Hey guys, here are this week's updated settings:

1. Nebula Swing Reactor

This H1 strategy is built for medium-term trades with a focus on strong trend movements. With high bullish signals and moderate bearish filtering, it uses tight stop-losses and trailing strategies to capture significant price swings, making it ideal for swing traders aiming for high returns while managing drawdowns.

Trading Style: Day Trading

Trading Mode: Aggressive

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 190

Take Profit: 740

Trailing Start: 300

Trailing Step: 30

Bullish Signals: 13

Bearish Signals: 6

2. Cosmic Trend Oscillator

This H4 strategy is designed for medium-term trades, balancing moderate risk with dynamic trailing adjustments. With a slightly stronger bearish signal bias, it seeks to capture price trends while managing drawdowns effectively, ideal for traders aiming to profit from extended market moves.

Trading Style: Swing Trading

Trading Mode: Moderate

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 100

Take Profit: 240

Trailing Start: 110

Trailing Step: 150

Bullish Signals: 5

Bearish Signals: 6

3. Pulsar Breakout Tracker

This daily strategy targets large market moves in SPX500 with a conservative risk profile and wide stop-losses. Combining strong bullish signals and dynamic trailing adjustments, it's designed for long-term traders seeking to capture significant trends while maintaining steady risk management.

Trading Style: Long-Term Investing

Trading Mode: Aggressive

Lots: 0

Risk: 1.0%

Max Orders: 2

Stop Loss: 2,200

Take Profit: 2,800

Trailing Start: 1,400

Trailing Step: 510

Bullish Signals: 8

Bearish Signals: 3

4. Lunar Silver Orbit

Optimized for M30 trading, this setting targets short- to medium-term trends in XAGUSD with a moderate risk profile. With a strong bullish signal bias and precise trailing adjustments, it captures momentum while minimizing drawdowns, making it ideal for traders seeking steady performance in precious metals.

Trading Style: Day Trading

Trading Mode: Conservative

Lots: 0

Risk: 2.5%

Max Orders: 2

Stop Loss: 910

Take Profit: 490

Trailing Start: 310

Trailing Step: 40

Bullish Signals: 13

Bearish Signals: 6

5. Nebula Meta Navigator

This H2 strategy is designed for mid-term trend trading, balancing risk with wide stop-loss and take-profit levels to capture larger price movements. With strong bullish signals and controlled drawdowns, it's ideal for swing traders looking to navigate volatile markets and sustain longer trends.

Trading Style: Swing Trading

Trading Mode: Aggressive

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 600

Take Profit: 3,000

Trailing Start: 1,100

Trailing Step: 400

Bullish Signals: 9

Bearish Signals: 5

6. Stellar Breakout Seeker

This M15 strategy targets quick market breakouts with a moderate risk profile and precise stop-loss settings. With a strong bullish signal bias, it aims to capitalize on short-term upward momentum while managing drawdowns, making it ideal for fast-paced day trading.

Trading Style: Day Trading

Trading Mode: Aggressive

Lots: 0

Risk: 4.5%

Max Orders: 2

Stop Loss: 220

Take Profit: 250

Trailing Start: 0

Trailing Step: 0

Bullish Signals: 11

Bearish Signals: 5

7. Quantum Scalper Voyager

This M1 strategy is crafted for high-frequency, ultra-short-term trades, ideal for scalping in fast-moving markets. With quick stop-losses and a strong bearish signal filter, it aims to capture small price movements efficiently while minimizing risk exposure.

Trading Style: Day Trading

Trading Mode: Moderate

Lots: 0

Risk: 4.5%

Max Orders: 2

Stop Loss: 190

Take Profit: 130

Trailing Start: 0

Trailing Step: 0

Bullish Signals: 6

Bearish Signals: 9

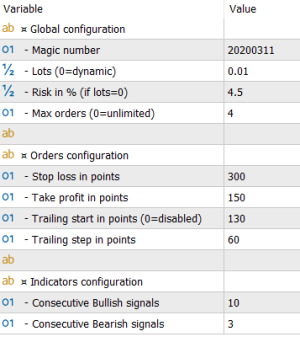

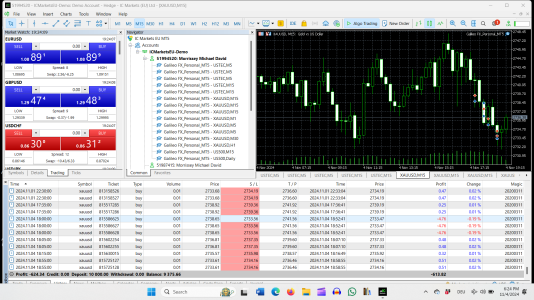

8. Galactic Trend Seeker

Designed for H12 swing trading, this setting focuses on capturing large price movements with moderate risk. Featuring wide stop-loss and trailing parameters, it balances bullish and bearish signals for precise trend entries, ideal for long-term trades in volatile market conditions.

Trading Style: Swing Trading

Trading Mode: Moderate

Lots: 0

Risk: 4.5%

Max Orders: 1

Stop Loss: 850

Take Profit: 2,800

Trailing Start: 1,200

Trailing Step: 150

Bullish Signals: 5

Bearish Signals: 4

9. Cosmic Pivot Raider

Optimized for M3 trading, this setting is designed to capture rapid price movements with tight stop-losses and quick take-profit targets. With a strong bullish bias and moderate risk control, it's ideal for traders looking to capitalize on short-term fluctuations in high-volatility markets.

Trading Style: Day Trading

Trading Mode: Moderate

Lots: 0

Risk: 2.5%

Max Orders: 2

Stop Loss: 170

Take Profit: 450

Trailing Start: 0

Trailing Step: 0

Bullish Signals: 12

Bearish Signals: 7

10. Nebula Swing Pulse

This H4 strategy is designed for medium-term swing trades, using a balanced risk profile with tight stop-losses and dynamic trailing stops. Its strong bearish signal filter and moderate drawdown management make it ideal for traders looking to capture both upward and downward price movements.

Trading Style: Swing Trading

Trading Mode: Aggressive

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 140

Take Profit: 630

Trailing Start: 250

Trailing Step: 50

Bullish Signals: 6

Bearish Signals: 13

Disclaimer: At Galileo FX, our bot is designed to empower users with tools to help them potentially achieve profitable outcomes. However, it's important to understand that all trading involves risk, and we cannot promise or guarantee easy profits. Please note that we do not provide financial or investment advice. We encourage you to make informed decisions based on your own research.

1. Nebula Swing Reactor

This H1 strategy is built for medium-term trades with a focus on strong trend movements. With high bullish signals and moderate bearish filtering, it uses tight stop-losses and trailing strategies to capture significant price swings, making it ideal for swing traders aiming for high returns while managing drawdowns.

Trading Style: Day Trading

Trading Mode: Aggressive

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 190

Take Profit: 740

Trailing Start: 300

Trailing Step: 30

Bullish Signals: 13

Bearish Signals: 6

2. Cosmic Trend Oscillator

This H4 strategy is designed for medium-term trades, balancing moderate risk with dynamic trailing adjustments. With a slightly stronger bearish signal bias, it seeks to capture price trends while managing drawdowns effectively, ideal for traders aiming to profit from extended market moves.

Trading Style: Swing Trading

Trading Mode: Moderate

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 100

Take Profit: 240

Trailing Start: 110

Trailing Step: 150

Bullish Signals: 5

Bearish Signals: 6

3. Pulsar Breakout Tracker

This daily strategy targets large market moves in SPX500 with a conservative risk profile and wide stop-losses. Combining strong bullish signals and dynamic trailing adjustments, it's designed for long-term traders seeking to capture significant trends while maintaining steady risk management.

Trading Style: Long-Term Investing

Trading Mode: Aggressive

Lots: 0

Risk: 1.0%

Max Orders: 2

Stop Loss: 2,200

Take Profit: 2,800

Trailing Start: 1,400

Trailing Step: 510

Bullish Signals: 8

Bearish Signals: 3

4. Lunar Silver Orbit

Optimized for M30 trading, this setting targets short- to medium-term trends in XAGUSD with a moderate risk profile. With a strong bullish signal bias and precise trailing adjustments, it captures momentum while minimizing drawdowns, making it ideal for traders seeking steady performance in precious metals.

Trading Style: Day Trading

Trading Mode: Conservative

Lots: 0

Risk: 2.5%

Max Orders: 2

Stop Loss: 910

Take Profit: 490

Trailing Start: 310

Trailing Step: 40

Bullish Signals: 13

Bearish Signals: 6

5. Nebula Meta Navigator

This H2 strategy is designed for mid-term trend trading, balancing risk with wide stop-loss and take-profit levels to capture larger price movements. With strong bullish signals and controlled drawdowns, it's ideal for swing traders looking to navigate volatile markets and sustain longer trends.

Trading Style: Swing Trading

Trading Mode: Aggressive

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 600

Take Profit: 3,000

Trailing Start: 1,100

Trailing Step: 400

Bullish Signals: 9

Bearish Signals: 5

6. Stellar Breakout Seeker

This M15 strategy targets quick market breakouts with a moderate risk profile and precise stop-loss settings. With a strong bullish signal bias, it aims to capitalize on short-term upward momentum while managing drawdowns, making it ideal for fast-paced day trading.

Trading Style: Day Trading

Trading Mode: Aggressive

Lots: 0

Risk: 4.5%

Max Orders: 2

Stop Loss: 220

Take Profit: 250

Trailing Start: 0

Trailing Step: 0

Bullish Signals: 11

Bearish Signals: 5

7. Quantum Scalper Voyager

This M1 strategy is crafted for high-frequency, ultra-short-term trades, ideal for scalping in fast-moving markets. With quick stop-losses and a strong bearish signal filter, it aims to capture small price movements efficiently while minimizing risk exposure.

Trading Style: Day Trading

Trading Mode: Moderate

Lots: 0

Risk: 4.5%

Max Orders: 2

Stop Loss: 190

Take Profit: 130

Trailing Start: 0

Trailing Step: 0

Bullish Signals: 6

Bearish Signals: 9

8. Galactic Trend Seeker

Designed for H12 swing trading, this setting focuses on capturing large price movements with moderate risk. Featuring wide stop-loss and trailing parameters, it balances bullish and bearish signals for precise trend entries, ideal for long-term trades in volatile market conditions.

Trading Style: Swing Trading

Trading Mode: Moderate

Lots: 0

Risk: 4.5%

Max Orders: 1

Stop Loss: 850

Take Profit: 2,800

Trailing Start: 1,200

Trailing Step: 150

Bullish Signals: 5

Bearish Signals: 4

9. Cosmic Pivot Raider

Optimized for M3 trading, this setting is designed to capture rapid price movements with tight stop-losses and quick take-profit targets. With a strong bullish bias and moderate risk control, it's ideal for traders looking to capitalize on short-term fluctuations in high-volatility markets.

Trading Style: Day Trading

Trading Mode: Moderate

Lots: 0

Risk: 2.5%

Max Orders: 2

Stop Loss: 170

Take Profit: 450

Trailing Start: 0

Trailing Step: 0

Bullish Signals: 12

Bearish Signals: 7

10. Nebula Swing Pulse

This H4 strategy is designed for medium-term swing trades, using a balanced risk profile with tight stop-losses and dynamic trailing stops. Its strong bearish signal filter and moderate drawdown management make it ideal for traders looking to capture both upward and downward price movements.

Trading Style: Swing Trading

Trading Mode: Aggressive

Lots: 0

Risk: 4.5%

Max Orders: 4

Stop Loss: 140

Take Profit: 630

Trailing Start: 250

Trailing Step: 50

Bullish Signals: 6

Bearish Signals: 13

Disclaimer: At Galileo FX, our bot is designed to empower users with tools to help them potentially achieve profitable outcomes. However, it's important to understand that all trading involves risk, and we cannot promise or guarantee easy profits. Please note that we do not provide financial or investment advice. We encourage you to make informed decisions based on your own research.

Attachments

-

Nebula Swing Reactor.zip105.5 KB · Views: 10

-

Cosmic Pivot Raider.zip68.4 KB · Views: 11

-

Galactic Trend Seeker-EURJPY-H12-set.zip1.2 KB · Views: 13

-

Quantum Scalper Voyager.zip85.8 KB · Views: 13

-

Stellar Breakout Seeker.zip103.8 KB · Views: 10

-

Nebula Meta Navigator.zip84.7 KB · Views: 9

-

Lunar Silver Orbit.zip72.7 KB · Views: 14

-

Pulsar Breakout Tracker.zip73.5 KB · Views: 8

-

Cosmic Trend Oscillator.zip97.3 KB · Views: 9

-

Nebula Swing Pulse.zip96.2 KB · Views: 8

Last edited: