Hello Sanchay, Thanks for providing this information. I am fairly new to Galileo, and have been experimenting and back testing it with demo accounts with both Forex and Ox over the last month. Although I am testing with the exact settings you are providing, the results are nowhere near as optimistic as the results you are publishing. Do you have any idea why my results are so wildly different?

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Extra Galileo FX Settings: Conservative, Moderate & Aggressive

- Thread starter Sanchay

- Start date

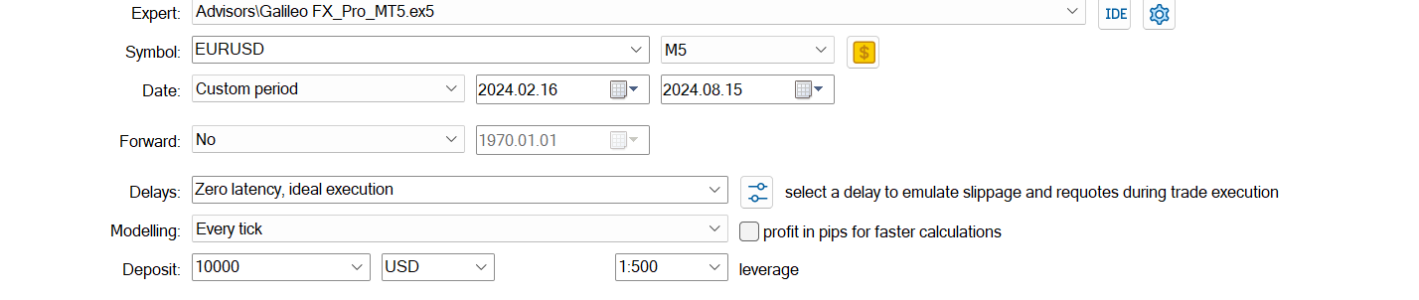

Hi tw3120, I understand your problem please use modeling as 'Every tick' or 'Every tick based on real ticks'. I hope you will be able to reproduce similar results. However, broker data may differ a bit and that may result in somewhat different result but the end result should be similar.Hello Sanchay, Thanks for providing this information. I am fairly new to Galileo, and have been experimenting and back testing it with demo accounts with both Forex and Ox over the last month. Although I am testing with the exact settings you are providing, the results are nowhere near as optimistic as the results you are publishing. Do you have any idea why my results are so wildly different?

Have a profitable trading journey with Galileo FX.

-Sanchay Kasturey

@Sanchay, Thanks for responding. I should have mentioned in my earlier communication that I had tested with 'Every Tick' setting, and my results are still off by an order of magnitude less than your posted results. I have back tested using both Forex and Ox, and both provide similar results. I am struggling to understand how my results can be so different than yours when I use the settings you provide. Can someone else monitoring this thread and using Forex or Ox back test using your settings and provide their results?

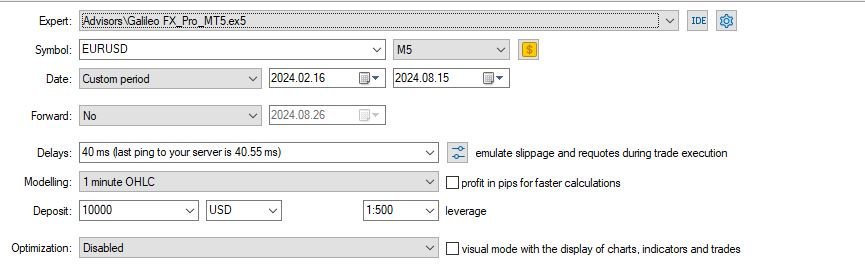

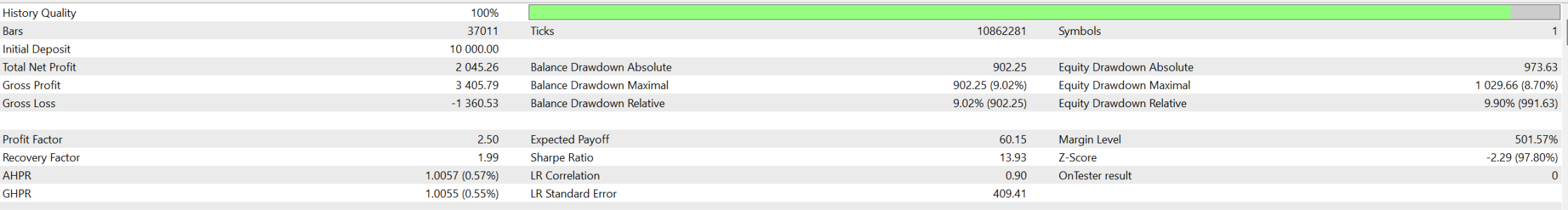

Hey I backtested again, kindly recheck the screenshots attached. Thanks.Hello Sanchay, Thanks for providing this information. I am fairly new to Galileo, and have been experimenting and back testing it with demo accounts with both Forex and Ox over the last month. Although I am testing with the exact settings you are providing, the results are nowhere near as optimistic as the results you are publishing. Do you have any idea why my results are so wildly different?

@Sanchay, Thanks for responding. I should have mentioned in my earlier communication that I had tested with 'Every Tick' setting, and my results are still off by an order of magnitude less than your posted results. I have back tested using both Forex and Ox, and both provide similar results. I am struggling to understand how my results can be so different than yours when I use the settings you provide. Can someone else monitoring this thread and using Forex or Ox back test using your settings and provide their results?

Attachments

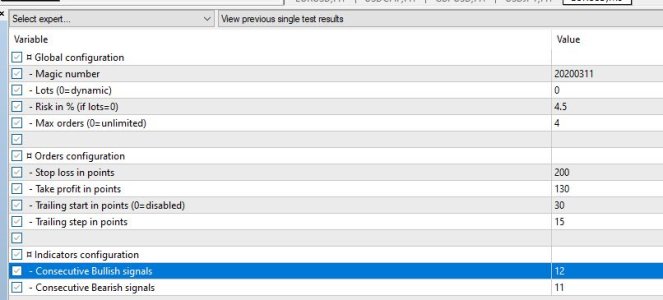

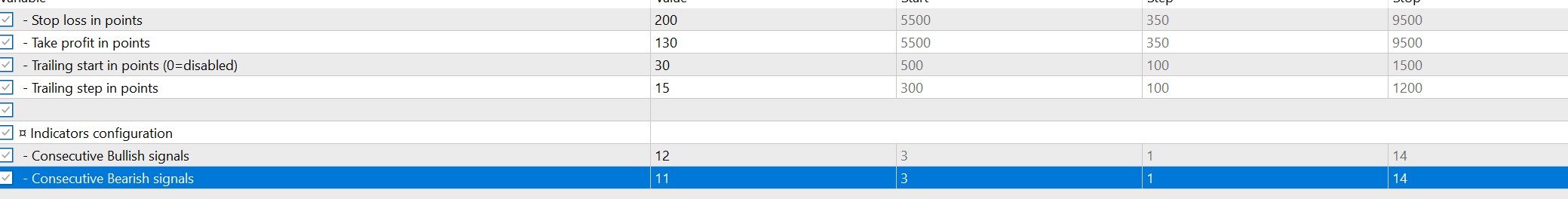

This week's updated settings back-tested with wide range of parameters:

1. Name: Steady Orbit Sync

Description: This configuration is designed for moderate traders aiming for stable growth. Utilizing a balanced risk profile with trailing stop strategies, it ensures controlled exposure while seeking consistent returns in trending markets. Optimized for longer holding periods with AUD/USD, it smoothly navigates the volatility waves while maintaining a focus on risk management.

Trading Style: Long Term Investing

Trading Mode: Conservative

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 510

Take Profit: 990

Trailing Profit: 250

Trailing Stop: 150

Bullish Signals: 3

Bearish Signals: 3

2. Name: Eclipse Trend Voyager

Description: Optimized for the EUR/GBP pair on the daily timeframe, this strategy focuses on capturing medium to long-term trends with a balanced approach. Using a conservative stop-loss and a carefully calibrated trailing stop, it’s designed to minimize drawdown while still allowing for substantial profit targets. Ideal for traders who prefer steady growth with a lower risk profile.

Trading Style: Long Term Investing

Trading Mode: Conservative

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 340

Take Profit: 500

Trailing Profit: 180

Trailing Stop: 50

Bullish Signals: 3

Bearish Signals: 7

3. Name: Equinox Trend Rider

Description: This strategy is crafted for the EUR/USD pair on the daily timeframe, aiming to capture sustained market trends with a focus on risk management. By employing balanced stop-loss and take-profit levels alongside a moderate trailing stop, it seeks to achieve steady gains while keeping drawdowns in check. Suitable for traders who prefer a balanced approach between risk and reward over longer periods.

Trading Style: Long Term Investing

Trading Mode: Conservative

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 1750

Take Profit: 1800

Trailing Profit: 380

Trailing Stop: 100

Bullish Signals: 3

Bearish Signals: 3

4. Name: Celestial Trend Navigator

Description: Tailored for the EUR/USD pair on the weekly timeframe, this strategy is built to capture long-term market trends with a focus on stability. Using wide stop-loss and take-profit levels along with a cautious trailing stop, this setup minimizes drawdowns while aiming to steadily accumulate profits over extended periods. Ideal for traders who prefer a methodical, low-risk approach.

Trading Style: Long-Term Investing

Trading Mode: Conservative

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 1750

Take Profit: 2150

Trailing Profit: 420

Trailing Stop: 100

Bullish Signals: 3

Bearish Signals: 3

5. Name: Dynamic Pulsar Shift

Description: Designed for the seasoned trader navigating high-volatility markets, this setup leverages adaptive trailing stops and a balanced risk approach to capture significant price movements. With a focus on EUR/JPY, it seeks to maximize returns in dynamic environments while maintaining robust drawdown control.

Trading Style: Swing Trading

Trading Mode: Moderate

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 1300

Take Profit: 1800

Trailing Profit: 200

Trailing Stop: 240

Bullish Signals: 3

Bearish Signals: 4

6. Name: Nebula Shift Explorer

Description: Designed for the EUR/GBP pair on the H8 timeframe, this strategy focuses on capturing substantial price movements with a mix of conservative entry signals and aggressive profit targets. The setup leverages an extended trailing stop mechanism to lock in gains while minimizing risk. Ideal for traders seeking to balance high returns with moderate drawdowns in a multi-session trading environment.

Trading Style: Swing Trading

Trading Mode: Aggressive

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 340

Take Profit: 500

Trailing Profit: 180

Trailing Stop: 50

Bullish Signals: 3

Bearish Signals: 7

7. Name: Stellar Equilibrium Drift

Description: Crafted for stability in the EUR/GBP market on the H4 timeframe, this strategy seeks to maintain a delicate balance between bullish and bearish signals. Utilizing precise stop-loss and trailing techniques, it’s designed to capture gradual movements with minimal drawdown, ideal for traders aiming for consistent performance with low risk.

Trading Style: Swing Trading

Trading Mode: Conservative

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 600

Take Profit: 120

Trailing Profit: 90

Trailing Stop: 50

Bullish Signals: 6

Bearish Signals: 8

8. Name: Turbo Nova Burst

Description: A high-frequency trading strategy designed for fast-paced XAU/USD markets. This setup is geared toward capturing rapid price movements with minimal lag, using tight trailing stops and a responsive signal configuration. Ideal for traders seeking aggressive entry and exit points on the M5 timeframe, balancing between high potential rewards and significant drawdowns.

Trading Style: Day Trading

Trading Mode: Aggressive

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 510

Take Profit: 290

Trailing Profit: 50

Trailing Stop: 10

Bullish Signals: 10

Bearish Signals: 3

9. Name: Pulsar Momentum Shift

Description: This setup is tailored for trading the EUR/CHF pair on the M30 timeframe, with a focus on capturing quick market shifts through a balanced combination of bullish and bearish signals. The strategy leverages moderate trailing stops and precise take-profit targets, aiming to strike a balance between consistent gains and manageable drawdowns.

Trading Style: Day Trading

Trading Mode: Moderate

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 130

Take Profit: 150

Trailing Profit: 70

Trailing Stop: 30

Bullish Signals: 9

Bearish Signals: 8

10. Name: Quasar Velocity Strike

Description: Optimized for fast-moving XAU/USD markets on the M15 timeframe, this strategy aims to capture sharp price movements with quick entries and exits. Using tight trailing stops and an aggressive signal configuration, it balances moderate drawdowns with the potential for steady profits. Perfect for traders who thrive in high-energy trading environments.

Trading Style: Day Trading

Trading Mode: Moderate

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 510

Take Profit: 290

Trailing Profit: 50

Trailing Stop: 10

Bullish Signals: 10

Bearish Signals: 3

Thanks for reading it.

Disclaimer: This is not financial advice. Trading involves risks, and past performance is not indicative of future results. Always trade responsibly.

1. Name: Steady Orbit Sync

Description: This configuration is designed for moderate traders aiming for stable growth. Utilizing a balanced risk profile with trailing stop strategies, it ensures controlled exposure while seeking consistent returns in trending markets. Optimized for longer holding periods with AUD/USD, it smoothly navigates the volatility waves while maintaining a focus on risk management.

Trading Style: Long Term Investing

Trading Mode: Conservative

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 510

Take Profit: 990

Trailing Profit: 250

Trailing Stop: 150

Bullish Signals: 3

Bearish Signals: 3

2. Name: Eclipse Trend Voyager

Description: Optimized for the EUR/GBP pair on the daily timeframe, this strategy focuses on capturing medium to long-term trends with a balanced approach. Using a conservative stop-loss and a carefully calibrated trailing stop, it’s designed to minimize drawdown while still allowing for substantial profit targets. Ideal for traders who prefer steady growth with a lower risk profile.

Trading Style: Long Term Investing

Trading Mode: Conservative

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 340

Take Profit: 500

Trailing Profit: 180

Trailing Stop: 50

Bullish Signals: 3

Bearish Signals: 7

3. Name: Equinox Trend Rider

Description: This strategy is crafted for the EUR/USD pair on the daily timeframe, aiming to capture sustained market trends with a focus on risk management. By employing balanced stop-loss and take-profit levels alongside a moderate trailing stop, it seeks to achieve steady gains while keeping drawdowns in check. Suitable for traders who prefer a balanced approach between risk and reward over longer periods.

Trading Style: Long Term Investing

Trading Mode: Conservative

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 1750

Take Profit: 1800

Trailing Profit: 380

Trailing Stop: 100

Bullish Signals: 3

Bearish Signals: 3

4. Name: Celestial Trend Navigator

Description: Tailored for the EUR/USD pair on the weekly timeframe, this strategy is built to capture long-term market trends with a focus on stability. Using wide stop-loss and take-profit levels along with a cautious trailing stop, this setup minimizes drawdowns while aiming to steadily accumulate profits over extended periods. Ideal for traders who prefer a methodical, low-risk approach.

Trading Style: Long-Term Investing

Trading Mode: Conservative

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 1750

Take Profit: 2150

Trailing Profit: 420

Trailing Stop: 100

Bullish Signals: 3

Bearish Signals: 3

5. Name: Dynamic Pulsar Shift

Description: Designed for the seasoned trader navigating high-volatility markets, this setup leverages adaptive trailing stops and a balanced risk approach to capture significant price movements. With a focus on EUR/JPY, it seeks to maximize returns in dynamic environments while maintaining robust drawdown control.

Trading Style: Swing Trading

Trading Mode: Moderate

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 1300

Take Profit: 1800

Trailing Profit: 200

Trailing Stop: 240

Bullish Signals: 3

Bearish Signals: 4

6. Name: Nebula Shift Explorer

Description: Designed for the EUR/GBP pair on the H8 timeframe, this strategy focuses on capturing substantial price movements with a mix of conservative entry signals and aggressive profit targets. The setup leverages an extended trailing stop mechanism to lock in gains while minimizing risk. Ideal for traders seeking to balance high returns with moderate drawdowns in a multi-session trading environment.

Trading Style: Swing Trading

Trading Mode: Aggressive

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 340

Take Profit: 500

Trailing Profit: 180

Trailing Stop: 50

Bullish Signals: 3

Bearish Signals: 7

7. Name: Stellar Equilibrium Drift

Description: Crafted for stability in the EUR/GBP market on the H4 timeframe, this strategy seeks to maintain a delicate balance between bullish and bearish signals. Utilizing precise stop-loss and trailing techniques, it’s designed to capture gradual movements with minimal drawdown, ideal for traders aiming for consistent performance with low risk.

Trading Style: Swing Trading

Trading Mode: Conservative

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 600

Take Profit: 120

Trailing Profit: 90

Trailing Stop: 50

Bullish Signals: 6

Bearish Signals: 8

8. Name: Turbo Nova Burst

Description: A high-frequency trading strategy designed for fast-paced XAU/USD markets. This setup is geared toward capturing rapid price movements with minimal lag, using tight trailing stops and a responsive signal configuration. Ideal for traders seeking aggressive entry and exit points on the M5 timeframe, balancing between high potential rewards and significant drawdowns.

Trading Style: Day Trading

Trading Mode: Aggressive

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 510

Take Profit: 290

Trailing Profit: 50

Trailing Stop: 10

Bullish Signals: 10

Bearish Signals: 3

9. Name: Pulsar Momentum Shift

Description: This setup is tailored for trading the EUR/CHF pair on the M30 timeframe, with a focus on capturing quick market shifts through a balanced combination of bullish and bearish signals. The strategy leverages moderate trailing stops and precise take-profit targets, aiming to strike a balance between consistent gains and manageable drawdowns.

Trading Style: Day Trading

Trading Mode: Moderate

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 130

Take Profit: 150

Trailing Profit: 70

Trailing Stop: 30

Bullish Signals: 9

Bearish Signals: 8

10. Name: Quasar Velocity Strike

Description: Optimized for fast-moving XAU/USD markets on the M15 timeframe, this strategy aims to capture sharp price movements with quick entries and exits. Using tight trailing stops and an aggressive signal configuration, it balances moderate drawdowns with the potential for steady profits. Perfect for traders who thrive in high-energy trading environments.

Trading Style: Day Trading

Trading Mode: Moderate

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 510

Take Profit: 290

Trailing Profit: 50

Trailing Stop: 10

Bullish Signals: 10

Bearish Signals: 3

Thanks for reading it.

Disclaimer: This is not financial advice. Trading involves risks, and past performance is not indicative of future results. Always trade responsibly.

Attachments

-

Quasar Velocity Strike-XAUUSD-M15.zip92.3 KB · Views: 28

-

Pulsar Momentum Shift-EURCHF-M30.zip76.6 KB · Views: 24

-

Turbo Nova Burst-XAUUSD-M5.zip202.5 KB · Views: 31

-

Stellar Equilibrium Drift-EURGBP-H4.zip73.1 KB · Views: 18

-

Nebula Shift Explore-EURGBP-H8.zip110.2 KB · Views: 20

-

Dynamic Pulsar Shift-EURJPY-1D.zip88.2 KB · Views: 19

-

Celestial Trend Navigator-EURUSD-1W.zip59.5 KB · Views: 22

-

Equinox Trend Rider-EURUSD-1D.zip78.7 KB · Views: 28

-

Eclipse Trend Voyager-EURGBP-1D.zip75.5 KB · Views: 20

-

Orbit Sync-AUDUSD-1W.zip71.1 KB · Views: 24

This week's updated settings back-tested and optimized with wide range of parameters:

1. Steady Momentum Orion

This setting prioritizes steady market movements with tight stop-loss and take-profit parameters, aiming for consistent gains through controlled risk management. The configuration uses a calculated balance of bullish and bearish signals to capitalize on directional trends while minimizing exposure.

Trading Style: Long Term Investing

Trading Mode: Aggressive

Lots: 0

Risk: 5.5%

Max Orders: 4

Stop Loss: 198,715

Take Profit: 279,440

Trailing Start: 70,000

Trailing Step: 55,000

Bullish Signals: 12

Bearish Signals: 3

2. Cautious Signal Nebula

Designed for precision in high-volatility markets, this setup balances conservative risk with responsive entry points, aiming to capture small, steady profits through dynamic trailing stops and careful monitoring of bullish and bearish signals.

Trading Style: Day Trading

Trading Mode: Aggressive

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 150

Take Profit: 190

Trailing Start: 100

Trailing Step: 20

Bullish Signals: 10

Bearish Signals: 13

3. Astro Trend Navigator

Built for longer-term trades, this configuration carefully tracks trends with moderate risk and flexible exits. Strong bullish confirmation and calculated take-profits make it ideal for capitalizing on sustained movements in the AUDCHF pair.

Trading Style: Long-Term Investing

Trading Mode: Moderate

Lots: 0

Risk: 5.5%

Max Orders: 4

Stop Loss: 200

Take Profit: 420

Trailing Start: 160

Trailing Step: 80

Bullish Signals: 12

Bearish Signals: 3

4. Aurora Scalper Matrix

Geared towards short-term price action on XAUUSD, this setup is designed for scalping with a slight bearish bias. With no trailing stop, it focuses on fixed take-profit and stop-loss levels, offering quick exits and disciplined entries based on sharp signal fluctuations.

Trading Style: Day Trading

Trading Mode: Conservative

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 510

Take Profit: 290

Trailing Start: 0

Trailing Step: 0

Bullish Signals: 10

Bearish Signals: 13

5. Stellar Reversal Scout

Ideal for range-bound or reversal strategies, this configuration is set to capture long-term trends with a focus on minimizing false bullish entries while being highly responsive to bearish conditions. The large stop loss and take profit settings allow for wide market swings, suiting long-term positions.

Trading Style: Long-Term Investing

Trading Mode: Moderate

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 560

Take Profit: 930

Trailing Start: 250

Trailing Step: 160

Bullish Signals: 3

Bearish Signals: 6

6. Impulse Vector Surge

This fast-paced M1 strategy is designed for scalping in the EURUSD market, focusing on short-term price swings. High sensitivity to bullish signals and quick trailing stop adjustments make it ideal for capturing rapid movements with minimal exposure to reversals.

Trading Style: Day Trading

Trading Mode: Aggressive

Lots: 0

Risk: 5.5%

Max Orders: 4

Stop Loss: 170

Take Profit: 40

Trailing Start: 10

Trailing Step: 40

Bullish Signals: 13

Bearish Signals: 7

7. Orbital Swing Navigator

Optimized for H4 trading on the AUDCAD pair, this strategy seeks to capture medium-term trends with a higher emphasis on bullish signals. Tight trailing stops provide protection while allowing trades to evolve, aiming for consistent profits in volatile conditions.

Trading Style: Swing Trading

Trading Mode: Aggressive

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 380

Take Profit: 420

Trailing Start: 160

Trailing Step: 40

Bullish Signals: 9

Bearish Signals: 3

8. Stellar Risk Pulse

This strategy thrives on consistent risk management with balanced bullish and bearish signals, making it well-suited for steady market trends.

Trading Style: Day Trading

Trading Mode: Conservative

Lots: 0.0 (Risk-based sizing)

Risk: 4.5%

Max Orders: 4

Stop Loss: 2700

Take Profit: 2700

Trailing Start: 500

Trailing Step: 900

Bullish Signals: 13

Bearish Signals: 7

9. Cosmic Trend Tracker

Tailored for Bitcoin's volatile swings, this setting leverages large trailing stops and balanced entry signals to capture long-term movements. With equal bullish and bearish signals, it is designed for patient traders seeking to ride large-scale trends with minimized drawdown.

Trading Style: Long-Term Investing

Trading Mode: Conservative

Lots: 0

Risk: 5.5%

Max Orders: 5

Stop Loss: 572,050

Take Profit: 460,555

Trailing Start: 175,000

Trailing Step: 50,000

Bullish Signals: 3

Bearish Signals: 3

10. Vigilant Trend Voyager

This setting capitalizes on sustained market trends while balancing risk with dynamic trailing stops. With robust bullish signal strength and timely exits on bearish signals, it is tuned for traders seeking medium-term gains in fast-moving indices like NAS100.

Trading Style: Day Trading

Trading Mode: Agressive

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 200

Take Profit: 350

Trailing Start: 270

Trailing Step: 140

Bullish Signals: 11

Bearish Signals: 5

Thank you for reading through this.

-Sanchay Kasturey

1. Steady Momentum Orion

This setting prioritizes steady market movements with tight stop-loss and take-profit parameters, aiming for consistent gains through controlled risk management. The configuration uses a calculated balance of bullish and bearish signals to capitalize on directional trends while minimizing exposure.

Trading Style: Long Term Investing

Trading Mode: Aggressive

Lots: 0

Risk: 5.5%

Max Orders: 4

Stop Loss: 198,715

Take Profit: 279,440

Trailing Start: 70,000

Trailing Step: 55,000

Bullish Signals: 12

Bearish Signals: 3

2. Cautious Signal Nebula

Designed for precision in high-volatility markets, this setup balances conservative risk with responsive entry points, aiming to capture small, steady profits through dynamic trailing stops and careful monitoring of bullish and bearish signals.

Trading Style: Day Trading

Trading Mode: Aggressive

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 150

Take Profit: 190

Trailing Start: 100

Trailing Step: 20

Bullish Signals: 10

Bearish Signals: 13

3. Astro Trend Navigator

Built for longer-term trades, this configuration carefully tracks trends with moderate risk and flexible exits. Strong bullish confirmation and calculated take-profits make it ideal for capitalizing on sustained movements in the AUDCHF pair.

Trading Style: Long-Term Investing

Trading Mode: Moderate

Lots: 0

Risk: 5.5%

Max Orders: 4

Stop Loss: 200

Take Profit: 420

Trailing Start: 160

Trailing Step: 80

Bullish Signals: 12

Bearish Signals: 3

4. Aurora Scalper Matrix

Geared towards short-term price action on XAUUSD, this setup is designed for scalping with a slight bearish bias. With no trailing stop, it focuses on fixed take-profit and stop-loss levels, offering quick exits and disciplined entries based on sharp signal fluctuations.

Trading Style: Day Trading

Trading Mode: Conservative

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 510

Take Profit: 290

Trailing Start: 0

Trailing Step: 0

Bullish Signals: 10

Bearish Signals: 13

5. Stellar Reversal Scout

Ideal for range-bound or reversal strategies, this configuration is set to capture long-term trends with a focus on minimizing false bullish entries while being highly responsive to bearish conditions. The large stop loss and take profit settings allow for wide market swings, suiting long-term positions.

Trading Style: Long-Term Investing

Trading Mode: Moderate

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 560

Take Profit: 930

Trailing Start: 250

Trailing Step: 160

Bullish Signals: 3

Bearish Signals: 6

6. Impulse Vector Surge

This fast-paced M1 strategy is designed for scalping in the EURUSD market, focusing on short-term price swings. High sensitivity to bullish signals and quick trailing stop adjustments make it ideal for capturing rapid movements with minimal exposure to reversals.

Trading Style: Day Trading

Trading Mode: Aggressive

Lots: 0

Risk: 5.5%

Max Orders: 4

Stop Loss: 170

Take Profit: 40

Trailing Start: 10

Trailing Step: 40

Bullish Signals: 13

Bearish Signals: 7

7. Orbital Swing Navigator

Optimized for H4 trading on the AUDCAD pair, this strategy seeks to capture medium-term trends with a higher emphasis on bullish signals. Tight trailing stops provide protection while allowing trades to evolve, aiming for consistent profits in volatile conditions.

Trading Style: Swing Trading

Trading Mode: Aggressive

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 380

Take Profit: 420

Trailing Start: 160

Trailing Step: 40

Bullish Signals: 9

Bearish Signals: 3

8. Stellar Risk Pulse

This strategy thrives on consistent risk management with balanced bullish and bearish signals, making it well-suited for steady market trends.

Trading Style: Day Trading

Trading Mode: Conservative

Lots: 0.0 (Risk-based sizing)

Risk: 4.5%

Max Orders: 4

Stop Loss: 2700

Take Profit: 2700

Trailing Start: 500

Trailing Step: 900

Bullish Signals: 13

Bearish Signals: 7

9. Cosmic Trend Tracker

Tailored for Bitcoin's volatile swings, this setting leverages large trailing stops and balanced entry signals to capture long-term movements. With equal bullish and bearish signals, it is designed for patient traders seeking to ride large-scale trends with minimized drawdown.

Trading Style: Long-Term Investing

Trading Mode: Conservative

Lots: 0

Risk: 5.5%

Max Orders: 5

Stop Loss: 572,050

Take Profit: 460,555

Trailing Start: 175,000

Trailing Step: 50,000

Bullish Signals: 3

Bearish Signals: 3

10. Vigilant Trend Voyager

This setting capitalizes on sustained market trends while balancing risk with dynamic trailing stops. With robust bullish signal strength and timely exits on bearish signals, it is tuned for traders seeking medium-term gains in fast-moving indices like NAS100.

Trading Style: Day Trading

Trading Mode: Agressive

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 200

Take Profit: 350

Trailing Start: 270

Trailing Step: 140

Bullish Signals: 11

Bearish Signals: 5

Thank you for reading through this.

-Sanchay Kasturey

Attachments

-

Orbital Swing Navigator-AUDCAD-H4.zip125.9 KB · Views: 14

-

Stellar Risk Pulse-ETHUSD-H1.zip63 KB · Views: 11

-

Cosmic Trend Tracker-BTCUSD-1W.zip60.2 KB · Views: 14

-

Vigilant Trend Voyager-NAS100-M15.zip117.1 KB · Views: 15

-

Impulse Vector Surge-EURUSD-M1.zip140.7 KB · Views: 15

-

Stellar Reversal Scout-EURCHF-1D.zip87.5 KB · Views: 11

-

Aurora Scalper Matrix-XAUUSD-M15.zip67.2 KB · Views: 16

-

Astro Trend Navigator-AUDCHF-D1.zip79.9 KB · Views: 11

-

Cautious Signal Nebula-XAUUSD-M1.zip78.3 KB · Views: 19

-

Steady Momentum Orion-BTCUSD-H8.zip103.6 KB · Views: 14

This week's updated settings:

1. Galactic Trend Pursuit

Designed for the volatile GBPJPY pair, this long-term strategy captures large market swings with wide take profit and stop-loss levels. It favors bullish signals, allowing for sustained trend-following while maintaining risk through trailing stops.

Trading Style: Swing Trading

Trading Mode: Conservative

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 900

Take Profit: 3,250

Trailing Start: 300

Trailing Step: 500

Bullish Signals: 13

Bearish Signals: 5

2. Solaris Momentum Pulse

Optimized for long-term trends on SOLUSD, this weekly trading strategy combines large stop losses with wide take-profit targets, aiming to capture significant market moves. Balanced between bullish and bearish signals, it allows flexibility while minimizing drawdown with a dynamic trailing stop.

Trading Style: Long-Term Investing

Trading Mode: Conservative

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 500

Take Profit: 1,450

Trailing Start: 500

Trailing Step: 500

Bullish Signals: 3

Bearish Signals: 3

3. Nebula Shift Dynamics

This H8 strategy is tuned for volatility in the CADCHF market, leaning towards bearish signals with high stop-loss and take-profit values. It is designed to capture both long and short movements, with fixed exits and no trailing stops, making it ideal for significant market shifts.

Trading Style: Swing Trading

Trading Mode: Aggressive

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 910

Take Profit: 710

Trailing Start: 0

Trailing Step: 0

Bullish Signals: 3

Bearish Signals: 7

4. Quantum Scalper Pulse

Built for high-frequency trading on NAS100, this M5 strategy focuses on short-term price movements with a bearish bias. Tight stop-loss and take-profit levels combined with trailing stops provide quick entries and exits, making it ideal for rapid market fluctuations.

Trading Style: Day Trading

Trading Mode: Moderate

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 100

Take Profit: 110

Trailing Start: 85

Trailing Step: 40

Bullish Signals: 6

Bearish Signals: 11

5. Orbital Reversal Scout

This H1 strategy for NZDCAD is designed to capture short-term reversals, focusing heavily on bearish signals. With a combination of tight stop-losses and dynamic trailing stops, it seeks to maximize gains from quick market shifts while managing drawdowns efficiently.

Trading Style: Day Trading

Trading Mode: Aggressive

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 150

Take Profit: 500

Trailing Start: 100

Trailing Step: 40

Bullish Signals: 6

Bearish Signals: 12

6. Galactic Swing Explorer

This weekly AUDCHF strategy is built to capture large market movements with its wide stop-loss and take-profit parameters. Balanced between bullish and bearish signals, it uses trailing stops to lock in gains while managing volatility for long-term trades.

Trading Style: Long-Term Investing

Trading Mode: Conservative

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 1,400

Take Profit: 2,100

Trailing Start: 400

Trailing Step: 250

Bullish Signals: 3

Bearish Signals: 3

7. Crater Shift Navigator

This M30 strategy is built for rapid movements on the AUDCHF pair, with a strong bearish bias. Quick trailing stops and moderate take-profit targets allow it to capture short-term market shifts, while careful risk management minimizes drawdown on volatile price swings.

Trading Style: Day Trading

Trading Mode: Aggressive

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 150

Take Profit: 310

Trailing Start: 110

Trailing Step: 10

Bullish Signals: 6

Bearish Signals: 12

8. Celestial Trend Seeker

Ideal for daily trading on the EURAUD pair, this strategy focuses on capturing long-term trends with wide stop-loss and take-profit targets. With more emphasis on bullish signals, it seeks to ride larger market movements while using trailing stops for protection.

Trading Style: Long-Term Investing

Trading Mode: Moderate

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 700

Take Profit: 1,800

Trailing Start: 500

Trailing Step: 200

Bullish Signals: 5

Bearish Signals: 3

9. Zenith Swing Voyager

Designed for the H4 timeframe, this strategy capitalizes on both bullish and bearish movements in the EURAUD pair. It combines balanced risk management with flexible trailing stops to capture market trends while minimizing drawdowns during high volatility periods.

Trading Style: Swing Trading

Trading Mode: Conservative

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 290

Take Profit: 700

Trailing Start: 180

Trailing Step: 60

Bullish Signals: 7

Bearish Signals: 11

10. Solar Drift Navigator

Optimized for H4 trading on the SOLUSD pair, this strategy emphasizes bearish signals with wide stop-losses and moderate take-profit levels. It uses trailing stops to safeguard profits while allowing the market to move, making it ideal for volatile price swings.

Trading Style: Swing Trading

Trading Mode: Moderate

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 640

Take Profit: 380

Trailing Start: 130

Trailing Step: 30

Bullish Signals: 5

Bearish Signals: 10

1. Galactic Trend Pursuit

Designed for the volatile GBPJPY pair, this long-term strategy captures large market swings with wide take profit and stop-loss levels. It favors bullish signals, allowing for sustained trend-following while maintaining risk through trailing stops.

Trading Style: Swing Trading

Trading Mode: Conservative

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 900

Take Profit: 3,250

Trailing Start: 300

Trailing Step: 500

Bullish Signals: 13

Bearish Signals: 5

2. Solaris Momentum Pulse

Optimized for long-term trends on SOLUSD, this weekly trading strategy combines large stop losses with wide take-profit targets, aiming to capture significant market moves. Balanced between bullish and bearish signals, it allows flexibility while minimizing drawdown with a dynamic trailing stop.

Trading Style: Long-Term Investing

Trading Mode: Conservative

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 500

Take Profit: 1,450

Trailing Start: 500

Trailing Step: 500

Bullish Signals: 3

Bearish Signals: 3

3. Nebula Shift Dynamics

This H8 strategy is tuned for volatility in the CADCHF market, leaning towards bearish signals with high stop-loss and take-profit values. It is designed to capture both long and short movements, with fixed exits and no trailing stops, making it ideal for significant market shifts.

Trading Style: Swing Trading

Trading Mode: Aggressive

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 910

Take Profit: 710

Trailing Start: 0

Trailing Step: 0

Bullish Signals: 3

Bearish Signals: 7

4. Quantum Scalper Pulse

Built for high-frequency trading on NAS100, this M5 strategy focuses on short-term price movements with a bearish bias. Tight stop-loss and take-profit levels combined with trailing stops provide quick entries and exits, making it ideal for rapid market fluctuations.

Trading Style: Day Trading

Trading Mode: Moderate

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 100

Take Profit: 110

Trailing Start: 85

Trailing Step: 40

Bullish Signals: 6

Bearish Signals: 11

5. Orbital Reversal Scout

This H1 strategy for NZDCAD is designed to capture short-term reversals, focusing heavily on bearish signals. With a combination of tight stop-losses and dynamic trailing stops, it seeks to maximize gains from quick market shifts while managing drawdowns efficiently.

Trading Style: Day Trading

Trading Mode: Aggressive

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 150

Take Profit: 500

Trailing Start: 100

Trailing Step: 40

Bullish Signals: 6

Bearish Signals: 12

6. Galactic Swing Explorer

This weekly AUDCHF strategy is built to capture large market movements with its wide stop-loss and take-profit parameters. Balanced between bullish and bearish signals, it uses trailing stops to lock in gains while managing volatility for long-term trades.

Trading Style: Long-Term Investing

Trading Mode: Conservative

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 1,400

Take Profit: 2,100

Trailing Start: 400

Trailing Step: 250

Bullish Signals: 3

Bearish Signals: 3

7. Crater Shift Navigator

This M30 strategy is built for rapid movements on the AUDCHF pair, with a strong bearish bias. Quick trailing stops and moderate take-profit targets allow it to capture short-term market shifts, while careful risk management minimizes drawdown on volatile price swings.

Trading Style: Day Trading

Trading Mode: Aggressive

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 150

Take Profit: 310

Trailing Start: 110

Trailing Step: 10

Bullish Signals: 6

Bearish Signals: 12

8. Celestial Trend Seeker

Ideal for daily trading on the EURAUD pair, this strategy focuses on capturing long-term trends with wide stop-loss and take-profit targets. With more emphasis on bullish signals, it seeks to ride larger market movements while using trailing stops for protection.

Trading Style: Long-Term Investing

Trading Mode: Moderate

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 700

Take Profit: 1,800

Trailing Start: 500

Trailing Step: 200

Bullish Signals: 5

Bearish Signals: 3

9. Zenith Swing Voyager

Designed for the H4 timeframe, this strategy capitalizes on both bullish and bearish movements in the EURAUD pair. It combines balanced risk management with flexible trailing stops to capture market trends while minimizing drawdowns during high volatility periods.

Trading Style: Swing Trading

Trading Mode: Conservative

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 290

Take Profit: 700

Trailing Start: 180

Trailing Step: 60

Bullish Signals: 7

Bearish Signals: 11

10. Solar Drift Navigator

Optimized for H4 trading on the SOLUSD pair, this strategy emphasizes bearish signals with wide stop-losses and moderate take-profit levels. It uses trailing stops to safeguard profits while allowing the market to move, making it ideal for volatile price swings.

Trading Style: Swing Trading

Trading Mode: Moderate

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 640

Take Profit: 380

Trailing Start: 130

Trailing Step: 30

Bullish Signals: 5

Bearish Signals: 10

Attachments

-

Crater Shift Navigator-AUDCHF-M30.zip89.6 KB · Views: 14

-

Celestial Trend Seeker-EURAUD-1D.zip85 KB · Views: 13

-

Zenith Swing Voyager-EURAUD-H4.zip58.5 KB · Views: 12

-

Sola Drift Navigator-SOLUSD-H4.zip84.2 KB · Views: 11

-

Galactic Swing Explorer-AUDCHF-1W.zip66.7 KB · Views: 12

-

Orbital Reversal Scout-NZDCAD-H1.zip73 KB · Views: 12

-

Quantum Scalper Pulse-NAS100-M5.zip62.1 KB · Views: 16

-

Nebula Shift Dynamics-CADCHF-H8.zip80.9 KB · Views: 10

-

Solaris Momentum Pulse-SOLUSD-1W.zip70.2 KB · Views: 13

-

Galactic Trend Pursuit-GBPJPY-1D.zip64.4 KB · Views: 11

Hey everyone, hope you are doing good. Here are the weekly updated winning settings for this week:

1. Cosmic Pivot Breaker

This setting utilizes key reversal levels while integrating dynamic stop-loss and take-profit strategies. Trailing starts are precisely calibrated to follow momentum shifts, making it ideal for catching early trend reversals in volatile markets.

Trading Style: Long Term Investing

Trading Mode: Conservative

Lots: 0.0

Risk: 4.5%

Max Orders: 4

Stop Loss: 2450

Take Profit: 2250

Trailing Start: 600

Trailing Step: 220

Bullish Signals: 3

Bearish Signals: 3

2. Nebula Breakout Surge

This setting capitalizes on breakout strategies with finely tuned stop-loss and take-profit levels, ideal for swing trading in high-volatility conditions. The trailing mechanism locks in gains during sudden price shifts, with balanced bullish and bearish signals to ensure strategic entries and exits.

Trading Style: Swing Trading

Trading Mode: Conservative

Lots: 0.0

Risk: 4.5%

Max Orders: 4

Stop Loss: 900

Take Profit: 2100

Trailing Start: 150

Trailing Step: 160

Bullish Signals: 4

Bearish Signals: 5

3. Lunar Pulse Reversal

Designed for traders seeking to capture swift market reversals, this setting uses a high signal count to confirm trend changes. The narrow stop-loss and take-profit allow for tight control, while a responsive trailing mechanism ensures gains are locked in during quick price movements.

Trading Style: Swing Trading

Trading Mode: Aggressive

Lots: 0.0

Risk: 4.5%

Max Orders: 4

Stop Loss: 120

Take Profit: 730

Trailing Start: 550

Trailing Step: 50

Bullish Signals: 6

Bearish Signals: 4

4. Solar Flare Scalper

This aggressive scalping strategy is optimized for high-frequency trading, leveraging rapid entry and exit points. With high bullish and bearish signal sensitivity, it locks in gains quickly, making it perfect for fast-moving markets. Trailing stops are tight to protect profits on sudden shifts.

Trading Style: Day Trading

Trading Mode: Moderate

Lots: 0.0

Risk: 4.5%

Max Orders: 4

Stop Loss: 300

Take Profit: 300

Trailing Start: 130

Trailing Step: 40

Bullish Signals: 13

Bearish Signals: 12

5. Stellar Swing Precision

Built for precision in volatile markets, this setting targets short to mid-term price reversals with tight stop-loss and take-profit levels. The high bullish and bearish signal thresholds ensure trades are taken only at critical points, enhancing accuracy for swing trading.

Trading Style: Day Trading

Trading Mode: Conservative

Lots: 0.0

Risk: 4.5%

Max Orders: 4

Stop Loss: 130

Take Profit: 160

Trailing Start: 115

Trailing Step: 20

Bullish Signals: 8

Bearish Signals: 12

6. Orbital Momentum Capture

This setting focuses on capturing short-term momentum swings in daily market movements. With high bullish sensitivity and responsive trailing stops, it is designed for consistent performance in fluctuating market conditions, ensuring profits are secured during price surges.

Trading Style: Swing Trading

Trading Mode: Conservative

Lots: 0.0

Risk: 4.5%

Max Orders: 4

Stop Loss: 400

Take Profit: 250

Trailing Start: 300

Trailing Step: 170

Bullish Signals: 13

Bearish Signals: 5

7. Galactic Surge Scalper

This setting is optimized for fast-paced, high-frequency trading. It leverages tight stop-loss and take-profit ratios with a quick trailing strategy, ideal for capturing short-term market shifts. The high bullish signal count ensures trades are only entered on strong trends, while bearish signals remain conservative.

Trading Style: Long Term Investing

Trading Mode: Aggressive

Lots: 0.0

Risk: 4.5%

Max Orders: 4

Stop Loss: 445

Take Profit: 385

Trailing Start: 250

Trailing Step: 40

Bullish Signals: 7

Bearish Signals: 3

8. Quantum Reversal Swing

This setting is designed for longer-term trades, capturing reversals in volatile markets. It uses a higher bearish signal threshold to minimize false breakouts, while trailing stops secure gains during price movements. A well-balanced take-profit and stop-loss setup ensures calculated risk management.

Trading Style: Swing Trading

Trading Mode: Aggressive

Lots: 0.0

Risk: 4.5%

Max Orders: 4

Stop Loss: 225

Take Profit: 375

Trailing Start: 300

Trailing Step: 110

Bullish Signals: 5

Bearish Signals: 12

9. Cosmic Gold Swing

This setting is optimized for medium-term trend-following in the gold market, combining high bullish signal sensitivity with a balanced bearish filter. The wide stop-loss ensures room for gold’s volatile movements, while the trailing stop secures profits during strong trends.

Trading Style: Day Trading

Trading Mode: Aggressive

Lots: 0.0

Risk: 4.5%

Max Orders: 4

Stop Loss: 570

Take Profit: 500

Trailing Start: 300

Trailing Step: 120

Bullish Signals: 10

Bearish Signals: 5

10. Starfall Momentum Snap

A strategy designed for rapid short-term trades, this setting capitalizes on quick market movements using tight stop-loss and take-profit levels. With a high bearish signal threshold, it is optimized for volatile conditions and fast execution, locking in profits on brief momentum shifts.

Trading Style: Day Trading

Trading Mode: Aggressive

Lots: 0.0

Risk: 4.5%

Max Orders: 4

Stop Loss: 100

Take Profit: 110

Trailing Start: 120

Trailing Step: 20

Bullish Signals: 4

Bearish Signals: 13

1. Cosmic Pivot Breaker

This setting utilizes key reversal levels while integrating dynamic stop-loss and take-profit strategies. Trailing starts are precisely calibrated to follow momentum shifts, making it ideal for catching early trend reversals in volatile markets.

Trading Style: Long Term Investing

Trading Mode: Conservative

Lots: 0.0

Risk: 4.5%

Max Orders: 4

Stop Loss: 2450

Take Profit: 2250

Trailing Start: 600

Trailing Step: 220

Bullish Signals: 3

Bearish Signals: 3

2. Nebula Breakout Surge

This setting capitalizes on breakout strategies with finely tuned stop-loss and take-profit levels, ideal for swing trading in high-volatility conditions. The trailing mechanism locks in gains during sudden price shifts, with balanced bullish and bearish signals to ensure strategic entries and exits.

Trading Style: Swing Trading

Trading Mode: Conservative

Lots: 0.0

Risk: 4.5%

Max Orders: 4

Stop Loss: 900

Take Profit: 2100

Trailing Start: 150

Trailing Step: 160

Bullish Signals: 4

Bearish Signals: 5

3. Lunar Pulse Reversal

Designed for traders seeking to capture swift market reversals, this setting uses a high signal count to confirm trend changes. The narrow stop-loss and take-profit allow for tight control, while a responsive trailing mechanism ensures gains are locked in during quick price movements.

Trading Style: Swing Trading

Trading Mode: Aggressive

Lots: 0.0

Risk: 4.5%

Max Orders: 4

Stop Loss: 120

Take Profit: 730

Trailing Start: 550

Trailing Step: 50

Bullish Signals: 6

Bearish Signals: 4

4. Solar Flare Scalper

This aggressive scalping strategy is optimized for high-frequency trading, leveraging rapid entry and exit points. With high bullish and bearish signal sensitivity, it locks in gains quickly, making it perfect for fast-moving markets. Trailing stops are tight to protect profits on sudden shifts.

Trading Style: Day Trading

Trading Mode: Moderate

Lots: 0.0

Risk: 4.5%

Max Orders: 4

Stop Loss: 300

Take Profit: 300

Trailing Start: 130

Trailing Step: 40

Bullish Signals: 13

Bearish Signals: 12

5. Stellar Swing Precision

Built for precision in volatile markets, this setting targets short to mid-term price reversals with tight stop-loss and take-profit levels. The high bullish and bearish signal thresholds ensure trades are taken only at critical points, enhancing accuracy for swing trading.

Trading Style: Day Trading

Trading Mode: Conservative

Lots: 0.0

Risk: 4.5%

Max Orders: 4

Stop Loss: 130

Take Profit: 160

Trailing Start: 115

Trailing Step: 20

Bullish Signals: 8

Bearish Signals: 12

6. Orbital Momentum Capture

This setting focuses on capturing short-term momentum swings in daily market movements. With high bullish sensitivity and responsive trailing stops, it is designed for consistent performance in fluctuating market conditions, ensuring profits are secured during price surges.

Trading Style: Swing Trading

Trading Mode: Conservative

Lots: 0.0

Risk: 4.5%

Max Orders: 4

Stop Loss: 400

Take Profit: 250

Trailing Start: 300

Trailing Step: 170

Bullish Signals: 13

Bearish Signals: 5

7. Galactic Surge Scalper

This setting is optimized for fast-paced, high-frequency trading. It leverages tight stop-loss and take-profit ratios with a quick trailing strategy, ideal for capturing short-term market shifts. The high bullish signal count ensures trades are only entered on strong trends, while bearish signals remain conservative.

Trading Style: Long Term Investing

Trading Mode: Aggressive

Lots: 0.0

Risk: 4.5%

Max Orders: 4

Stop Loss: 445

Take Profit: 385

Trailing Start: 250

Trailing Step: 40

Bullish Signals: 7

Bearish Signals: 3

8. Quantum Reversal Swing

This setting is designed for longer-term trades, capturing reversals in volatile markets. It uses a higher bearish signal threshold to minimize false breakouts, while trailing stops secure gains during price movements. A well-balanced take-profit and stop-loss setup ensures calculated risk management.

Trading Style: Swing Trading

Trading Mode: Aggressive

Lots: 0.0

Risk: 4.5%

Max Orders: 4

Stop Loss: 225

Take Profit: 375

Trailing Start: 300

Trailing Step: 110

Bullish Signals: 5

Bearish Signals: 12

9. Cosmic Gold Swing

This setting is optimized for medium-term trend-following in the gold market, combining high bullish signal sensitivity with a balanced bearish filter. The wide stop-loss ensures room for gold’s volatile movements, while the trailing stop secures profits during strong trends.

Trading Style: Day Trading

Trading Mode: Aggressive

Lots: 0.0

Risk: 4.5%

Max Orders: 4

Stop Loss: 570

Take Profit: 500

Trailing Start: 300

Trailing Step: 120

Bullish Signals: 10

Bearish Signals: 5

10. Starfall Momentum Snap

A strategy designed for rapid short-term trades, this setting capitalizes on quick market movements using tight stop-loss and take-profit levels. With a high bearish signal threshold, it is optimized for volatile conditions and fast execution, locking in profits on brief momentum shifts.

Trading Style: Day Trading

Trading Mode: Aggressive

Lots: 0.0

Risk: 4.5%

Max Orders: 4

Stop Loss: 100

Take Profit: 110

Trailing Start: 120

Trailing Step: 20

Bullish Signals: 4

Bearish Signals: 13

Attachments

-

Cosmic Gold Swing-XAUUSD-M15.zip93.9 KB · Views: 19

-

Quantum Reversal Swing-NZDCHF-H4.zip75.4 KB · Views: 20

-

Galactic Surge Scalper-AUDNZD-H8.zip92.6 KB · Views: 18

-

Orbital Momentum Capture-GBPCHF-D1.zip69.7 KB · Views: 17

-

Stellar Swing Precision-GBPJPY-M3.zip57.9 KB · Views: 18

-

Solar Flare Scalper-NZDUSD-M1.zip93.4 KB · Views: 19

-

Nebula Breakout Surge-EURJPY-H6.zip87.4 KB · Views: 18

-

Lunar Pulse Reversal-GBPAUD-H4.zip78.9 KB · Views: 16

-

Cosmic Pivot Breaker-AUDCAD-W1.zip65 KB · Views: 19

-

Starfall Momentum Snap-GBPUSD-M5.zip115.1 KB · Views: 29

estellings

New member

I am a novice so forgive me but if I am running the pro version, and using those settings, do I need to actually go in and replace them with. these things in order to best set the bot up for trading success? Somehow I was under the impression that I should be in great shape with the default Pro settings for each currency.

Good and important questions above. Please reply! Have a heart for newbies! Surely it is easier for the Galileo team to answer questions here than to reply to emails -- and the chat function doesn't work at all (understandably). Experienced traders could also be generous here and help us beginners out. You would not be giving away any secrets that would undermine your winnings, so why not?

II would also like to know if there is an easier and quicker way to load the settings into MT5. The ones I painstakingly loaded have mysteriously disappeared and I don't know how to get them back except by going through the whole process again.I am a novice so forgive me but if I am running the pro version, and using those settings, do I need to actually go in and replace them with. these things in order to best set the bot up for trading success? Somehow I was under the impression that I should be in great shape with the default Pro settings for each currency.

estellings

New member

Can't you select the "load" file option and pick one of these file folders they have for download in the right currency and it does it for you?II would also like to know if there is an easier and quicker way to load the settings into MT5. The ones I painstakingly loaded have mysteriously disappeared and I don't know how to get them back except by going through the whole process again.

Hey Noah & estellings,

Surely I will help you with all the questions:

For saving any settings:

Disclaimer: This is not financial advice. Trading involves risks, and past performance is not indicative of future results. Always trade responsibly.

I hope I have answered all your questions. Thanks for writing to us.

- Sanchay Kasturey

Surely I will help you with all the questions:

1. These backtested results are reports of the previous history that worked best in context with risk adjusted returns (that tries to get maximum returns with the adequate risk). The reports are made in such a way that suits everyone's trading style as well as the balance requirements, these results vary from past week to past year with different account size and different risk criteria.Sanchay, you posted this yesterday (Sept. ). Is this intended as a recommendation for this coming week or as a report of the past week?

2. These are the results of past performance and are posted here so that everyone can learn how settings can be optimized based on trading style (day trading, swing trading or long term investing) and trading mode (aggressive, conservative or moderate). We do not encourage you to use these settings without your own satisfaction. What you could do is:I am a novice so forgive me but if I am running the pro version, and using those settings, do I need to actually go in and replace them with. these things in order to best set the bot up for trading success? Somehow I was under the impression that I should be in great shape with the default Pro settings for each currency.

- Understand the settings and the testing conditions (account balance, leverage, backtesting period, etc)

- If you like these you can try to backtest them according to how your real trading conditions might be

- Once you are satisfied with the backtesting result deploy the settings on demo account, make sure to modify

the demo account settings as what you will be using in real account (leverage, account balance, your trading time, etc) - Then once you are completely satisfied, based on your understanding you can choose to deploy these settings or not.

3. I am not quite sure what you are referring to the settings that have disappeared, but here is how you can load any setting in MT5 or MT4 also how to save them.II would also like to know if there is an easier and quicker way to load the settings into MT5. The ones I painstakingly loaded have mysteriously disappeared and I don't know how to get them back except by going through the whole process again.

For saving any settings:

- If you are backtesting or optimizing, you can click on Inputs tab (for MT5) in strategy tester (you can get strategy tester by clicking on view and then on strategy tester), for MT 4 you can click on expert properties.

- Right click on inputs tab there will be option of Save (in MT 5); for MT 4 in expert properties there will be button for Save.

- Click on to the save a file explorer dialog box will appear, save in the preferred location and the file will be saved with .set extension.

- NOTE: for metatrader 4 and 5 both the set file will be renamed with .set , but both files are different and are compatible with only their version of metatrader 4 or 5. So, if you are using both 4 and 5 versions of Metatrader, please save the settings in an identifiable way.

- With the same method as explained above you can open the expert properties dialog, for MT 5, right click on inputs tab and select Load.

- File explorer dialog box will appear select the setting you want to use and then click on Open.

- The setting will be applied.

- NOTE: Make sure the correct asset and timeframe is selected.

Disclaimer: This is not financial advice. Trading involves risks, and past performance is not indicative of future results. Always trade responsibly.

I hope I have answered all your questions. Thanks for writing to us.

- Sanchay Kasturey

estellings

New member

Hey everyone, hope you are doing good. Here are the weekly updated winning settings for this week:

1. Cosmic Pivot Breaker

This setting utilizes key reversal levels while integrating dynamic stop-loss and take-profit strategies. Trailing starts are precisely calibrated to follow momentum shifts, making it ideal for catching early trend reversals in volatile markets.

Trading Style: Long Term Investing

Trading Mode: Conservative

Lots: 0.0

Risk: 4.5%

Max Orders: 4

Stop Loss: 2450

Take Profit: 2250

Trailing Start: 600

Trailing Step: 220

Bullish Signals: 3

Bearish Signals: 3

2. Nebula Breakout Surge

This setting capitalizes on breakout strategies with finely tuned stop-loss and take-profit levels, ideal for swing trading in high-volatility conditions. The trailing mechanism locks in gains during sudden price shifts, with balanced bullish and bearish signals to ensure strategic entries and exits.

Trading Style: Swing Trading

Trading Mode: Conservative

Lots: 0.0

Risk: 4.5%

Max Orders: 4

Stop Loss: 900

Take Profit: 2100

Trailing Start: 150

Trailing Step: 160

Bullish Signals: 4

Bearish Signals: 5

3. Lunar Pulse Reversal

Designed for traders seeking to capture swift market reversals, this setting uses a high signal count to confirm trend changes. The narrow stop-loss and take-profit allow for tight control, while a responsive trailing mechanism ensures gains are locked in during quick price movements.

Trading Style: Swing Trading

Trading Mode: Aggressive

Lots: 0.0

Risk: 4.5%

Max Orders: 4

Stop Loss: 120

Take Profit: 730

Trailing Start: 550

Trailing Step: 50

Bullish Signals: 6

Bearish Signals: 4

4. Solar Flare Scalper

This aggressive scalping strategy is optimized for high-frequency trading, leveraging rapid entry and exit points. With high bullish and bearish signal sensitivity, it locks in gains quickly, making it perfect for fast-moving markets. Trailing stops are tight to protect profits on sudden shifts.

Trading Style: Day Trading

Trading Mode: Moderate

Lots: 0.0

Risk: 4.5%

Max Orders: 4

Stop Loss: 300

Take Profit: 300

Trailing Start: 130

Trailing Step: 40

Bullish Signals: 13

Bearish Signals: 12

5. Stellar Swing Precision

Built for precision in volatile markets, this setting targets short to mid-term price reversals with tight stop-loss and take-profit levels. The high bullish and bearish signal thresholds ensure trades are taken only at critical points, enhancing accuracy for swing trading.

Trading Style: Day Trading

Trading Mode: Conservative

Lots: 0.0

Risk: 4.5%

Max Orders: 4

Stop Loss: 130

Take Profit: 160

Trailing Start: 115

Trailing Step: 20

Bullish Signals: 8

Bearish Signals: 12

6. Orbital Momentum Capture

This setting focuses on capturing short-term momentum swings in daily market movements. With high bullish sensitivity and responsive trailing stops, it is designed for consistent performance in fluctuating market conditions, ensuring profits are secured during price surges.

Trading Style: Swing Trading

Trading Mode: Conservative

Lots: 0.0

Risk: 4.5%

Max Orders: 4

Stop Loss: 400

Take Profit: 250

Trailing Start: 300

Trailing Step: 170

Bullish Signals: 13

Bearish Signals: 5

7. Galactic Surge Scalper

This setting is optimized for fast-paced, high-frequency trading. It leverages tight stop-loss and take-profit ratios with a quick trailing strategy, ideal for capturing short-term market shifts. The high bullish signal count ensures trades are only entered on strong trends, while bearish signals remain conservative.

Trading Style: Long Term Investing

Trading Mode: Aggressive

Lots: 0.0

Risk: 4.5%

Max Orders: 4

Stop Loss: 445

Take Profit: 385

Trailing Start: 250

Trailing Step: 40

Bullish Signals: 7

Bearish Signals: 3

8. Quantum Reversal Swing

This setting is designed for longer-term trades, capturing reversals in volatile markets. It uses a higher bearish signal threshold to minimize false breakouts, while trailing stops secure gains during price movements. A well-balanced take-profit and stop-loss setup ensures calculated risk management.

Trading Style: Swing Trading

Trading Mode: Aggressive

Lots: 0.0

Risk: 4.5%

Max Orders: 4

Stop Loss: 225

Take Profit: 375

Trailing Start: 300

Trailing Step: 110

Bullish Signals: 5

Bearish Signals: 12

9. Cosmic Gold Swing

This setting is optimized for medium-term trend-following in the gold market, combining high bullish signal sensitivity with a balanced bearish filter. The wide stop-loss ensures room for gold’s volatile movements, while the trailing stop secures profits during strong trends.

Trading Style: Day Trading

Trading Mode: Aggressive

Lots: 0.0

Risk: 4.5%

Max Orders: 4

Stop Loss: 570

Take Profit: 500

Trailing Start: 300

Trailing Step: 120

Bullish Signals: 10

Bearish Signals: 5

10. Starfall Momentum Snap

A strategy designed for rapid short-term trades, this setting capitalizes on quick market movements using tight stop-loss and take-profit levels. With a high bearish signal threshold, it is optimized for volatile conditions and fast execution, locking in profits on brief momentum shifts.

Trading Style: Day Trading

Trading Mode: Aggressive

Lots: 0.0

Risk: 4.5%

Max Orders: 4

Stop Loss: 100

Take Profit: 110

Trailing Start: 120

Trailing Step: 20

Bullish Signals: 4

Bearish Signals: 13

I have a question. So some weeks you mention a time setting (M15, H1) but on this set of recommendations I don't see any. Do you have a guideline for say "conservative" (H4, D1, W1) vs "aggressive" (M1, M15, M30, 1H)?

estellings

New member

I have a question. So some weeks you mention a time setting (M15, H1) but on this set of recommendations I don't see any. Do you have a guideline for say "conservative" (H4, D1, W1) vs "aggressive" (M1, M15, M30, 1H)?

This seems to be stuck, it won't post for response

Hey guys,

I hope I could help you thanks.

I understand your point but humbly speaking there is no shortcut to success. We provide the weekly updated settings and their performance reports. This helps everyone to identify how different trading styles on different timeframes with different assets works, and what suits them best based on their account size as well. Humbly speaking, we can not dictate how and what a user trades because everyone has different risk conditions and its hard for us to adhere for everyone's risk profile. Please check the performance page and this thread; ask questions, learn but we strongly recommend to use the settings with proper knowledge and understanding.What about the "Winning Trading Strategies" and "Today's Top Choice" listed here? This is what people are looking for. If we have to do all the research ourselves, we would be experts and would not need Galileo.

It's hard enough for beginners like myself to find a broker, set up a demo account and learn how to load the recommendations. So are they recommendations or not?Now you seeming to be telling us that these are only "suggestions" and that we have to do the research ourselves to tweak the recommendations.

The timeframes not always tells us about the trading mode, to understand the trading mode there are factors like drawdown, etc which tells us about how risky a setting can be.I have a question. So some weeks you mention a time setting (M15, H1) but on this set of recommendations I don't see any. Do you have a guideline for say "conservative" (H4, D1, W1) vs "aggressive" (M1, M15, M30, 1H)?

I hope I could help you thanks.

Hey Noah,I have been running a number of the recommended settings and consistently losing money with eur/usd and gbp/usd. Why are these pairs still recommended?

We have many live videos on our youtube channel with these pairs making money in live market. There are no pairs or settings we recommend, please understand that we only publish performance reports of the settings with different time periods, you need to understand these and test it if you are satisfied in a demo account then when you are completely satisfied then only load the settings on a live account. If you are not satisfied adjust the settings as per the tutorials in the following page:

- https://forum.galileofx.com/threads...etter-profitability-a-systematic-approach.37/

- https://forum.galileofx.com/threads...ds-scalping-day-trading-and-swing-trading.43/

- https://forum.galileofx.com/threads/how-to-optimize-stop-loss-take-profit-and-lot-size.44/

- https://forum.galileofx.com/threads/5-ways-to-limit-trading-losses-in-galileo-fx.3/

Yes, I understand your point Noah. These titles are not suggestions they are reports as I said earlier. You are doing right by using these on Demo account, once you see them make profits and you are satisfied you can make the correct decision. You might need to adjust the setting/s, also depending on your trading strategy you need to deploy it longer its not instant win.I am now running the 3 bots you feature as your "top picks" and "today's top choice" on your "Performance Page" as "winning trading strategies." If these are not "recommendations" then what good are they? I expect them to work and be profitable in my demo account. I do not have the time or motivation to spend hours and days learning all the intricacies of trading. That is why I bought your product. I will post here what happens to them and check the "Performance Page" daily to adjust my bots accordingly.

Similar threads

- Replies

- 9

- Views

- 259

- Replies

- 13

- Views

- 692

- Replies

- 11

- Views

- 1K