. Galactic Euro Thrust

This setting is built for precision with EURUSD on the M1 timeframe, capitalizing on rapid market movements. Using tight stop loss and trailing mechanisms, it aims to capture short-term gains while swiftly mitigating risk.

Trading Style: Day Trading

Trading Mode: Moderate

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 150

Take Profit: 140

Trailing Start: 50

Trailing Step: 10

Bullish Signals: 11

Bearish Signals: 12

4. Solar Pivot Surge

Engineered for H4 trading with the EURAUD pair, this configuration aims to capture medium-term market movements with a balanced risk-reward approach. Its trailing stop system locks in profits while conservative signal settings help avoid false entries.

Trading Style: Swing Trading

Trading Mode: Conservative

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 200

Take Profit: 850

Trailing Start: 270

Trailing Step: 30

Bullish Signals: 7

Bearish Signals: 12

5. Quantum Impulse Vector

A precise setting for trading the SPX500, blending calculated risk with tight control over drawdowns. This configuration is designed to seize profitable opportunities in a trending market while minimizing losses through conservative stop and trailing parameters.

Trading Style: Day Trading

Trading Mode: Aggressive

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 140

Take Profit: 120

Trailing Start: 60

Trailing Step: 30

Bullish Signals: 11

Bearish Signals: 6

6. Lunar Flux Horizon

Tailored for weekly trading on AUDCHF, this strategy captures long-term market shifts with a focus on steady growth. With conservative signals and well-calibrated trailing stops, it seeks to maximize gains from prolonged trends while managing risk effectively.

Trading Style: Long-Term Investing

Trading Mode: Conservative

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 950

Take Profit: 1940

Trailing Start: 420

Trailing Step: 30

Bullish Signals: 3

Bearish Signals: 3

7. Nebula Ether Ascend

Optimized for ETHUSD, this strategy leverages large stop and take profit distances to capture significant market trends. Ideal for long-term investors looking to balance bullish momentum signals with disciplined risk management, aiming for gradual capital appreciation.

Trading Style: Swing Trading

Trading Mode: Moderate

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 5000

Take Profit: 16000

Trailing Start: 7000

Trailing Step: 6000

Bullish Signals: 7

Bearish Signals: 5

8. Nebulae Trade Pulse

Geared for H8 trading on AUDNZD, this setting focuses on rapid long entries with a high bullish sensitivity. With its robust trailing stop mechanism and moderate take profit, it’s ideal for traders looking to capitalize on swift, directional market moves.

Trading Style: Long-Term Investing

Trading Mode: Aggressive

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 400

Take Profit: 260

Trailing Start: 170

Trailing Step: 40

Bullish Signals: 13

Bearish Signals: 3

9. Aurora Swiss Momentum

Configured for H8 trading on CADCHF, this strategy capitalizes on medium-term volatility with a balanced risk-reward ratio. A solid trailing stop approach ensures that profits are protected as the trade moves favorably, making it suitable for active traders in dynamic markets.

Trading Style: Long-Term Investing

Trading Mode: Aggressive

Lots: 0

Risk: 5.5%

Max Orders: 5

Stop Loss: 840

Take Profit: 640

Trailing Start: 100

Trailing Step: 30

Bullish Signals: 3

Bearish Signals: 10

10. Cosmic Yen Vector

Designed for daily trading on EURJPY, this setting captures large market swings with higher risk tolerance. A strong focus on long-term momentum, combined with precise stop and trailing systems, makes it ideal for traders seeking larger moves in trending markets.

Trading Style: Swing Trading

Trading Mode: Conservative

Lots: 0

Risk: 6.5%

Max Orders: 4

Stop Loss: 2900

Take Profit: 3900

Trailing Start: 200

Trailing Step: 120

Bullish Signals: 3

Bearish Signals: 3

Thanks for reading it.

Disclaimer: This is not financial advice. Trading involves risks, and past performance is not indicative of future results. Always trade responsibly.

1. Celestial Momentum Surge

Designed for those seeking to capitalize on swift NAS100 market movements, this setting balances risk with precision, leveraging trailing stops and profit trades to secure gains while limiting exposure to losses.

Trading Style: Day Trading

Trading Mode: Aggressive

Lots: 0.5

Risk: 4%

Max Orders: 4

Stop Loss: 600

Take Profit: 300

Trailing Start: 190

Trailing Step: 40

Bullish Signals: 12

Bearish Signals: 7

2. Stellar Wave Pulsar

Focused on long-term opportunities with XAGUSD, this setting targets consistent profit accumulation with disciplined risk management. Trailing stops and balanced signal settings ensure traders capture momentum while limiting exposure to adverse market movements.

Trading Style: Swing Trading

Trading Mode: Moderate

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 2150

Take Profit: 1650

Trailing Start: 210

Trailing Step: 50

Bullish Signals: 4

Bearish Signals: 4

3. Galactic Euro Thrust

This setting is built for precision with EURUSD on the M1 timeframe, capitalizing on rapid market movements. Using tight stop loss and trailing mechanisms, it aims to capture short-term gains while swiftly mitigating risk.

Trading Style: Day Trading

Trading Mode: Moderate

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 150

Take Profit: 140

Trailing Start: 50

Trailing Step: 10

Bullish Signals: 11

Bearish Signals: 12

4. Solar Pivot Surge

Engineered for H4 trading with the EURAUD pair, this configuration aims to capture medium-term market movements with a balanced risk-reward approach. Its trailing stop system locks in profits while conservative signal settings help avoid false entries.

Trading Style: Swing Trading

Trading Mode: Conservative

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 200

Take Profit: 850

Trailing Start: 270

Trailing Step: 30

Bullish Signals: 7

Bearish Signals: 12

5. Quantum Impulse Vector

A precise setting for trading the SPX500, blending calculated risk with tight control over drawdowns. This configuration is designed to seize profitable opportunities in a trending market while minimizing losses through conservative stop and trailing parameters.

Trading Style: Day Trading

Trading Mode: Aggressive

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 140

Take Profit: 120

Trailing Start: 60

Trailing Step: 30

Bullish Signals: 11

Bearish Signals: 6

6. Lunar Flux Horizon

Tailored for weekly trading on AUDCHF, this strategy captures long-term market shifts with a focus on steady growth. With conservative signals and well-calibrated trailing stops, it seeks to maximize gains from prolonged trends while managing risk effectively.

Trading Style: Long-Term Investing

Trading Mode: Conservative

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 950

Take Profit: 1940

Trailing Start: 420

Trailing Step: 30

Bullish Signals: 3

Bearish Signals: 3

7. Nebula Ether Ascend

Optimized for ETHUSD, this strategy leverages large stop and take profit distances to capture significant market trends. Ideal for long-term investors looking to balance bullish momentum signals with disciplined risk management, aiming for gradual capital appreciation.

Trading Style: Swing Trading

Trading Mode: Moderate

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 5000

Take Profit: 16000

Trailing Start: 7000

Trailing Step: 6000

Bullish Signals: 7

Bearish Signals: 5

8. Nebulae Trade Pulse

Geared for H8 trading on AUDNZD, this setting focuses on rapid long entries with a high bullish sensitivity. With its robust trailing stop mechanism and moderate take profit, it’s ideal for traders looking to capitalize on swift, directional market moves.

Trading Style: Long-Term Investing

Trading Mode: Aggressive

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 400

Take Profit: 260

Trailing Start: 170

Trailing Step: 40

Bullish Signals: 13

Bearish Signals: 3

9. Aurora Swiss Momentum

Configured for H8 trading on CADCHF, this strategy capitalizes on medium-term volatility with a balanced risk-reward ratio. A solid trailing stop approach ensures that profits are protected as the trade moves favorably, making it suitable for active traders in dynamic markets.

Trading Style: Long-Term Investing

Trading Mode: Aggressive

Lots: 0

Risk: 5.5%

Max Orders: 5

Stop Loss: 840

Take Profit: 640

Trailing Start: 100

Trailing Step: 30

Bullish Signals: 3

Bearish Signals: 10

10. Cosmic Yen Vector

Designed for daily trading on EURJPY, this setting captures large market swings with higher risk tolerance. A strong focus on long-term momentum, combined with precise stop and trailing systems, makes it ideal for traders seeking larger moves in trending markets.

Trading Style: Swing Trading

Trading Mode: Conservative

Lots: 0

Risk: 6.5%

Max Orders: 4

Stop Loss: 2900

Take Profit: 3900

Trailing Start: 200

Trailing Step: 120

Bullish Signals: 3

Bearish Signals: 3

Thanks for reading it.

Disclaimer: This is not financial advice. Trading involves risks, and past performance is not indicative of future results. Always trade responsibly.

Attachments

-

Cosmic Yen Vector-EURJPY-1D.zip74.9 KB · Views: 22

-

Aurora Swiss Momentum-CADCHF-H8.zip86.7 KB · Views: 17

-

Nebulae Trade Pulse-AUDNZD-H8.zip106.5 KB · Views: 14

-

Nebula Ether Ascend-ETHUSD-H12.zip77.5 KB · Views: 15

-

Lunar Flux Horizon-AUDCHF-1W.zip65.7 KB · Views: 16

-

Quantum Impulse Vector-SPX500-M15.zip71.3 KB · Views: 14

-

Solar Pivot Surge-EURAUD-H4.zip56 KB · Views: 14

-

Galactic Euro Thrust-EURUSD-M1.zip95 KB · Views: 16

-

Stellar Wave Pulsar-XAGUSD-H4.zip93.9 KB · Views: 19

-

Celestial Momentum Surge-NAS100-M5.zip98.7 KB · Views: 18

Ok, thanks, I' change them all to Lot 0.01 and H1. I used the shorter time frames because that was what was given on the Performance page.Hey Noah,

I don't know your account size, I would use $1000 per currency pair and I would use only 0.01 lot. For every $1000 more i can add one more currency pair with 0.01 lot. Now, coming to the adjustment part I see you are trading M1 and M5 timeframes a lot, these timeframes change way too much and way too fast so my suggestion is to test a mix of timeframes on an account prefer higher timeframes like M30 and H1 for ensuring small gains but steady.

I used the shorter time frames because that is what is given on the Performance page. Can I use those settings for any time frame? Does the same go for all the settings? I thought the time frame was coordinated with the other settings. I cannot make the other adjustments myself, if that is what is necessary. Why are the time frames included at all, then, if you can use the same settings with different time frames?Hey Noah,

I don't know your account size, I would use $1000 per currency pair and I would use only 0.01 lot. For every $1000 more i can add one more currency pair with 0.01 lot. Now, coming to the adjustment part I see you are trading M1 and M5 timeframes a lot, these timeframes change way too much and way too fast so my suggestion is to test a mix of timeframes on an account prefer higher timeframes like M30 and H1 for ensuring small gains but steady.

Ok, thanks, I' change them all to Lot 0.01 and H1. I used the shorter time frames because that was what was given on the Performance page.

I used the shorter time frames because that is what is given on the Performance page. Can I use those settings for any time frame? Does the same go for all the settings? I thought the time frame was coordinated with the other settings. I cannot make the other adjustments myself, if that is what is necessary. Why are the time frames included at all, then, if you can use the same settings with different time frames?

Sanchay, I think I misunderstood you. You meant to look for bots that use longer time frames, not to just change the time frame of a particular bot, right? I guess the settings of a bot are all made for a particular time frame that should not be changed. I hope I now have that right. I am now using the settings you just described, which include a mix of time frames.

What do you suggest doing with bots that, say, at the end of a week, do not make a profit?

What do you suggest doing with bots that, say, at the end of a week, do not make a profit?

Disclaimer: This is not financial advice. Trading involves risks, and past performance is not indicative of future results. Always trade responsibly.

Hey Noah,

Yes understood it correctly now. Each setting provided in weekly performance reports has performed well because of the timeframe used. Each timeframe can have different setting because of the change in the information.

In my opinion the settings need to be changed quite frequently of the GalileoFX EA. I do this to ensure I use the settings adjusted to the market condition, since markets are always evolving we need to adjust accordingly. There is no one stop solution when it comes to financial markets. How do i keep myself updated:

I hope I could help you. Please go through this thread again if you still have some doubts. Trading involves risk so trade responsibly.

Thanks

Hey Noah,

Yes understood it correctly now. Each setting provided in weekly performance reports has performed well because of the timeframe used. Each timeframe can have different setting because of the change in the information.

In my opinion the settings need to be changed quite frequently of the GalileoFX EA. I do this to ensure I use the settings adjusted to the market condition, since markets are always evolving we need to adjust accordingly. There is no one stop solution when it comes to financial markets. How do i keep myself updated:

- Checking performance page and the thread every week to see if I have the settings that meet my trading goals.

- Then I would download if I want to experiment on something and will check the drawdown to understand how much is expected profit and how much can i lose.

- I would check these settings on the demo account by using these in same time and with same leverage, I usually trade.

- I will ensure that I use mix timeframes because a frequent generating signal is not necessarily correct one but it can be because market is volatile

- To tackle this i will use higher timeframe setting so even if there is volatility i will lose less

- If the settings are not performing continuously for more than two weeks I will change it with a more updated setting

- If there are high number of trades in a small timeframe that might mean that market is sideways and I can lose here, so I will refrain myself and just take a break

- I will wait until the asset I am trading recovers from sideways zone or I will simply trade a different asset if it suits my trading comfort.

I hope I could help you. Please go through this thread again if you still have some doubts. Trading involves risk so trade responsibly.

Thanks

Hey Noah,

There can be many reasons for this try updating metatrader 5. Help > Check for updates

Also, I recommend you to use our support email: support@galileofx.com

There can be many reasons for this try updating metatrader 5. Help > Check for updates

Also, I recommend you to use our support email: support@galileofx.com

I have the latest release version, and I am trying to get some answers from support but so far without success.Hey Noah,

There can be many reasons for this try updating metatrader 5. Help > Check for updates

Also, I recommend you to use our support email: support@galileofx.com

Okay got it.I have the latest release version, and I am trying to get some answers from support but so far without success.

Noah, please provide the screenshot of Settings tab

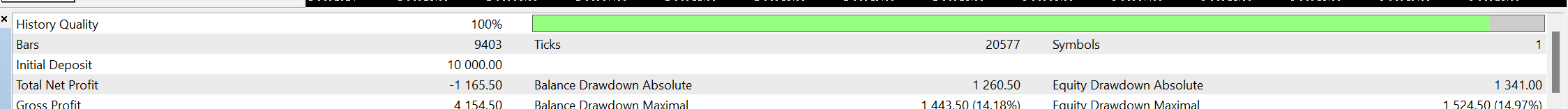

Hi, the back test with the above settings on cable retuned a loss of 1165, is it possible to ask the algo to just trade long or just trade short signals if the W1 or MN trend is obviously bullish or bearish?This thread is created for sharing the updated settings on a weekly basis for different instruments across different time-frames and different time periods. These settings will also be categorized into conservative, moderate and aggressive for different types of trading styles (Day Trading, Swing Trading and Long Term Investing).

Past 12 months performance for XAU/USD (M30) with $10000 on Conservative mode with Day Trading style:

Lots: 0

Risk (in %): 4.5

Max Orders: 3

Stop Loss in points: 1000

Take Profit in points: 270

Trailing Start in points: 200

Trailing Step in points: 100

Consecutive Bullish Signals: 8

Consecutive Bearish Signals: 10

Attachment Name: XAUUSD-M30.zip

Past 12 months performance for USD/CAD (M5) with $10000 on Moderate mode with Day Trading style:

Lots: 0

Risk (in %): 4.5

Max Orders: 4

Stop Loss in points: 180

Take Profit in points: 190

Trailing Start in points: 120

Trailing Step in points: 30

Consecutive Bullish Signals: 12

Consecutive Bearish Signals: 12

Attachment Name: USDCAD-M5.zip

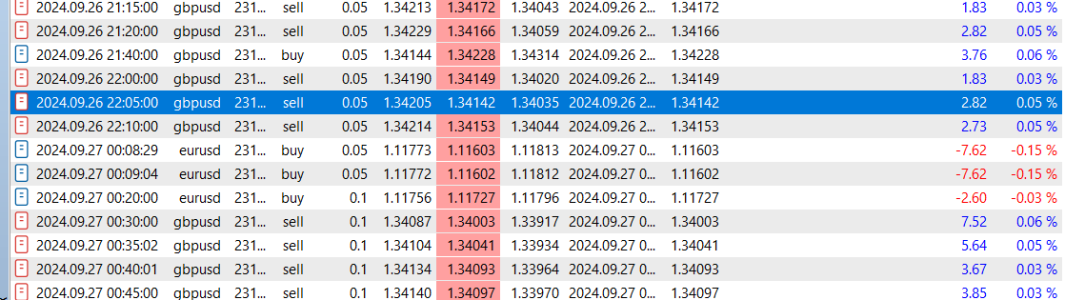

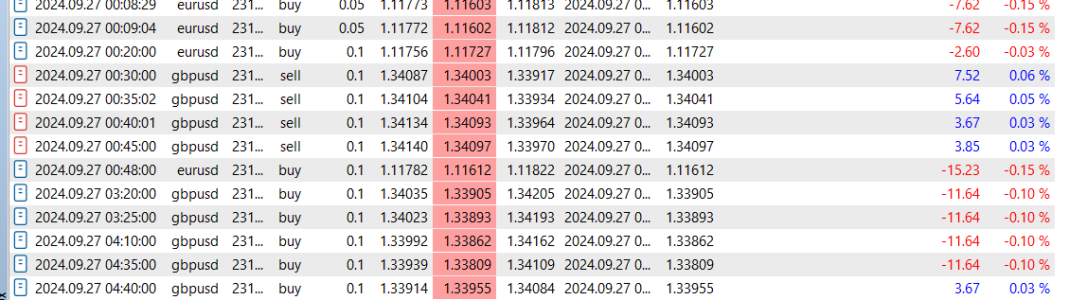

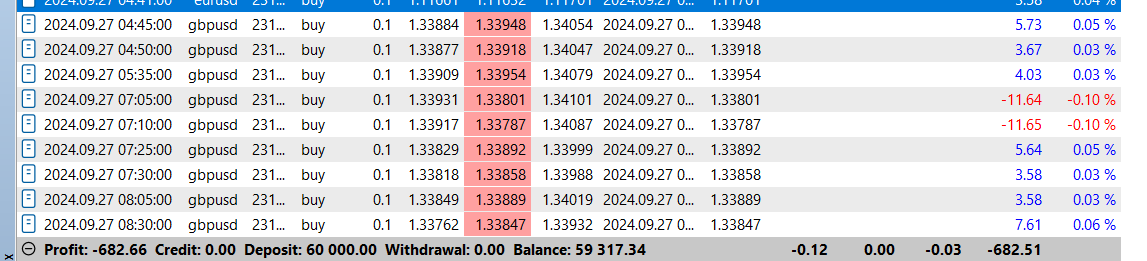

Past 12 months performance for GBP/USD with $10000 on Aggressive mode with Day Trading style:

Lots: 0

Risk (in %): 3.5

Max Orders: 3

Stop Loss in points: 190

Take Profit in points: 190

Trailing Start in points: 130

Trailing Step in points: 60

Consecutive Bullish Signals: 7

Consecutive Bearish Signals: 10

Attachment Name: GBPUSD-M30.zip

Past 12 months performance for NAS100 with $10000 on Moderate mode with Day Trading style:

Lots: 0

Risk (in %): 4.5

Max Orders: 4

Stop Loss in points: 1260

Take Profit in points: 420

Trailing Start in points: 360

Trailing Step in points: 220

Consecutive Bullish Signals: 9

Consecutive Bearish Signals: 10

Attachment Name: NAS100-M15.zip

Please note that past performance do not guarantee future performance.

-Sanchay Kasturey

Hi, the back test with the above settings on cable retuned a loss of 1165, is it possible to ask the algo to just trade long or just trade short signals if the W1 or MN trend is obviously bullish or bearish?

Attachments

Similar threads

- Replies

- 13

- Views

- 541

- Replies

- 11

- Views

- 750

- Replies

- 11

- Views

- 682

- Locked

- Sticky

- Replies

- 0

- Views

- 541