Hey Noah,

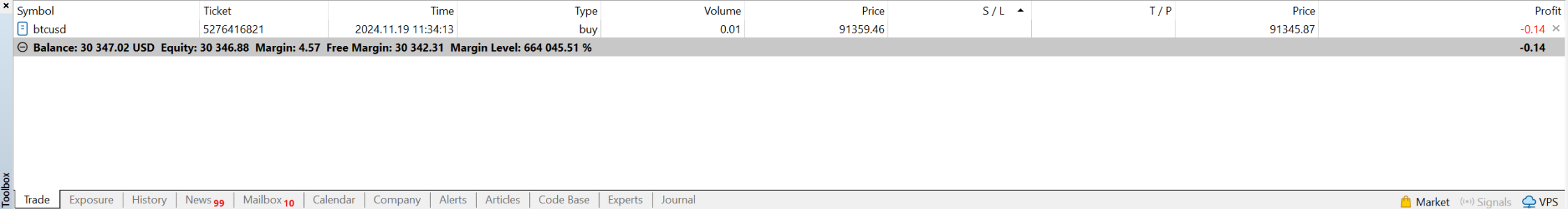

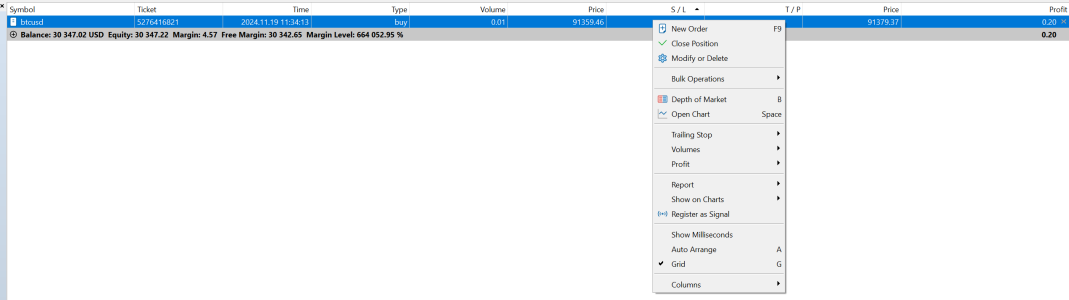

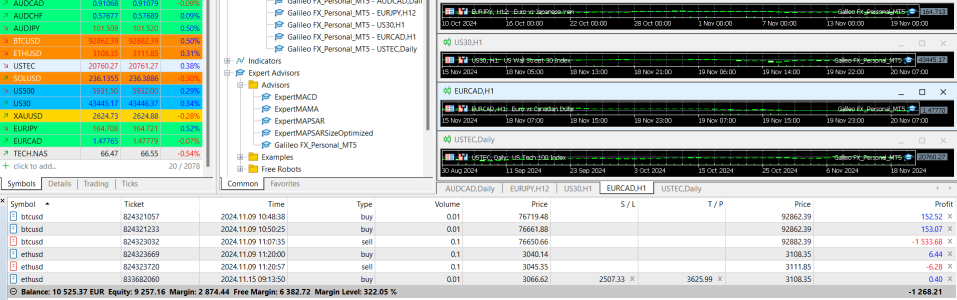

About how to setup demo account or accounts, metatrader backtesting process, volatile timings of markets to understand when not to trade, etc.What exactly does one have to learn about MT5?

It should matter, because depending on the account size the positions will be big and the loss will also be big according to you however, the loss when taken in percentage will not be that big for example, a drawdown of $300 might be big for you but for an account of $100,000 its not even 1%, on a $10,000 it is 3% and on a $1000 account its 30%. So in trading we generally avoid to use absolute terms and rely more on percentage for better understanding.I have used different amounts in my demo account, but why should that make a difference?

Thanks Noah, I will take this as a feedback and forward the same to my boss, please be patient we are working on parallel projects to provide as much help as we legally can to our customers.Yes, there are a lot of videos about how to learn MT5 in 5 minutes etc., but can you suggest one that actually shows people like me how to use the Galileo bot profitably? How about posting a walk-through for beginners on the Galileo site (just for customers so you won't be giving away anything for free) that goes beyond installing the bot?